What a market!

What a market!

I know it's hard to talk about hedging when the market is doing so well but that's the lesson of Joseph and the Pharoh from the Bible – you have to prepare for the bad times DURING the good times or you get screwed. As a rule of thumb, we like to put 25-33% of our unrealized portfolio gains into our hedges in order to lock them in against a downturn. If we do our jobs well, we get out of our longs ahead of a correction and ride the shorts down to even more profits – that's been working well for us for the past two years.

At PSW, our two main portfolios are our Long-Term and Short-Term Portfolios (LTP and STP) and, very simply, the STP has our hedges as well as fun short-term plays while the LTP is generally full of bullish plays. We started with $500,000 in the LTP and $100,000 in the STP back in October of 2019 – after cashing out our previous set with a $2M balance (up 233%) that September. Now we're back over 2M again and it's very tempting to just cash out but the market has been so strong – and our long positions are so good – we don't have a good enough reason to sell yet. So we hedge….

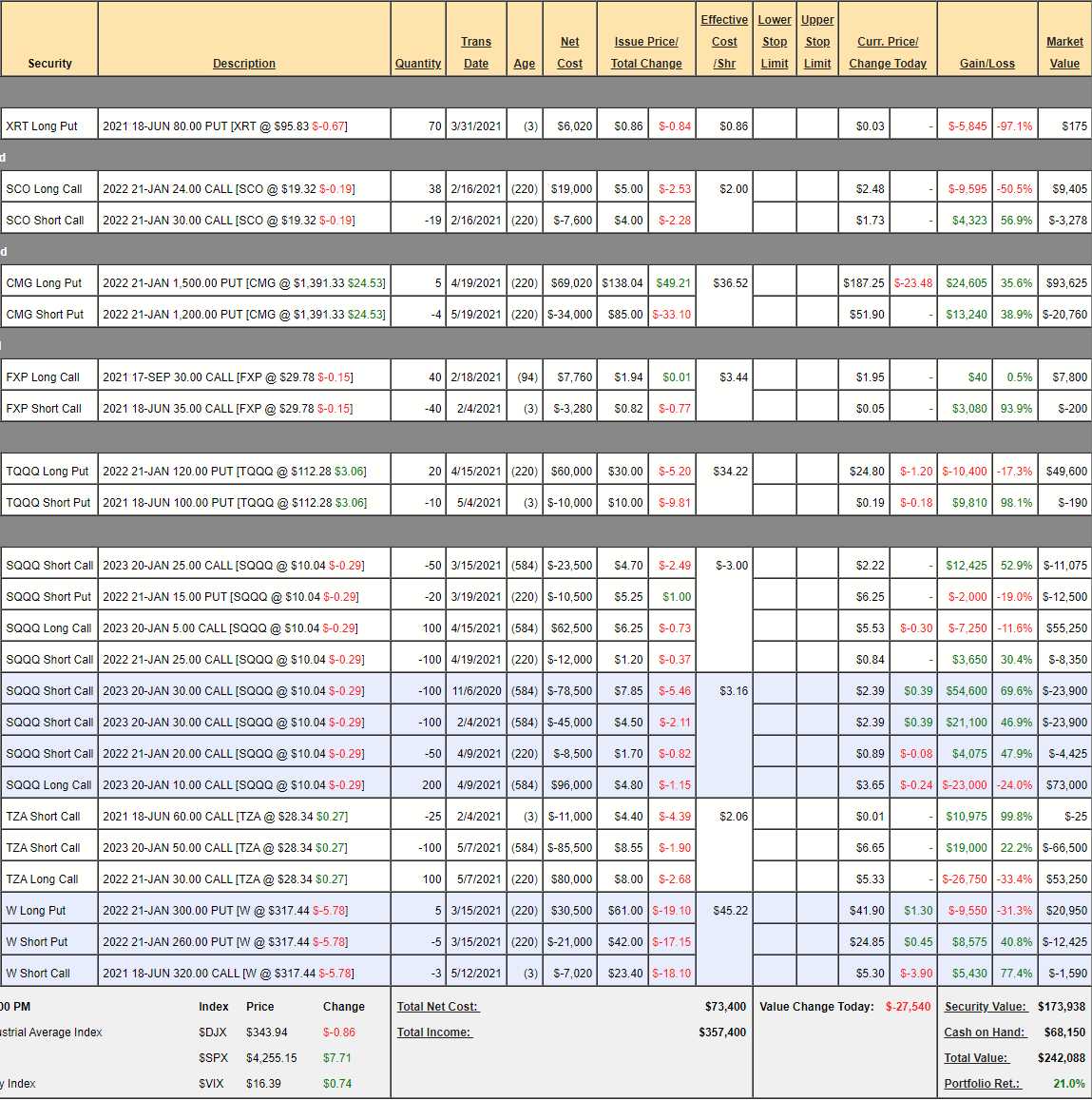

Our last STP Review was May 14th and our STP was up 40% at $281,128 (we had added $100,000 from the LTP when the STP was down to $50,000 after the big rally last year) and, as of yesterday's close, we're up 21% at $242,088, so we've lost $39,040 this month but the combined balance with the LTP is positive – and that's what we care about. We're hedged pretty much to neutral – not really trusting what I believe is a toppy market.

We made 4 changes to the STP last month and we felt adequately hedged and we also added a lot of LTP positions to shift a bit more bullish – but nothing too crazy.

- XRT – Our short play on retail did not work out – total loss.

- SCO – They did a 1:4 reverse split and our prediction is that oil will be below $60 by the year's end. So far – not working.

- CMG – We rolled our short puts last time and bought back the short calls on the dip so now we're waiting for a move up to sell short calls again. It's very tempting to take net $72,865 and run on this trade as we started at net $35,000 but we have 220 days left and we think CMG will be below $1,200 this year and we could sell 3 Sept $1,500 calls for $40 ($12,000) using just half our time so, when they get to $21,000 ($70), let's do that! If they don't get to $21,000 – then our long puts will be on track, right?

- FXP – The short June $35 calls paid off and we can cash out with a nice profit or maintain a hedge on China. Nothing has really changed there so let's roll our 40 Sept $30 calls at $1.95 ($7,800) to 40 Dec $30 calls at $3 ($12,000) and pay for that by selling 40 Dec $40 calls for $1.25 ($5,000). That's net $800 back in our pocket and we've get 3 more months to make gains on our spread.

- TQQQ – The Nasdaq just keeps going higher. We're about even on the spread so, mechanically, let's roll the 20 Jan $120 puts at $24.80 to the $130 puts at $30.30 for net $5.50 and the June $100 puts will go worthless so now we can sell 10 July $110 puts for $5.50 ($5,500) to pay for the roll. That's how we keep ourselves in position to win – letting the short-term short puts take the brunt of the losses.

- SQQQ #1 – As above – are we in a position to win? Our Jan $5 calls are $5 in the money and they are covered by short $25s that will not likely be hit. If the Nas falls 20% then SQQQ rises 60% (theoretically) to $16. Even a 40% drop will only get SQQQ to $22 so are we better off with 100 $5s or 200 $10s? Well 100 5s would be $11 at $16 for $110,000 and 200 $10s would be $6 for $120,000 so there's no benefit to having the $5s, is there? The Jan $10s are $2.10 so let's roll up to 200 of those as it's much better protection on a more than 20% drop and it's a net credit on the roll so no reason at all not to do it.

- SQQQ #2 – Already in the correct position but 2023 on these. The short $30 calls are pointless but I wouldn't spend perfectly good money buying them back.

- TZA – 20% drop is 60% pop from $28.34 to $45.34 and that would make the $30 calls worth $150,000 and the curreent net on the spread is $13,250 so that is a LOT of bang for the buck on this one. That's because we sold the 2023 short calls, not 2022 but I think we'll adjust just fine down the road. Not going to sell more calls at the moment as we're pretty low.

- W – I don't know how they keep recovering. We're not behind but I'm annoyed we aren't doing better. The short $320 calls should go worthless and earnings are early Aug so I'd rather sell 3 Nov $340 calls at $35 ($10,500) to pay for rolling the 5 Jan $300 puts at $42 ($21,000) to 5 2023 $350 ($98.50)/$250 ($43.50) bear put spread at net $55 ($27,500). So we have a net $4,000 credit and we've raised the spread $50 and widened it considerably. Hopefully now it doesn't drop too fast as we still have those short Jan $260 puts but lots of time to roll.

So we've made some very aggressive adjustments but, not only have we spent no money – we've put money back in our pocket!

How much protection do we have (post adjustment, rough numbers)?

- SCO, CMG and W are more like bets – we don't count them as hedges.

- FXP – $40,000 spread at net $7,000 – $33,000 protection.

- TQQQ – $60,000+ spread at net $45,000 – $15,000+ protection (half cover).

- SQQQ – Now 400 $10 calls which hit $240,000 at $16 (20% drop), now net $44,000 – $200,000 protection

- TZA – $85,000 spread at net $13,250 – $72,000 protection.

So that's about $320,000 of downside protection we expect to kick in against a 20% drop and that would pretty much double on a 40% drop so now all we have to do is make sure our primary positions won't lose more than that on a 20% drop and we're in good shape to weather a storm.