Why do we ever have 5-day work-weeks?

Why do we ever have 5-day work-weeks?

They did a huge 4-year test in Iceland, with 2,500 workers (1% of the labor force) where they paid the workers the same amount for about 36 hours of work (9 hours a day) just 4 days a week and, surprise!, productivity remained the same or even improved in the majority of workplaces. The trials led unions to renegotiate working patterns, and now 86% of Iceland's workforce have either moved to shorter hours for the same pay, or will gain the right to, the researchers said.

Workers reported feeling less stressed and at risk of burnout, and said their health and work-life balance had improved. They also reported having more time to spend with their families, do hobbies and complete household chores. Will Stronge, director of research at Autonomy, said: "This study shows that the world's largest ever trial of a shorter working week in the public sector was by all measures an overwhelming success.

Spain is piloting a four day working week for companies in part due to the challenges of coronavirus. And consumer goods giant Unilever is giving staff in New Zealand a chance to cut their hours by 20% without hurting their pay in a trial. While employees are hurting for Labor, now is the time to re-negotiate those hours. I did that in one of my first jobs – telling my boss I'd work 4 10-hour days (selling computers) if I could take Monday's off, which were typically slow days. I was the top salesman in the company. Still, Corporations being what they are – they never experimented on anyone else – just the one guy who asked for it.

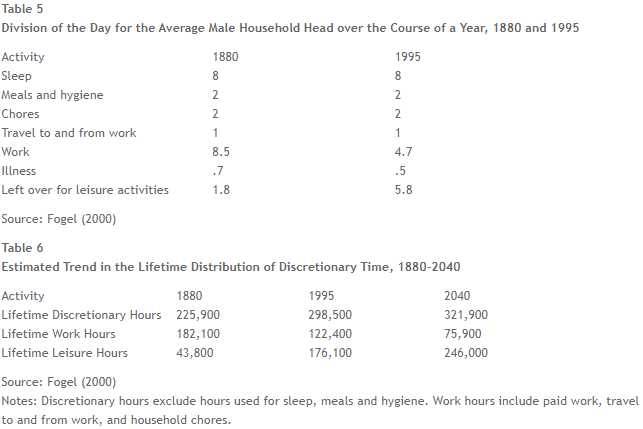

The average workweek for factory workers in the US in 1830 was 69 hours! In 1900 it was still 60 hours but then we had automation and we were down to 50 hours by 1930 – though the economy did collapse – so take that with a grain of salt. After World War II we got down to 40 hours and no actual improvement since then, though it is projected that, by 2040, we should have about 30% less work in our week as the next round of automation kicks in.

The average workweek for factory workers in the US in 1830 was 69 hours! In 1900 it was still 60 hours but then we had automation and we were down to 50 hours by 1930 – though the economy did collapse – so take that with a grain of salt. After World War II we got down to 40 hours and no actual improvement since then, though it is projected that, by 2040, we should have about 30% less work in our week as the next round of automation kicks in.

That gives us 246,000 hours (28 years) of Leisure Time, up from 43,800 hours (5 years) back in 1880. More importantly, it's up 40% from 1995 and that's a trend we can invest in. More Leisure Time means more Leisure spending and there are Leisure stocks we can invest in like:

Onewater Marine (ONEW) – Purveyors of boats, new and used and, even more lucrative, caretakers of boats and financers of boats (and then repossessors of boats!). Even last year, they grew 30% from 2019 in revenues though profits slipped but this year they are on track to make $80M yet, at $39, you can buy the whole company for less than $600M. Unfortunately, they don't have options but it's a great little company to bet on.

YETI Holding (YETI) – Started out as a cooler company but have expanded into all sorts of things. Very expensive at $90, which is close to $8Bn and they are only making $200M a year (40x earnings) but they made $50M in 2019 on about half as much revenue so we can split the baby on this one and promise to buy them if they drop 33% by selling the 2023 $65 puts for $7.50, which would net you in at $57.50, which would be down to a $5Bn market cap and that I'd love to own it at so let's sell 10 of those in our Long-Term Portfolio (LTP) for $7,500.

International Game Technology (IGT) – Has a solid base making casino machines (a growth industry) but also has their hand in lottery games, on-line poker (growth) and Sports Betting (GROWTH) so, despite their 7-year age, we're going to put them in our Future is Now Portfolio as such:

- Sell 10 IGT 2023 $17 puts for $3 ($6,000)

- Buy 20 IGT 2023 $20 calls for $8.30 ($16,600)

- Sell 20 IGT 2023 $27 calls for $4.20 ($8,400)

That's net $2,200 on the $14,000 spread so we have $11,800 of upside potential if IGT is over $27 in Jan, 2023. We're starting out $5,000 in the money on the position so it's a great way to play IGT and, even if it drops and we're assigned 1,000 shares, the net would be $19.20 – still a 14.6% discount to the current price. That's our WORST case! Aren't options fun?

Have a great weekend,

– Phil