4,275.

4,275.

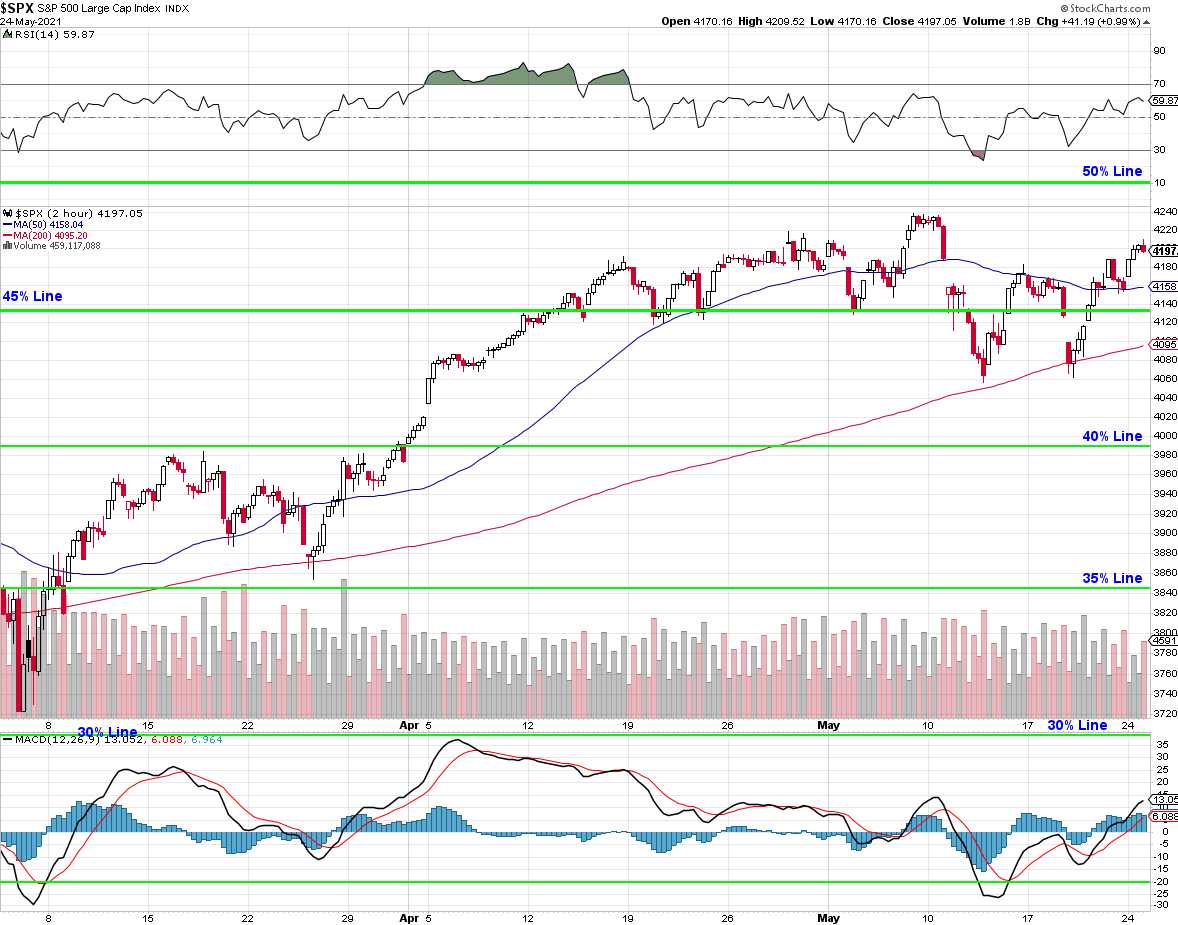

That's the 50% line from our S&P 2,850 base. A base which is no longer valid as it doesn't include 0% Interest Rates, lower Corporate Tax Rates or Trillions of Dollars in Stimulus but it also doesn't include the virus – as it's a base we set well before it came about. So why do we still use it? Because it's not possible to accurately understand what companies are really making until we are able to strip away the noise but it's going to a very painful band-aid to pull off, that's for sure!

As you can see from the chart, we're up a whopping 20% since March, when we were at the 30% line so that's a nice move for the month – at this pace we'll be up 80% for the year – nice! Is that how the markets work though? Not really. Usually the go down as well as up but that isn't stopping people from paying 20% more than they paid in March and expecting even more gains to come, is it?

You have to have what they call a willing suspension of disbelief to be bullish at the top of a run like this and yes, I said the same thing in 1998 and the market went up ANOTHER 100% in 1999 and, in retrospect, we knew that was crazy but, while it was going on, people were making millions — before they lost millions, of course. The trick is to be one of the very fast ones who plays it long and gets out at the tippy tippy top of the market. I think there were 3 of those guys.

I feel much like Hamlet trying to navigate the current market. We have many longs in our Member Portfolios and I do think they are solid but we have done so well in the past year that every day forward seems like an unnecessary risk but, as we've discussed often in the past few years – where else are we going to put our money but the markets? We can't sit passively by while inflation erodes the buying power of our savings and the interest rates paid by the banks or bonds are a joke as the Dollar collapses before our eyes.

I feel much like Hamlet trying to navigate the current market. We have many longs in our Member Portfolios and I do think they are solid but we have done so well in the past year that every day forward seems like an unnecessary risk but, as we've discussed often in the past few years – where else are we going to put our money but the markets? We can't sit passively by while inflation erodes the buying power of our savings and the interest rates paid by the banks or bonds are a joke as the Dollar collapses before our eyes.

There's 10% of the buying power of your life's savings gone in a year – how's that for a stealth tax? The Republicans love to pretend not to tax you but all they do is erode the value of the money you do have while the Top 1% benefit from the devaluation of the currency in the markets, which have gone up 60% in the same time-frame. That's why none of us think inflation is a big deal – we're investors. When the companies we own are hit by inflation, they mostly pass the costs down to the Bottom 99%, who don't own stocks and have to live on fixed incomes or scramble for raises at work to keep up with inflation.

That's how the rich rob the poor and that's why the wealth gap is at recods not seen since Feudalism. In fact, no king was ever richer than Jeff Bezos though, in theory, Jakob Fugger had $400Bn (inflation-adjusted) in the early 1500s (copper monopoly in Europe) and Rockefeller (oil monopoly) had about $350Bn in the early 1900s (and was the first actual Billionaire) and Andrew Carnegie (steel) had $300Bn at about the same time along with Henry Ford (duh), who had about $200Bn.

Now we have Bezos ($188Bn – Amazon), Bernard Arnault ($187Bn – Louis Vuitton,Sephora, Tiffany), Elon Musk ($152Bn – WTF?!?) and Bill Gates ($126Bn – Microsoft) – so we still have an auto guy but commodities have fallen out of fashion this century – though perhaps they are making a comeback?

Carnegie's US Steel (X) has risen to $24.32 from below $10 last year but it's only a $6.5Bn market cap. In a good year, US Steel can make $2Bn and 2021 should be a good year but steel plants are expensive to operate and, in a bad year, they can lose $1Bn – that's why they are called cyclicals but investors these days have no patience for cycles. X made $350M in Q1 and should do better as the year rolls on. I don't like chasing them but we can sell the 2023 $17 puts for $3.50, which nets us in for $13.50 and we'd love to own them down there so:

In our Earnings Portfolio, which has too much cash, let's make the following trade:

- Sell 10 X 2023 $17 puts for $3.50 ($3,500)

- Buy 20 2023 $20 calls for $9.50 ($19,000)

- Sell 20 2023 $30 calls for $6.20 ($12,400)

That's net $3,100 on the $20,000 spread that's $8,000 in the money to start and the upside potential is $16.900 (545%) if X is over $30 for us and that's the top of their rising channel so we'll also probably make a bit of income selling short calls at some point along the way.

That is how you stay ahead of inflation, with trade ideas that return 545% on cash! Our worst-case scenario is 1,000 shares of X are assigned to us at $17 ($17,000) plus whatever we lose on the spread, though the net of the spread is $6,600 so, as long as we stop it out with $3,100 or more, we net into X for $17, which is 30% below the current price. That's another great way to make sure you profit in the markets – never buy stocks for full price!

Rio Tinto (RIO) is another nice inlation hedge and we already sold 5 2023 $69.07 puts for $7 in our Long-Term Portfolio and now they are $7.50. At $85.70, RIO's market cap is $137Bn and they are not even projecting copper will stay over $3/lb (it's $4.50 now) in their forecasts but they are still going to make over $15Bn this year and next. Copper demand is much more predictable than Steel so we love RIO down here and we'll expand our trade this way:

In the Long-Term Portfolio (LTP), let's

- Sell 5 more 2023 $69.07 puts for $7.50 to average 10 short at $7,250.

- Buy 15 2023 $69.07 calls for $18 ($27,000)

- Sell 15 2023 $89.07 calls for $9 ($13,500)

That's net $6,250 on the $30,000 spread so we have $23,750 (380%) upside potential over $89.07 and we're at $85.69 now – so we're not asking for a lot of gains. Worst case is owning 1,000 shares of RIO at $69.07 and again, since we're net $6,250 in on the spread, if we stop out our $13,500 spread before it falls below $6,250, then our worst-case is simply owning 1,000 shares of RIO at $16.63 (20%) below the current price. Notice how great the support looks at the $75 line – I'm not worried.

We have a LOT of cash in our Member portfolios and we'll be looking for bargains like these as earnings season winds down. We're also remaining very well-hedged, just in case but we're through earnings and starting the summer and, so far, no major catastrophes – so let's enjoy it while it lasts.