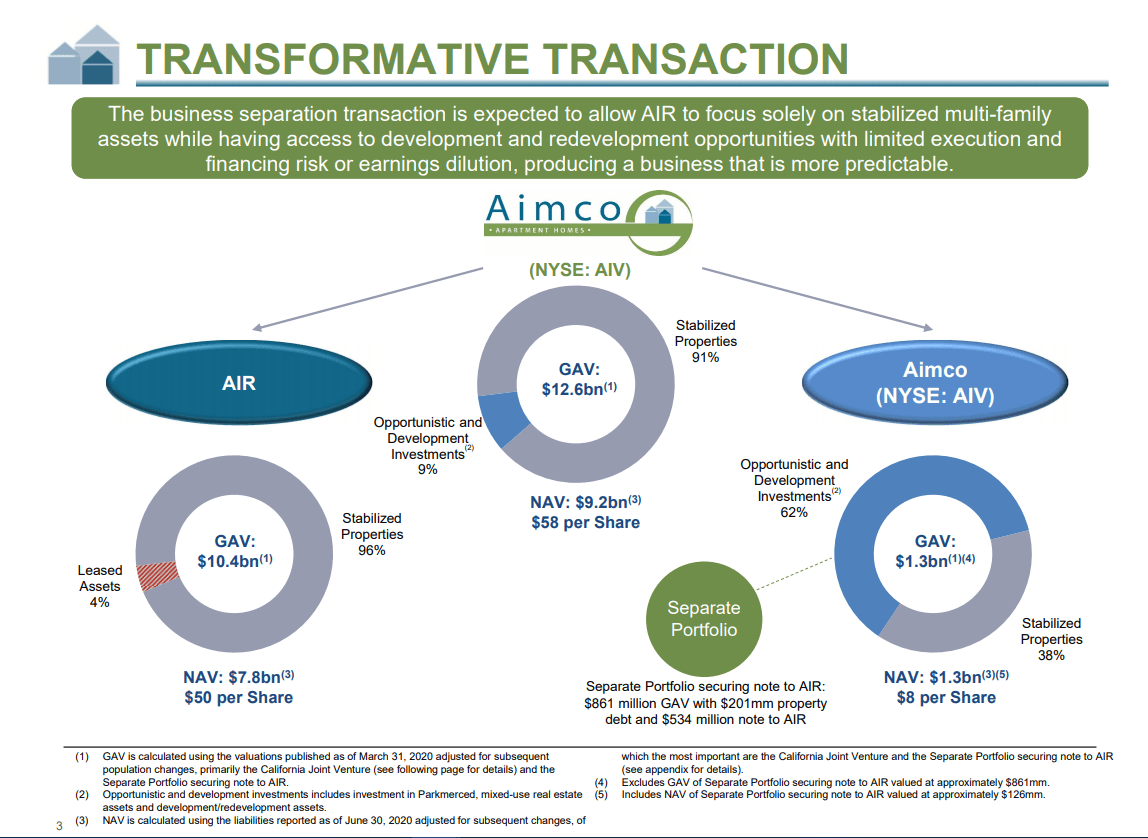

AIV is a nice little Apartment Management company that split off AIR (the actual apartments) from their REIT so they are just focused on managing and refurbishing apartments now. I don't think AIV was getting any credit at $1.1Bn in market cap - even after they've run up to $7.50.

This is the same good management they had before - they are just splitting the business, which I think we're getting for free against the asset value ($8/share) of the company. It's a long-term growth thing but they don't have long-term options though the ones they do have are actively traded so, in the Dividend (which they don't pay yet) Portfolio, let's:

- Buy 2,000 shares of AIV for $7.61 ($15,220)

- Sell 20 AIV Dec $7.50 puts for $1 ($2,000)

- Sell 20 AIV Dec $7.50 calls for $1.10 ($2,200)

That gives us a net entry of $11,020 or $5.51 per share and, if assigned 2,000 more at $7.50, we're average $6.50, which is a nice discount to the current price (and then we'd sell more calls to drop to $5.50). AIV does not yet pay a dividend (no profits) but, if we get called away at $7.50, that's a $3,980 (36% profit in 6 months) or, if we end up owning $22,000 worth (4,000 shares) at $5.50, just selling 10 calls for $1,000 is the same as getting a 5% dividend - and that's what we'd be getting every 6 months.