$2,142,405!

$2,142,405!

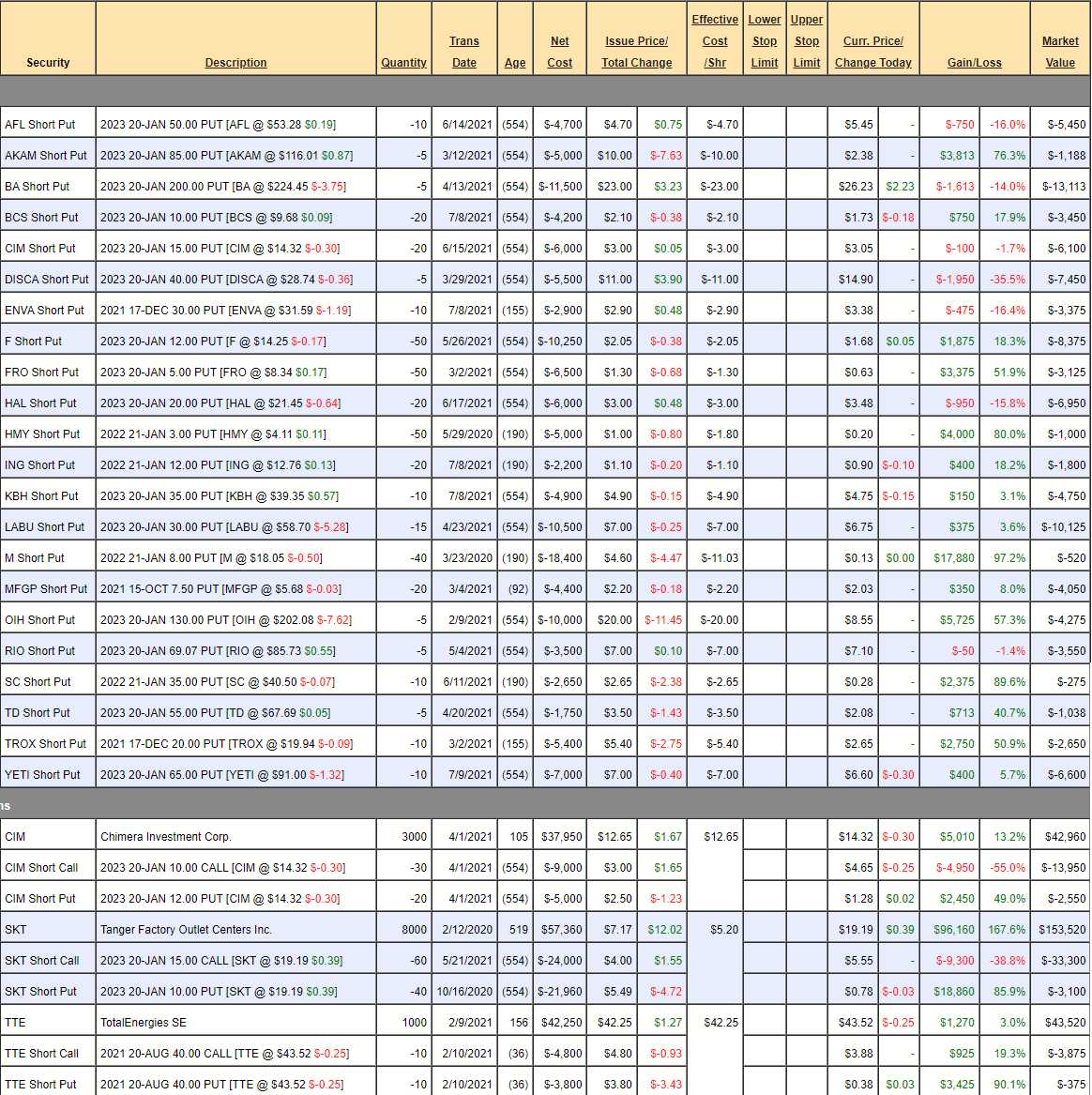

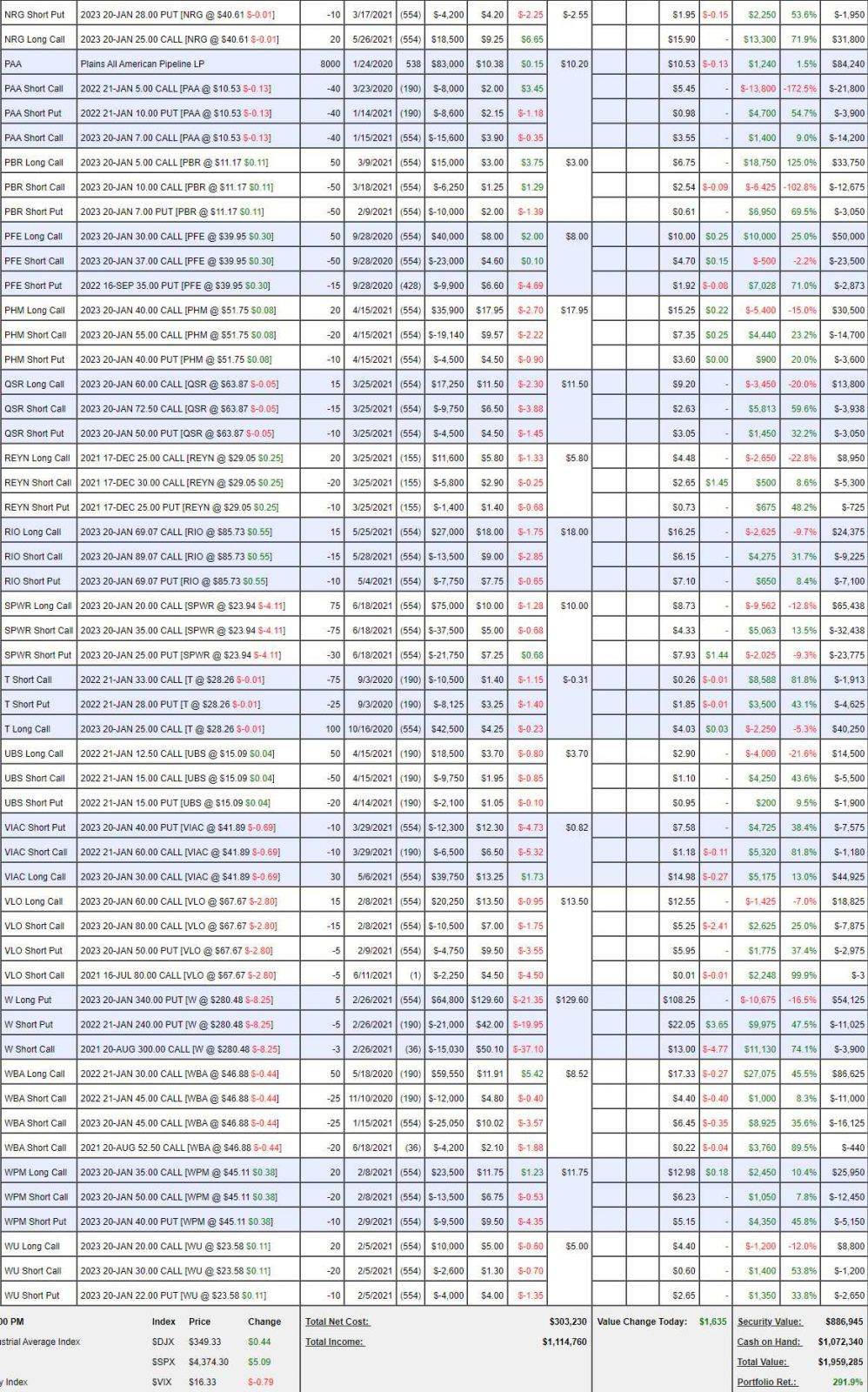

That is DOWN $4,838 since our last review as our Short-Term Portfolio (STP) hedges continue to be hammered by this relentless rally. Of course, the Long-Term Portfolio (LTP) gained $39,937 and, in theory, we have locked in those gains with the STP, which has $585,435 of downside protection and that should be enough to cover our $886,945 worth of longs against a 20% drop. We also have $1,072,340 in CASH!!! in our LTP and that too makes a nice hedge. Keep in mind we started with a combined $600,000 – which is why we're so keen to protect our $1.5M in gains.

We did a detailed review last month, so I won't be doing that today. Our positions at the time had the potential to gain $676,193 over the next 18 months and that means $40,000 per month is just about "on track" in an up market. While $40,000 is "only" 2% of $1.9M, it's a whopping 4.5% monthly gain on the actual positions (not the cash). Clearly we have an abundance of caution coming into Q2 earnings but I know I sleep a lot better at night knowing our portfolio is fairly shock-proof.

Being well-hedged has allowed us to add new positions on BCS, ENVA, ING, KBH, MU and YETI in the past month – $21,000 worth of short puts and the MU spread is a $22,500 spread that is still a net $115 credit so, as we should do, we picked up another $43,500 worth of upside potential for the month to replace the $39,937 we have realized (and locked in with our hedges).

As long as we continue to do this in an up market – even if we end up burning the entire $183,290 balance in our STP, we'll still be about $300,000 ahead for the year – that's without doing anything smart along the way! BALANCE, Danielson, BALANCE is the key to everything. If you have balance, like a good surfer, you can make little adjustments and ride almost any wave. If not – Wipeout!

Short Puts – We have 22 of them now with about $90,000 of upside potential remaining. On the whole we like to sell one or two a month but we felt we were too bearish and short put selling is an easy way to create a Watch List of stocks you'd like to buy if they get cheaper – and get paid while you wait. We do pruning along the way and, of course, 7 will be expiring by January and soon we'll be adding 2024 puts to the mix – it's a constant rotation:

- SC – These are already up 90% with just $275 left to gain over 6 months so we will clear the spot for a more productive put.

- M – Is in a similar position except it's so far in the money it's highly unlikely we won't get the last $520 out of it, so why pay to get out early when we don't need the margin? The same goes for HMY and AKAM – there's not enough worry about the positions to merit spending money to buy them back. SC, on the other hand, is only $5 in the money and you never know what might go wrong in Finance.

- CIM – They just paid us an 0.33/share ($1,000) dividend on 6/29, which I love. The spread is very conservative – we're just in it for the dividends.

- SKT – We have another $1,000 coming on this one at the end of the month.

- TTE – This one just paid us $800.

That's $12,000 a year in dividends from just 3 of our stocks. Considering this was a $600,000 original investment, that's 5% back on our money right there. THAT is how you make sure you outperform the market! There are $240,000 worth of longs here so you get 5% back if you just do that. We sold short puts and calls to bring our cash outlay down to $182,850 (current net) and that makes $12,000 a 6.5% annual return – very nice for coupon-clippers. Not everything in your portfolio has to be a home run – singles are good! Actually, we already have $112,850 in profits, mostly because we never lost faith in SKT, as it got cheaper and kept adding to it – that's why the $240,000 seems like a lot – half of it is profits on these "boring" dividend plays.

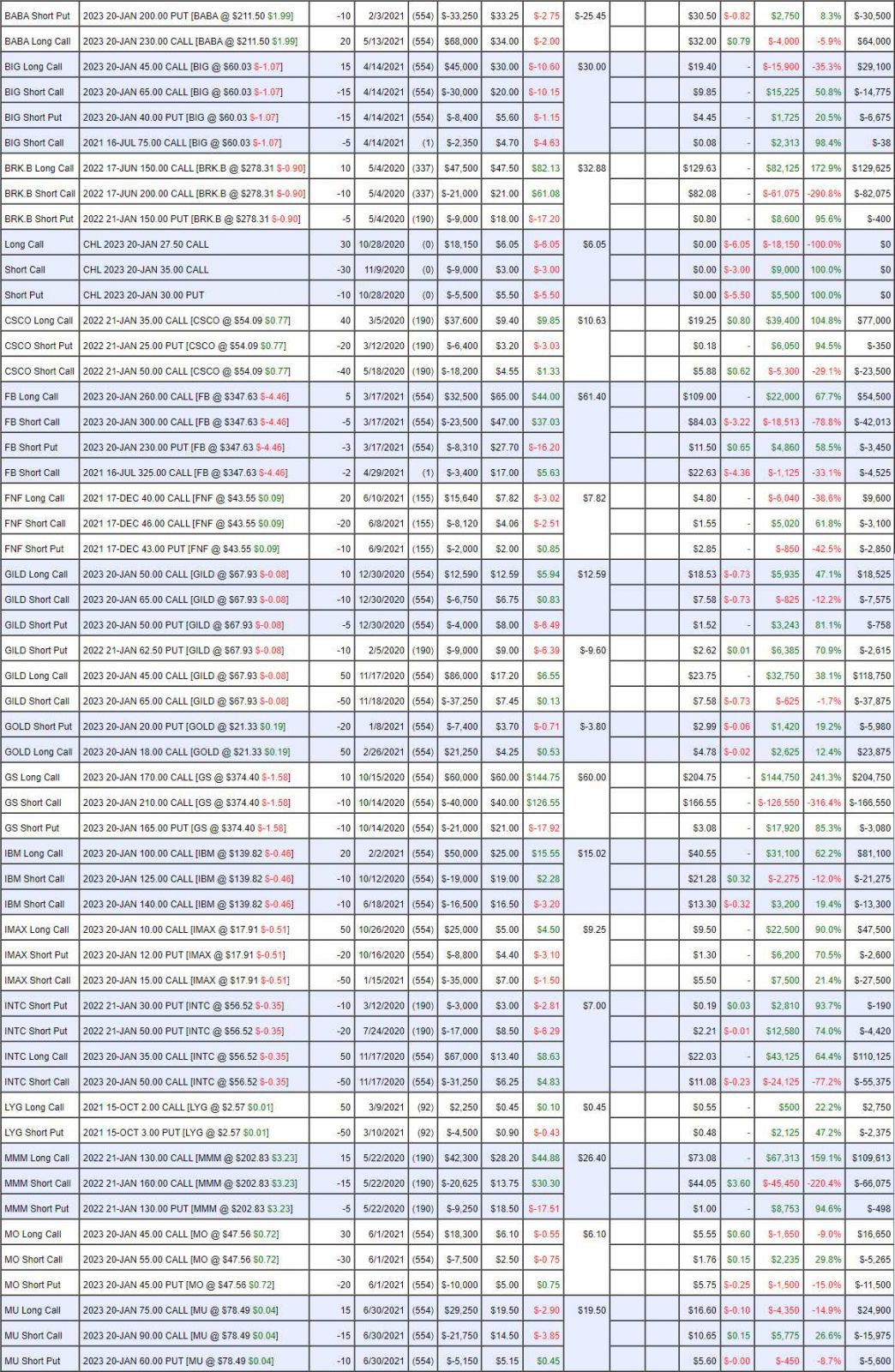

- BABA – Last month we bought back the short calls, expecting $200 to be the bottom. I'm not brave enough to sell more puts but I do want to roll the 20 2023 $230 calls at $32 ($64,000) to 20 2023 $200 calls at $45 for net $13 ($26,000) to buy us net $24,000 of additional upside and put us in the money (increasing our Delta from 0.53 to 0.65).

- BIG – The short July calls will go worthless for a lovely $2,350 profit for the quarter on our net $4,250 spread. It was only a 1/3 sale so no reason not to sell 5 Oct $70 calls for $2.20 ($1,100) while we wait for earnings at the end of August.

- BRK.B – If I wasn't writing this review, I'd be writing about how RIDICULOUS it is that Berkshire is up from $215 in 2019 to $278 today (30%) but in 2019 the company made $81Bn and in 2020 they made $42Bn and this year they project $25Bn. So making half as much money and charging 50% more is a strong proxy for what's wrong with the entire market at the moment. They were woefully underpriced in 2019 but now the P/E at $638Bn is 25.5 – still better than the S&P but, come on people, can't you see how insane these markets have become? Needless to say we're miles over our target at net $47,150 on the $50,000 spread – there's just no point in buying it back early.

- CHL – Damaged goods. We're being massively ripped off because the options are untradeable. Hopefully that clears up by next year.

- CSCO – Right on track.

- FB – $1Tn Baby! They actually make $37Bn so not too overpriced but I think we hit peak Facebook usage last year so these guys need to figure out some new revenue streams or they'll be disappointing the extrapolators. We have to buy back the July $325 calls we sold for $3,400 for $4,525 so a little loss there but that means our net $2,710 CREDIT spread is well on track to make the full $22,710. Of course $350 is ridiculous so we're going to sell 3 FB Sept $365 calls for $10.50 ($3,150) and hopefully we do better on these.

- FNF – Cheaper than our entry so still good for a new trade at net $3,650 on the $12,000 spread. That's $8,350 (228%) upside potential by December!

- GILD #1 – On track.

- GILD #2 – On track

- GOLD – We bought back the short calls and got more aggressive.

- GS – Another one that's ridiculously in the money. The bull call spread is $38,200 so silly to wait for $1,800 more, let's kill those and leave the short puts.

- IBM – Right on track.

- IMAX – Over targets with 18 months to go, despite the pullback on renewed lockdown fears. We're getting $20,000 out of a potential $25,000 on the bull call spread so only 25% to make over 18 months isn't worth any risk at all so let's kill the whole trade.

- INTC – Over targets already.

- LYG – Aggresively long and we'll see how earnings look. I'm assuming a lot of their worst-case Covid policies didn't have to pay out.

- MMM – Well in the money, expires in Jan. They make the masks – how obvious was this play?

- MO – Fairly new trade and about where we came in. Net $115 CREDIT on the $30,000 spread. I can only tell you how you can make $30,115 – that is the extent of my powers…

- MU – New trade, same(ish) net $3,325 on the $22,500 spread is how you can make $19,175 (570%) betting on a chip stock, during a global chip shortage.

- NRG – We were aggressively long and got out pop so NOW that our long calls are up 72%, we can cover by selling 20 2023 $42 calls for $5.15 ($10,300) and that drops us to net $4,000 on the $34,000 spread and THAT is how you leg into a trade by paying attention to the trading channel! Keep in mind though, this is not a chart thing – it was a VALUE call we made in May, when the short put we had sold in NRG reminded us it was a good time to leg into the bull spread (because it had a big loss and we said "WTF?" and did more research and decided our fellow traders were idiots).

- PAA – We have a $1,500 dividend coming at the end of the month. Otherwise, right on target.

- PBR – On track.

- PFE – Another very obvious Covid pick. Over our target already.

PHM – Pretty new and went nowhere so far so good for a new trade at net $12,200 on the $30,000 spread that's mostly in the money to start.

QSR – Right on track.

REYN – At goal already.and expires in Dec. It's only net $2,925 out of $10,000 at $30 so let's buy 30 more of the bull spreads and sell 15 more puts! Because who doesn't want to make 200% in 5 months?

- RIO – This is what's fun about options, the stock went down but we still made money on the spread! Not at all worried.

- SPWR – My baby! Took a big hit yesterday but not much to do as we took the previous winner off the table last month and this is the replacement trade.

- T – What an opportunity to get into this stock at $28.28! I almost feel like converting it to a stock play to get the 7% dividends.

- UBS – Still good for a new trade.

- VIAC – Another stock I love. Funny how stocks I love end up in our LTP, isn't it? We're pretty aggressive here and there's no point in buying back the Jan $60 calls as, if the stock pops 50%, we'll be happy enough.

- VLO – Wow, lots of energy stocks. I guess that was good into summer but the pullback has been hard and fast. The short July calls are paying us $2,250 and we only spent net $2,750 on the spread so no reason to kill it. Let's sell 10 Sept $70 calls for $2.95 ($2,950) and see how that goes.

- W – Finally starting to pay off. I have no idea why it took traders so long to agree with me…

- WBA – Another one of my babies! Right on track.

- WPM – On track

- WU – On track and still net $4,000(ish) on a $20,000 spread so 400% upside potential I'd call good for a new trade.

IN PROGRESS