Congratulations to Richard Branson!

Mr. Branson took 90 minutes out of his busy schedule yesterday to pop over to space for a quick float (enter to get your own trip here) and, while it's one small step for Sir Richard, it's one giant leap for the future of mankind as we are now a big step closer to the reality of space travel opening up to the masses. Well, the very, very rich masses – but that too will change.

Russia was charging $20M to take people to the International Space Station and Jeff Bezos is about to launch his first rocket with his first passenger paying $28M for a 15-minute flight so Branson's $500,000 90-minute flight (but the same 3-5 minutes in actual space) is kind of a bargain and that's why Virgin Galactic Holdings (SPCE) is up 5% this morning – even though it's already trading at hundreds of times what it's likely to make over the next few years ($12Bn).

SPCE has been losing $50M per quarter recently but that's not so bad in the grand scheme of things. Carnival Cruise lines lost $10 BILLION last year and is losing $1.5Bn/qtr this year and the only way you get to space on one of those ships is when you overdo it at the bar.

SPCE has been losing $50M per quarter recently but that's not so bad in the grand scheme of things. Carnival Cruise lines lost $10 BILLION last year and is losing $1.5Bn/qtr this year and the only way you get to space on one of those ships is when you overdo it at the bar.

This is a big moment in human history. In 1914, the first commercial airline flight took off from St. Petersburg, Florida and flew all the way to Tampa, Florida – 21 miles away! In 1913, a trip between the two cities, sitting on opposite sides of Tampa Bay, took two hours by steamship or from 4 to 12 hours by rail. Traveling by automobile around the bay took about 20 hours. The flight would take about 20 minutes.

The airplane had a top speed of 64 mph (103 km/h). The hull was made of three layers of spruce with fabric between each layer. The wings were made of spruce spars with linen stretched over them. The plane was built to hold only a pilot and one passenger side-by-side on a single wooden seat.

The airplane had a top speed of 64 mph (103 km/h). The hull was made of three layers of spruce with fabric between each layer. The wings were made of spruce spars with linen stretched over them. The plane was built to hold only a pilot and one passenger side-by-side on a single wooden seat.

The first flight went off on New Year's Day, 1914, with much pomp and circumstance. About 3,000 people paraded from downtown St. Petersburg to the waterfront to watch as the first ticket was auctioned off. Former St. Petersburg Mayor Pheil, then in the warehouse business, won with a bid of $400 (more than $40,000 in today’s dollars).

That flight actually didn't go so well and the plane had an engine problem and touched down in the bay but they fixed it (you could just hit them with a wrench back then) and were able to take off and continue the flight, which never went more than 50 feet over the water. After that, the airline made two flights daily, six days a week. The regular fare was $5 per person (about $500 in today's dollars) and $5 per 100 pounds of freight. Tickets sold out for 16 weeks in advance. A second Benoist airboat was added, and flights were extended to Sarasota, Bradenton and Manatee.

What we'll be doing in 100 years is hard to imagine. “What was impossible yesterday is an accomplishment today, while tomorrow heralds the unbelievable,” is what Mayor Fansler said at the time and that's just as true today with 13 MILLION people flying every day above our planet, almost 5Bn people each year, which is almost our entire population – lifted off the ground and sent to 30,000 feet. So don't let people tell you we can't leave this planet – we do it all the time!

This is incredible, exciting stuff but does it make SPCE a good investment? Well, the company that flew people around Florida for $5 went broke in 4 months. It wasn't until 1925, when Ford (F) bought out the Stout Aircraft Company and started making the all-metal Ford Trimotor planes, which took 6 passengers or cargo (not both) about 100 miles, that commercial aviation became a reality. That was less than 100 years ago and that's about where SPCE is now.

Ford (F) wasn't even a public company until 1953, when they went public at $3.2Bn (now $57Bn and miles off the all-time highs of well over $100Bn). Of course, Ford was like Boeing (BA) – they only made the planes. Betting on an individual airline at the time was a one in a thousand chance that they wouldn't go bankrupt (not much different today as most of them have gone bankrupt at some point), so why will SPCE be any different?

Ford (F) wasn't even a public company until 1953, when they went public at $3.2Bn (now $57Bn and miles off the all-time highs of well over $100Bn). Of course, Ford was like Boeing (BA) – they only made the planes. Betting on an individual airline at the time was a one in a thousand chance that they wouldn't go bankrupt (not much different today as most of them have gone bankrupt at some point), so why will SPCE be any different?

Well, they are better-funded than most airlines were but Branson is 70 now and who knows what kind of promoter the next boss will be? F went up a good 100x in 100 years and I'm sure if you picked a winning Airline (and cerainly BA), you woulld have done just as well – making an average of 100% per year for 100 years. What could be better than that?

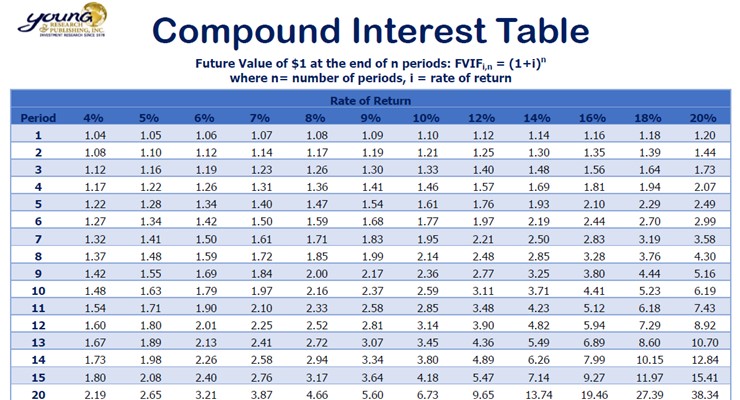

NOT BEING MISLED IS BETTER THAN THAT!!! Almost any business that grows and lasts 100 years will make you 100x. Try this Compound Interest Calculator and put in $1 for 100 years at 5% growth (interest) and you'll see you end up with $131.50! The problem is most people don't have the PATIENCE to invest like that and year one you have $1.05, year 2 is $1.10, year 3 is $1.155…. You sure don't feel like you're getting rich along the way but the math makes it inevitable – if you have the patience to let it work.

But, if that's the case with ANY reasonable rate of return, why would you RISK your money betting on one unknowable stock or the other that MIGHT win in the future when there are so many sure things. Pfizer (PFE) pays a 4% dividend and we have a rapidly aging population that needs more pills – what could be a simpler premise than that? AT&T (T) pays a 7% dividend and, every time a new subscriber is born, they get an IPhone – very simple. Apple (AAPL) only pays a 0.6% dividend (because their stock went up so fast they didn't increase it) and they still only sell phones and computers – lots of room to grow….

Don't Gamble with your Investments is Lesson #1 at PSW and that means don't chase after the sexy trends with the money that matters to you. Sure, we can always have some fun with our excess profits – with the money we make that is over and above what we PLAN to make for our retirement – but don't gamble with the whole thing! Treat risk with respect and keep all those eggs in different baskets – we never really know what the future holds.

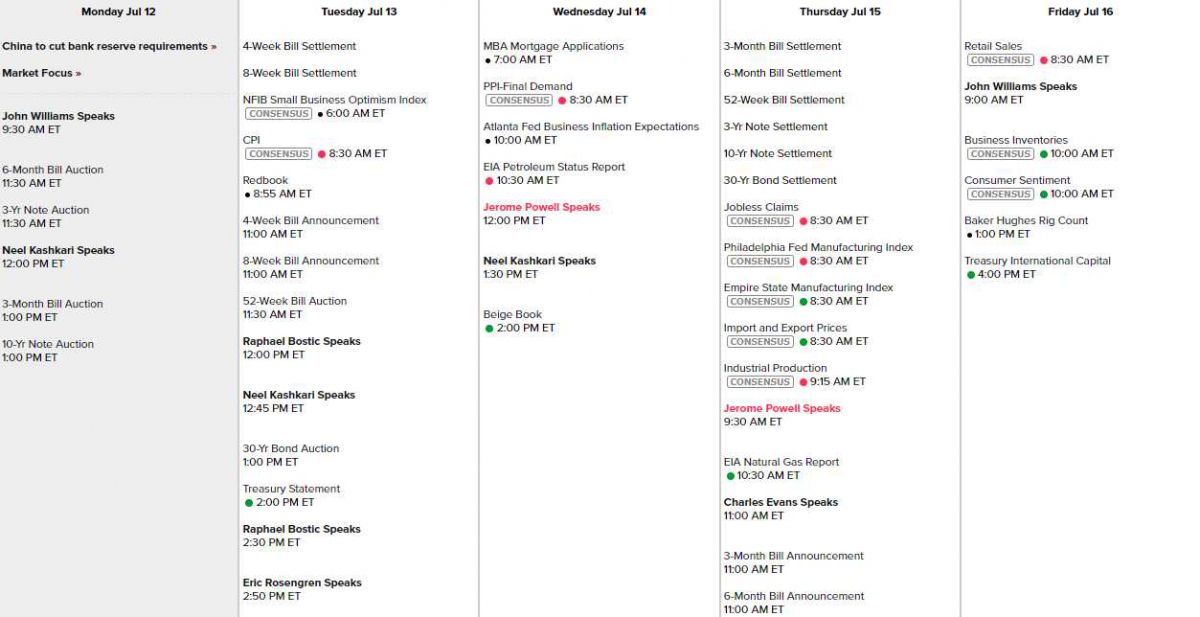

We are back to work this week and so is the Fed with 11 speeches on schedule (2 by Powell) and tomorrow we have scary CPI, PPI Weds with the Beige Book along with the NY and Philly Fed Reports on Thursday with Inducstrial Production and Consumer Sentiment on Friday:

But that's nothing as it's EARNINGS SEASON once again and look at all the big, huge companies we'll be hearing from this week and next. Will the earnings be good enough to support these all-time market highs? I can't wait to find out:

We still have plenty of bullish positions but we had a nice test of our hedges last week and they are working very well so we are confident but we also have a stop on our paired porfolios at $2M (now $2.15M) as this is already the gambling money we didn't mind risking after the last portfolio cycle took us from $600,000 to $2M and we cashed that out. And that is the right way to do it when you get ahead – move most of the bonus money into something very safe and then gamble with what's left.

We were very aggressive in this cycle, which began in October of 2019 with $600,000 and thank goodness we had put that $1.4M on the side as the market collapsed in March of 2020 and, rather than freaking out, we were able to jump on the opportunities with $1.4M (from the original $600,000) still safely in our banks. That's how playing it safe can be exciting because, sometimes, the market doesn't go straight up!