What inflation?

What inflation?

That's what the Fed says when confronted with the facts, which showed the CPI over 4% last month and that number is a drastically low estimate of inflation since it says things like "Netflix was $13 last month and this month it's $15 but, since they added 10% more shows (in Turkish), we're only going to count that at an 0.70 price increase."

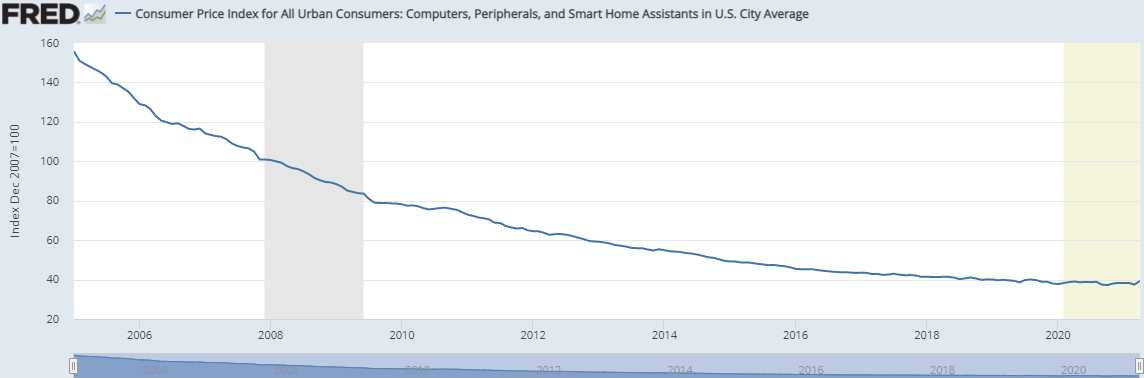

These are called Quality Adjustments and that's why, if your computer costs 10% more than your last model but it has 10% more memory and 10% more processing power – it's considered to be the same price – even if you have no desire for the extra memory or power. Think about your IPhone, the original ones has 256 Megabytes of memory – now they have 256 Gigabytes of memory – that's 1,000 times more so your phone is 1,000 times less expensive than you think it is – less than $2 in 2007 prices. The fact that you actually pay $1,200 for it is simply a mathematical inconvenience ignored by the Government.

According to the BLS, the price of computers is only 39% of what it was in 2007. Are consumers really paying 60% less for computers today than they did in 2007? Of course not. Track any computer that has remined in production for the last 12 years, and you’ll see that none of them have gone down in price. The only reason why BLS argues that computer prices have declined 61% since 2007 is because today, you can get a $400 computer as fast as the $1000 computer in 2007.

According to CPI, inflation in new cars and trucks is 47% since 1982. At the same time, according to the industry analysts at Kelly Blue Book, the average transaction price for a new light vehicle is $37,185 in May 2019. Yet in early 1980s, the price of a Porsche 911 Super Carrera was only $20,775. The price of a mid-trim Honda Accord was only $8,549. $37,185/1.47 = $25,295. If I had $25,295 in 1982, I could purchase almost any car on the market outside of top tier flagships and supercars. How is it, that the average price of a car today, deflated to 1982 levels, would allow me to buy almost anything from a Porsche, Mercedes-Benz or Cadillac dealer?

In 2010, Ford’s V6 Mustang made ~200hp, and the Mustang GT made ~300hp. The v6 coupe sold for $21,395, while the GT coupe sold for $28,395. In 2011, Ford updated the engines in the Mustang lineup. The old crappy “boat anchor” v6 disappeared, while the new v6 made ~300hp and the new GT made ~400hp. In 2011 the v6 Mustang sold for $22,145 while the GT sold for $29,645. In this example, consumers would understand it as the price of the Mustang went up. However, when calculating CPI, the BLS would argue that the price of the Mustang went down. After all, now you can get the same amount of power out of a $22,145 v6 Mustang as you previously did out of the $28,395 GT!

This is all complete and utter BS and these are vitally important numbers. The CPI is used to determine how large your Social Security check should be or Disability Payments or Unemployment payments but it's also used to calculate our GDP and the lower CPI gives us a higher GDP so the system feeds in on itself to completely distort the image of our economy and that then affects investing decisions, long-term planning, Government Spending, etc.

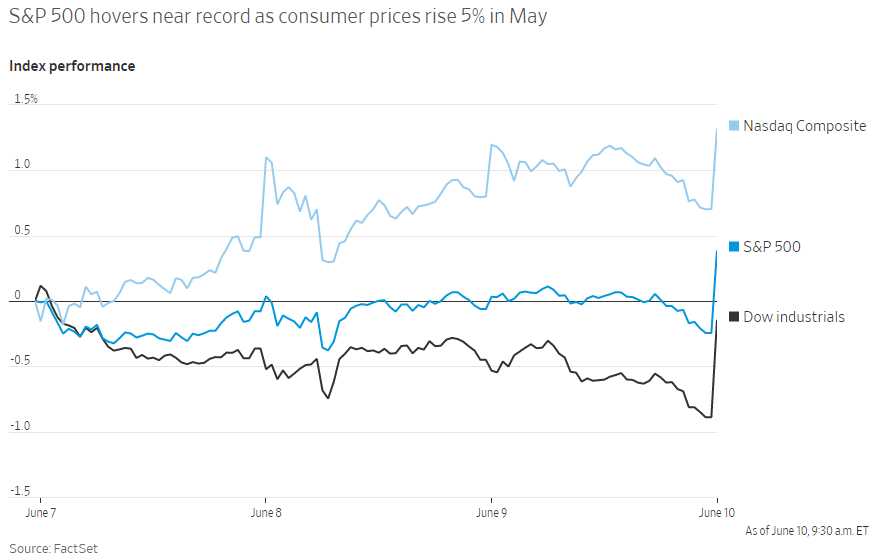

8:30 Update: Consmer Prices were indeed up 5% in May (year over year) but that hasn't stopped the market from flying higher. The action is summed up here:

8:30 Update: Consmer Prices were indeed up 5% in May (year over year) but that hasn't stopped the market from flying higher. The action is summed up here:

“As long as we’ve got cheap money, we’ve got a savings glut, not just in the West but in Asia. I think there is decent support for stocks,” said Jane Foley, head of foreign-exchange strategy at Rabobank. “I don’t imagine there is going to be a really serious downturn.”

Inflation is not INITIALLY bad for the market but it becomes an issue if it's persistent and the Fed insists all this inflation is "transitory" but we have a 30-year Bond Auction at 1pm and we'll see how transitory the bond investors think inflation is. 30-year notes pay 2.395%, not even 1/2 the current rate of actual inflation – even as incorrectly measured as our CPI data. What will be more interesting is tomorrow's Consumer Confidence Report (10am) – we'll see if the average consumer is concerned about inflation yet.

Another issue about to hit the news cycle is Climate Change, which we talked about yesterday. Biden is in Europe to attend the G7 Summit and a lot of expensive items are going to be discussed like fighting Corona Globally (yes, it's still a thing) and committing Trillions of Dollars to combating Climate Change – and where is that money going to come from?

Oil (/CL) is back at $70.50 this morning, that's a good line to short ($72.50 on Brent (/BZ)) and S&P (/ES) 4,250 is not likely to hold either.