We're going to get started early this week.

We're going to get started early this week.

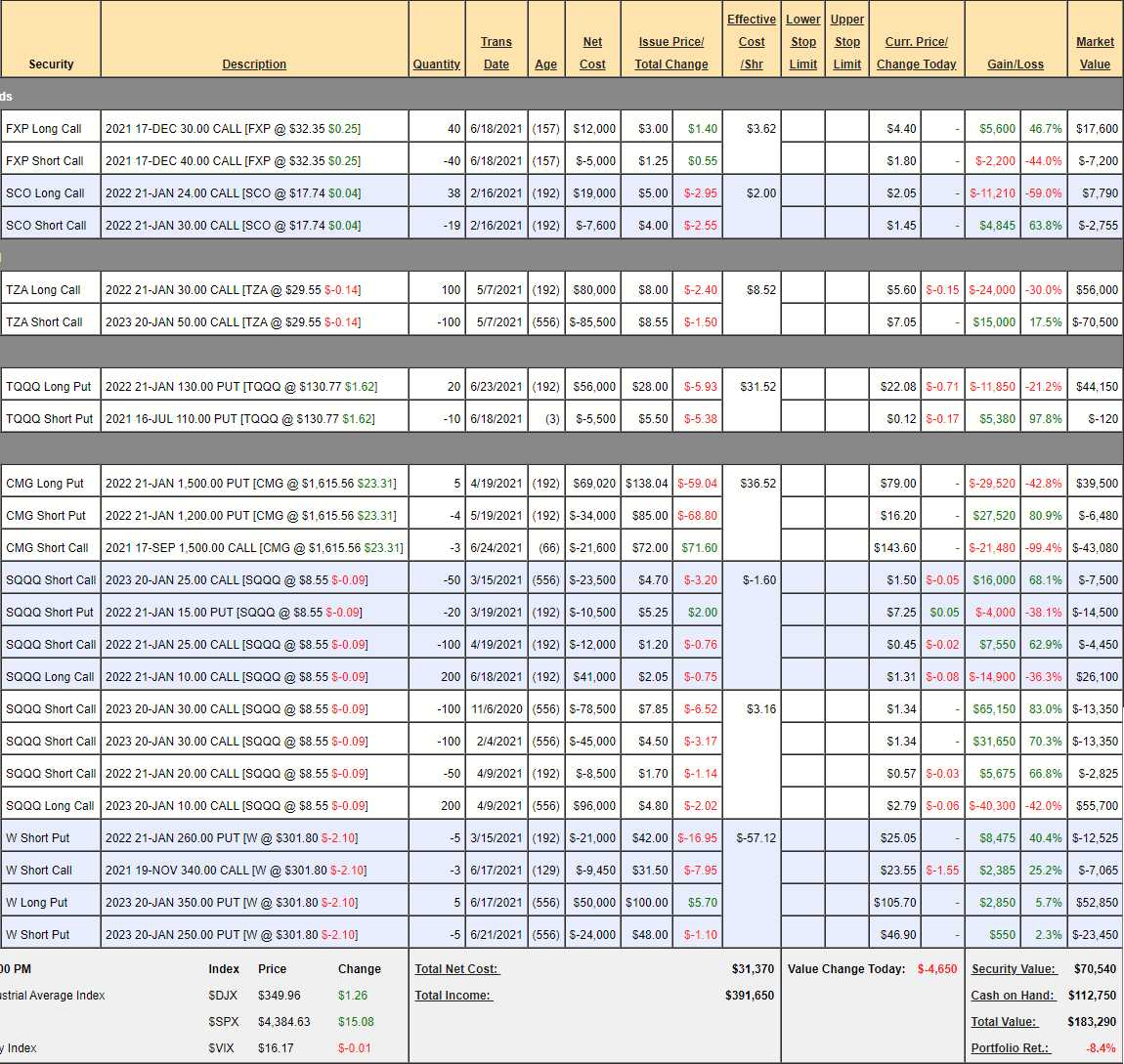

Mostly because I want to be protected as Earnings Season kicks off today but also because my daughters are coming on Thursday and I'll be taking off early on Friday. We're certainly well-hedged and we had a test drop last week where the gains in our Short-Term Portfolio (STP) kept up with the losses in our Long-Term Portfolio (LTP) but, overall, the Short-Term Portfolio (STP) is down $58,798 (24%) since our last review as we have once again rallied back and gone higher but also because we got much more aggressively short last month and have not yet added enough longs in our LTP to cover a major rally.

Short-Term Portfolio (STP) Review: The STP has our hedges and we're supposed to lose money on the way up and the Dow is up 1,000 (3%) and the S&P is up 150 points (3.5%) since the last week of June – and really since last Thursday as well. If this earnings season doesn't knock us back, nothing will and we'll have to make some more bullish bets to even things out better. As I noted yesterday, however, at over $2.1M (up 150%) in our paired portfolios – I'd be happier just cashing them out and starting from scratch again.

- FXP – Ultra ETF against China and it's a 2x ETF with FXP at $32.35 so a 20% drop in China's FTSE 50 would be a 40% pop in FXP to $45.29 between now and September and that would pay $40,000 on the net $10,400 spread so $29,600 of downside protection.

- SCO – This one is killing us. 2x short on oil but we expected to top out at $75 around July 4th. If oil goes back to $60 that's down 20% and that would pop SCO 40% from $17.74 to $24.83 and that only put us in the money, so there's no point to leaving this alone. 38 Jan $24 calls at $2.05 ($7,790) can be rolled down to 40 of the Jan $18 calls at $3.30 ($13,200) and we can sell 21 Jan $25 calls at $2 ($4,200) to pay for most of it. So now we've spend net $1,210 but at $25 we get back $28,000 instead of $3,800 and the new net is $3,825 so we've created $24,175 of downside protection.

- TZA – This is a 3x ETF so $29.55 becomes $47.28 on a 20% drop in the Russell and that's pretty much goal so no need to adjust this. It's a $200,000 spread at net $14,500 so about the most efficient protection you can buy for a portfolio, offering us net $185,500 of downside protection!

- TQQQ – This is a 3x Ultra-Long ETF for the Nasdaq, which we are shorting and a 20% drop in QQQ would send TQQQ down 60% to $52.30 where the 10 uncovered $130 puts would be about $80,000 and the 10 covered would be $20,000. Currently net $44,030, so we have $55,970 of downside protection.

- CMG – Up and up she goes and that's killing our short Sept $1,500 calls, which are new and $21,480 against us, so half our losses are right here. Actually all of our losses as the rest of the spread was up $37,000 last month and now it's flat so there's nothing wrong with the rest of our hedges – just CMG! This is why we analyze, right? We identify the correct problem and don't fix things that don't need fixing. Still earnings are July 20th and $1,615 is $45.47Bn for a company that will be lucky to make $700M this year so 65 times earnings is very excessive for a fast-food franchise. We may as well buy back the 4 short Jan $1,200 puts at $16, not because we think they'll be hit but so we have room to sell something else on a dip. Call this $50,000 of downside protection (getting last month's money back).

- SQQQ #1 – Although this is a 3x Ultra-Short, we're down to $8.50 so a 20% drop only gets us to $13.6 and we have the $10 calls although 400 longs at $3.60 is $144,000, what's the point of these compared to the TZAs? We're going to leave this one in place but adjust #2.

- SQQQ #2 – We're going to cash out our 2023 $10 calls at $3 ($60,000) when there's a dip – it's not an emeregency. We'll buy back the 100 short 2023 $30 calls at $1.30 ($13,000) as we're up 83% on those and that leaves 150 short calls here and 150 short calls above covered by 200 long calls. We're netting $47,000 and we'll double down on the TZA spread to keep a good cover. That will add $185,500 of downside protection and 200 longs at $3.60 is $72,000 but let's just say $200,000 of downside protection overall.

- W – Finally took the dip we expected and now we'll see if $300 holds up. Our target is $250 so you know what we expect. The short calls are looking good and the spread tops out at $50,000 and currently net $9,810 despite being $25,000 in the money. $40,190 of downside protection.

If CMG gets realistic we'll be in great shape and there's net $585,435 of downside protection against a 20% drop in the market and, as I noted earlier, we already stress-tested the LTP and it wasn't losing more than the STP was gaining so we can ride out a 20% correction before we have to make any big decisions – that's very comforting.

The CMG loss was unusual and, if not for that, the gains in the LTP would have given us a net positive month and that's all we're looking for when the market is this toppy into earnings. Hopefully, we'll find some bargains to add as companies begin to report.

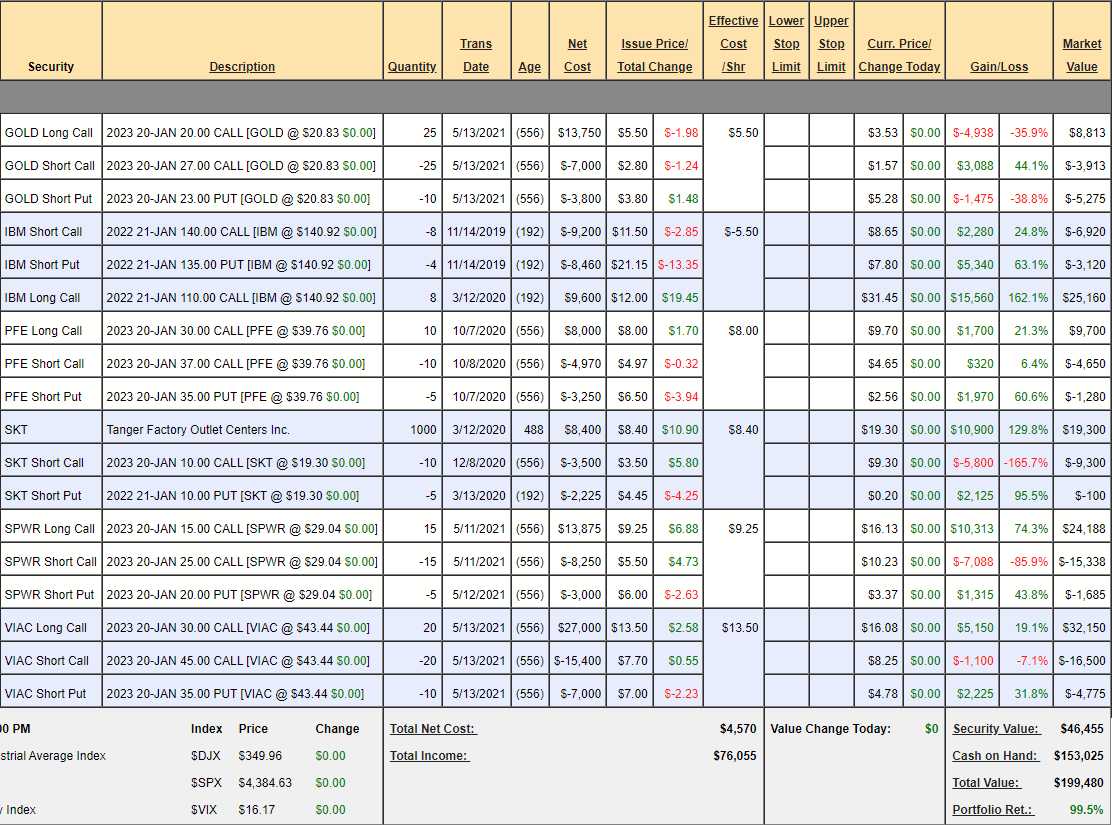

Money Talk Portfolio Review: This one is easy as we can't make adjustments unless we're on the show so it's mostly a "no-touch" portfolio. We added GOLD and VIAC on our May appearance and, since last month's review, we're up $1,732 at $199,480 – just under a double from our 11/13/2019 start. That's very good for a low-touch portfolio.

- GOLD – From our "Trade of the Year" collection. It's a $17,500 spread already losing money for us at net -$375 so $17,875 left to gain on a credit spread seems good for a new trade to me!

- IBM – At the money on this $24,000 spread at net $15,120 so $8,880 left to gain.

- PFE – Another shot anyone? Already in the money on our $7,000 spread at net $3,770 so $3,230 (85%) left to gain is too boring for you?

- SKT – Deep in the money so we'll get $10,000 back and it's $10,000 now so we'll be killing this one next time I'm on the show. We did just get a $178 dividend payment, though!

That is the point of these review exercises. In looking at our positions and what we have left to gain vs what's at risk, we can easily identify what needs to be changed. There's no sense in carrying dead-weight positions in your portfolio – you have to move on and re-deploy your captial.

- SPWR – Stock of the Decade has 9 years left to run but this trade expires in Jan, 2023 at $15,000 if all goes well and currently it's 100% in the money at net $7,115 so $7,885 (110%) left to gain if our Stock of the Decade doesn't drop $4 over the next 18 months. I can only tell you how to make 110% – the rest is up to you!

- VIAC – Still not getting any respect at $43.44 but we don't care as our target was only $45. Amazingly, this $30,000 spread is still only net $10,875 so it has $19,125 (175%) left to gain over the next 18 months, which is 10% PER MONTH if VIAC can make it up over $45 (up 3.6%). If they are just going to leave this money lying around – who are we not to pick it up?

Notice the trades in the Money Talk Portfolio are not complicated and not very risky. We are playing solid Blue-Chip companies that we added about once per quarter for the past 18 months and we're up $99,480 over that period and, over the next 18 months, the positions we have now have the potential to make another $56,995 and we are 75% in CASH!!!

You don't have to take big risks to get big rewards and you don't have to constantly trade. I'm on the show pretty randomly but about once per quarter and I simply spend the week before the show looking for the best bargain at that moment to add and deciding if anything should be removed (now SKT) or adjusted. That's it – then we don't touch it for another 3 months.

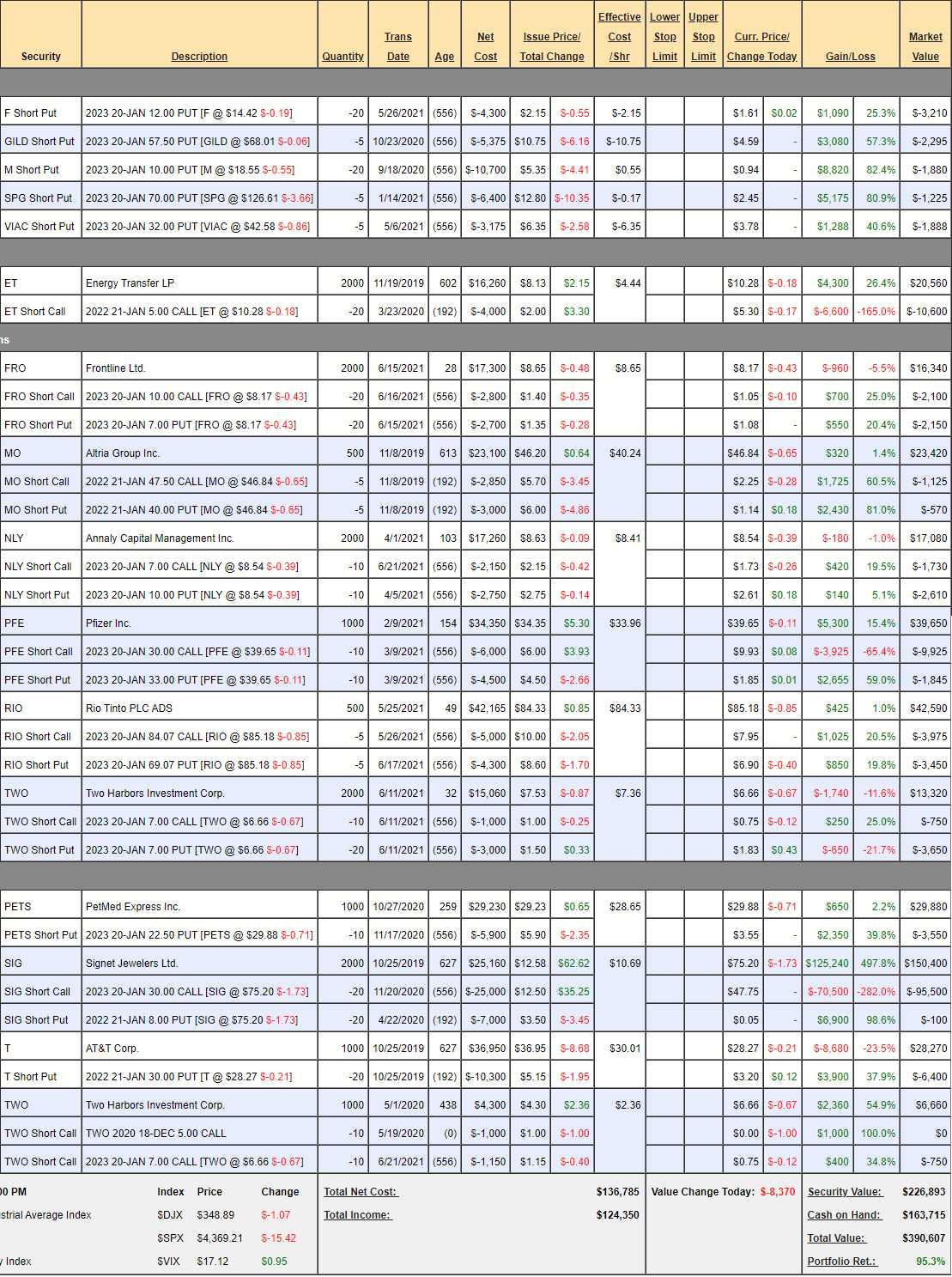

Dividend Portfolio Review: $390,607 is up $2,860 since our last review and about half of that was from dividends. Dividends are a fantastic way to boost your portfolio's performance and here we have a nice, diversified group to choose from. Most importantly, we cashed out two positions last month and raised our CASH!!! to $163,715, about 40% – and that in itself is a nice hedge to fall back on.

- Short Puts – Though M and SPG are both up 80%, there's no way we expect that they won't expire worthless so why pay to buy them back? Short puts are mostly there to remind us we'd love to buy the stocks if they get cheaper – but they also provide a nice income.

- ET – We bougth back the short puts on this one, expecting a pullback. We are miles over target.

- FRO – This one is right on track, just added.

- MO – On target.

- NLY – On track (note the aggressive put sale).

- PFE – Way over target.

- RIO – At goal.

- TWO – On target.

- PETS – We bought back the short calls, waiting for them to pop again to sell more.

- SIG – Only $45,000 out of $50,000 so no point in getting out early.

- T – Waiting for them to pop back to sell short calls.

TWO – We liked them enough to buy them twice. Just took a big hit but fine as our position was conservative.

It seems like a boring way to invest but the money keeps rolling in. The reason we're up so much is we made an aggressive adjustment in March, 2020 and caught that nice bounce higher – that was unusual but we made $2,860 on $226,893 in positions last month and that's 1.2%/month – beats money in the bank!