While Biden's away.

While Biden's away.

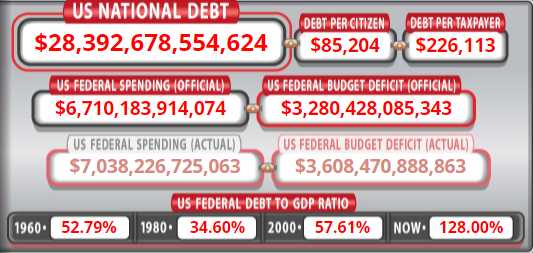

A bipartisan group of 10 Senators have agreed to $579Bn in additional spending (from the Republican's first offer) over 8 years and, rather than raise taxes to pay for it, they have played with the numbers enough to show no tax hikes are necessary – even though we are currently running a $3.6Tn deficit by spending $7Tn and only collecting $3.4Tn (Corporations are paying $231Bn). This is not a problem that's going to fix itself.

$3.6Tn is close to 20% of our GDP and we're already 128% of our GDP in debt and the solution is not to raise taxes – even though the markets and jobs and inflation data are indicating tremendous economic strength. If we can't raise taxes now, when can we ever? And, if we can't ever raise taxes, then the debt will simply keep growing until it's completely out of control and wrecks the economy – that seems to be our current plan.

$1.2Tn is still $500Bn below Biden's proposed $1.7Tn. The proposal is limited to core physical infrastructure and omits the social programs such as elderly care Biden included in his “American Jobs Plan.” There is also the possibility of a gasoline tax, which is a tax the Republicans don't mind as it disproportionately taxes poor people. But the White House has made it clear to lawmakers that such a measure, as well as any discussion about an electric vehicle mileage tax, would violate Biden’s red line of not raising taxes on Americans who earn under $400,000 a year, and cannot be part of any package,

The current Federal Gasoline Tax is 0.184/gallon and hasn't changed since 1993, when gas was $1. We use about 125Bn gallons of gas so we're talking $23Bn and adding 0.368 (proportional) would bring in $46Bn of additional revenue – still nowhere near enough but at least we didn't ask Jeff Bezos to chip in – that would have been a catastrophe, right? Jeff is leaving the planet next month – so he won't be subject to US taxes anyway.

Speaking of taxes, we'll have to pay some on our Oil (/CL) shorts as the $70.50 line has been working so far with a nice dip to $69 yesterday for a $1,500 per contract gain and this morning we've been able to short it again at $70.50 and our goal is to take 1/2 off the table at $70 or lower and then we can use $70.25 as a stop line to lock in gains. I don't mind holding 2 short contracts over the weekend as I really think oil is overpriced at the moment though, of course, this is a dangerous play with July 4th just around the corner.

Speaking of taxes, we'll have to pay some on our Oil (/CL) shorts as the $70.50 line has been working so far with a nice dip to $69 yesterday for a $1,500 per contract gain and this morning we've been able to short it again at $70.50 and our goal is to take 1/2 off the table at $70 or lower and then we can use $70.25 as a stop line to lock in gains. I don't mind holding 2 short contracts over the weekend as I really think oil is overpriced at the moment though, of course, this is a dangerous play with July 4th just around the corner.

Still, it's Econ 101 that a gas tax should impact demand in the World's largest consumer of gasoline – we just have to wait for analysts to put 2 and 2 together over the weekend (they'll probably get 3). A gasoline tax is not so good for Valero (VLO) who we have in the Long-Term Portfolio like this:

| VLO Long Call | 2023 20-JAN 60.00 CALL [VLO @ $81.94 $0.00] | 15 | 2/8/2021 | (588) | $20,250 | $13.50 | $10.75 | $13.50 | $24.25 | $0.00 | $16,125 | 79.6% | $36,375 | ||

| VLO Short Call | 2023 20-JAN 80.00 CALL [VLO @ $81.94 $0.00] | -15 | 2/8/2021 | (588) | $-10,500 | $7.00 | $5.13 | $12.13 | $0.00 | $-7,688 | -73.2% | $-18,188 | |||

| VLO Short Put | 2023 20-JAN 50.00 PUT [VLO @ $81.94 $0.00] | -5 | 2/9/2021 | (588) | $-4,750 | $9.50 | $-6.32 | $3.19 | $0.00 | $3,158 | 66.5% | $-1,593 |

This is a good time for us to sell 5 July $80 calls in the LTP for $4.50 ($2,250) to protect our gains. We're currently well over our target of $80 and we entered the spread at net $5,000 in February and we're already up $11,594 (231%) at $16,594 on the $30,000 spread so plenty of room to run if VLO holds $80 so the short calls aren't likely to hurt us much and it's a nice little 35-day bonus income while we wait.

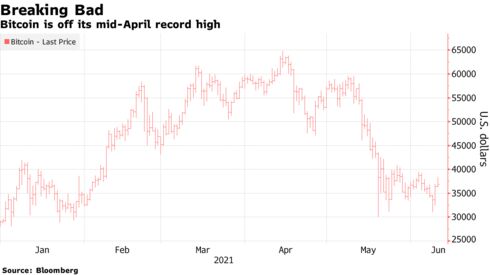

Meanwhile, in other speculations: The Basel Committee on Banking Supervision proposed that a 1,250% risk weight be applied to a bank’s exposure to Bitcoin and certain other cryptocurrencies. Bitcoin was trading around $36,200 this morning. It would make it extremely costly for banks to hold digital tokens on their balance sheets, potentially delaying crypto’s wider adoption. “The only consistency has been the volatility — it’s been big spikes, tons of enthusiasm, followed by big selloffs,” Ross Mayfield, investment strategy analyst at Robert W. Baird & Co., said of Bitcoin’s moves. “If you believe in it you’re probably to stomach the volatility, but if you’re just in it because it seems like the hot way to get a quick buck, that volatility is going to be hard to deal with.”

Meanwhile, in other speculations: The Basel Committee on Banking Supervision proposed that a 1,250% risk weight be applied to a bank’s exposure to Bitcoin and certain other cryptocurrencies. Bitcoin was trading around $36,200 this morning. It would make it extremely costly for banks to hold digital tokens on their balance sheets, potentially delaying crypto’s wider adoption. “The only consistency has been the volatility — it’s been big spikes, tons of enthusiasm, followed by big selloffs,” Ross Mayfield, investment strategy analyst at Robert W. Baird & Co., said of Bitcoin’s moves. “If you believe in it you’re probably to stomach the volatility, but if you’re just in it because it seems like the hot way to get a quick buck, that volatility is going to be hard to deal with.”

In the world of real commodities, Corn is becoming a big problem, with supplies at their lowest since 2013, when corn topped out at $850 (now $650 – usually $300). Corn is mainly used as feedstock for cattle and hogs and that drives food inflation (5% in yesterday's CPI) and this is a Global shortage – with China going everywhere trying to feed their rapidly expanding hog herd. Not only does it take a year to plant more crops, making this a long-term problem, but the crops we have are in peril with droughts and heatwaves in the US Corn Belt (soybeans will be affected too). Should the non-existent Global Warming wreck this year's corn and soy crops (and don't forget the locust in Africa), the next crisis we ignore will be food insecurity on a massive scale.

We're going to be running around giving vaccines to people who would rather have a loaf of bread….

Have a great weekend,

– Phil