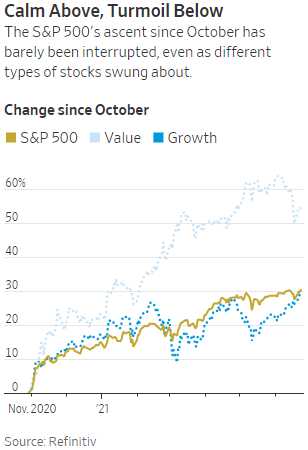

Value stocks are up 50% since Novemeber.

Value stocks are up 50% since Novemeber.

Growth stocks, however, are up 30% so it seems a bit like the leadership is changing but when "Value Stocks" are up 50% – is it possible they are no longer values anymore? This is a situation that doesn't seem to be phasing investors so far in what is being called a "TINA" market, which means: "There Isn't Any Alternative" to putting your money in stocks when the bank and bond rates don't even come close to keeping up with inflation and housing is scarce and expensive (and bound to collapse when rates rise as well).

That's keeping the money flowing into stocks and the Fed just hit us with $235Bn in reverse-repo funding, which pulled us off the floor, which was caused by the Fed's last meeting looking a bit more hawkish. That's taken the S&P 500 (/ES) to 4,272 to start off this week and that's record-highs and only the Dow (34,286) is not back at it's record high (35,000) but that can change on a couple of good days.

What I worry about, with Q2 earnings just around the corner, is how companies will justify these sky-high valuations with inflation eating into their profits. We're getting a preview of that out of China, where industrial profit growth slowed in May due to rising costs. They were still 36.4% better than last year (lockdown) but way down from a 57% increase last month and the 83.4% average of the first 5 months of the year. And that includes a 136% profit increase in the mining sector!

Rising commodity prices have boosted profits for upstream industries such as raw material producers, but put a squeeze on downstream businesses as input costs climbed. Producer prices rose 9% in May from a year earlier, the fastest pace since 2008, mainly due to higher metal prices.

The pharmaceutical manufacturing sector saw accelerated profit growth driven by demand for pandemic-related medical supplies such as vaccines and test kits. While Americans may think the virus is defeated, there were 309,453 new cases in the World yesterday led by 46,148 in India alone and 3.9Bn people are dead, so we'll be passing the 4M death mark – just in time for the holidays. Globally, stocks are up 26% from when the pandemic officially began on Jan 23rd, of 2020 so I guess here's to another prosperous 18 months???

Australia is back on lockdown – by the way.

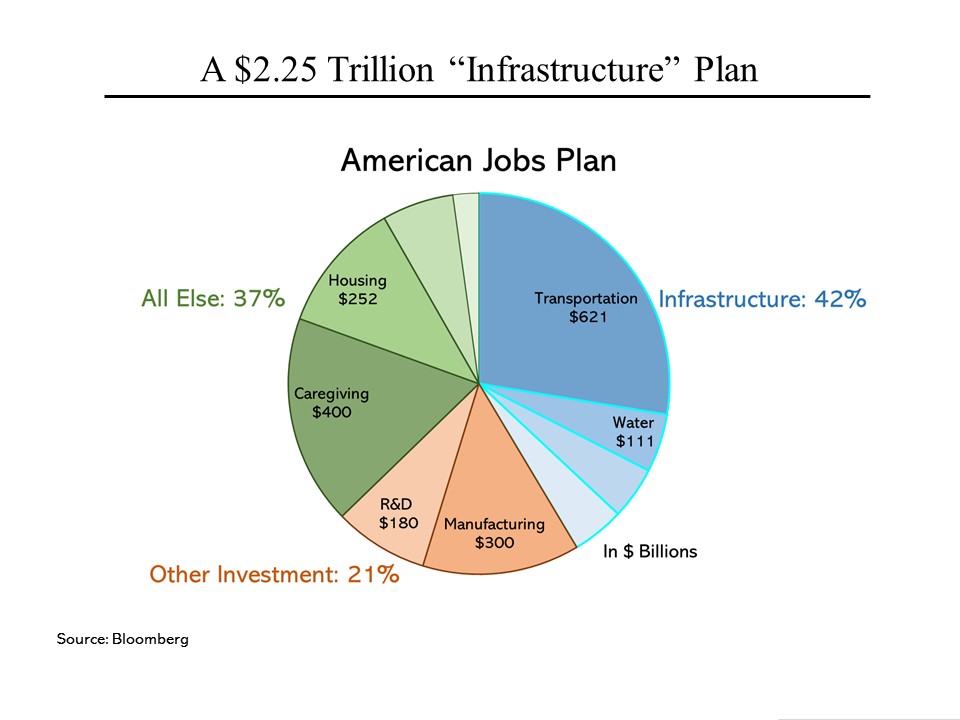

On the FREE MONEY front, what is now a $1.2Tn Infrastructure Bill seems to be moving forward as the Democrats have agreed to pretend with the Republicans that we don't have to raise taxes to pay for it because – as usual – the tax cuts will pay for themselves or whatever (it's such BS one tends to lose track). Biden plans to begin traveling the country on Tuesday to promote the bipartisan deal, with his first stop in Wisconsin, a White House official said. The goal is to build public support not only for the deal but for the now SEPARATE social-spending and tax increases Democrats hope to include in the second piece of legislation, which would include elements of his American Families Plan.

On the FREE MONEY front, what is now a $1.2Tn Infrastructure Bill seems to be moving forward as the Democrats have agreed to pretend with the Republicans that we don't have to raise taxes to pay for it because – as usual – the tax cuts will pay for themselves or whatever (it's such BS one tends to lose track). Biden plans to begin traveling the country on Tuesday to promote the bipartisan deal, with his first stop in Wisconsin, a White House official said. The goal is to build public support not only for the deal but for the now SEPARATE social-spending and tax increases Democrats hope to include in the second piece of legislation, which would include elements of his American Families Plan.

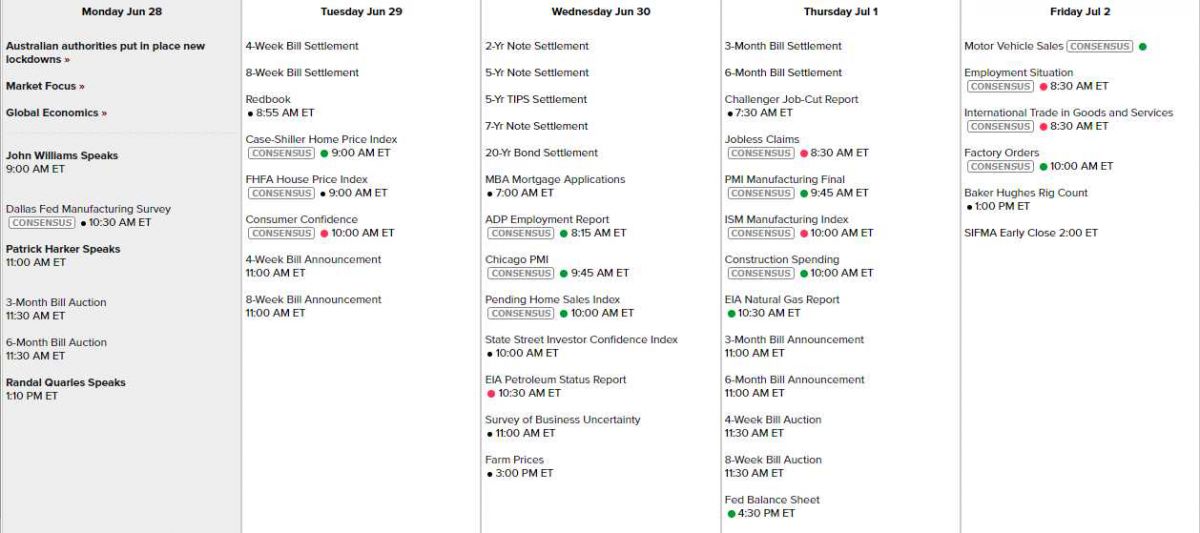

Next Monday is a holiday so this week will get quieter and quieter as it moves forward but Friday is Non-Farm Payrolls alond with Motor Vehicle Sales and Factory Orderds, so it is worth checking in to see if anything exciting is happening. Other than that, we have 3 Fed speakers today and that's it (scheduled) but they have taken to popping up all over the place like whack-a-moles, rather than announcing their intentions in advance.

This morning we get the Dallas Fed at 10:30, tomorrw we have Case-Shiller & FHFA Home Prices and Consumer Confidence, Wednesday is Chicage PMI, Pending Home Sales, State Street Cofnidence and Business Uncertainty should be interesting (inflation read) followed by a shocking rise in Farm Prices. Thursday (if anyone is left by then) we have PMI, ISM and Construction Spending along with what would be a shockingly large Fed Balance Sheet – if we still had the capacity to be shocked by such things.