Good morning!

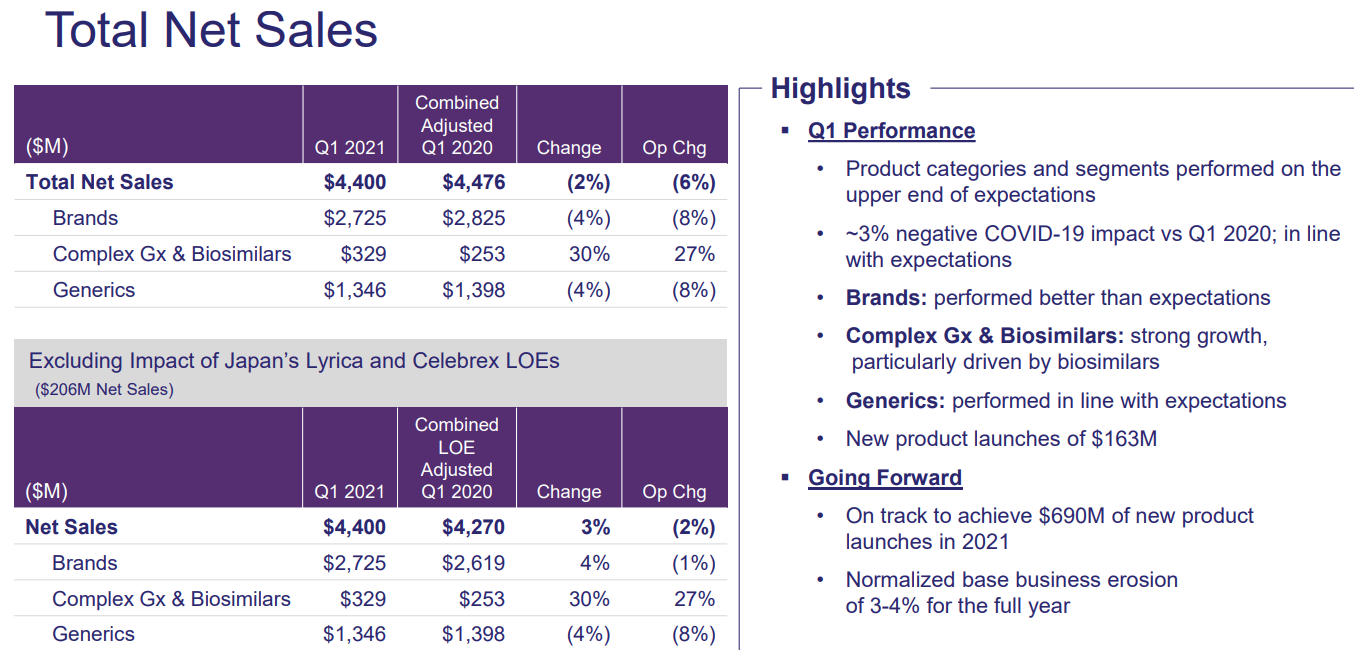

VTRS used to be Upjohn (medicine), which is a combination of MYL and PFE and no one pays attention to them yet but they are at $17Bn at $13.89 but they are making $4Bn/yr selling Lipitor, Norvasc, Lyrica, and Viagra, along with Mylan's portfolio of more than 7,500 marketed products around the world, including the epinephrine auto-injector, EpiPen, and antiretroviral therapies on which 40% of people living with HIV/AIDS globally depend.

They are paying a 3.4% dividend (0.44) so, for our Dividend Portfolio, let's:

- Buy 2,000 shares of VTRS at $14 ($28,000)

- Sell 20 2023 $15 calls for $2 ($4,000)

- Sell 20 2023 $12.50 puts for $2.10 ($4,200)

Here's we're spending net $19,800 and that makes our $880 dividend a respectable 4.4% while we wait to get called away at $30,000 with a $10,800 (54%) additional profit - not boring at all for 18 months.

In our LTP we can be more aggressive with:

- Sell 20 VTRS 2023 $12.50 puts for $2.10 ($4,200)

- Buy 50 VTRS 2023 $12.50 calls for $3.30 ($16,500)

- Sell 50 VTRS 2023 $17.50 calls for $1.50 ($7,500)

Here we are foregoing the dividend and spending net $4,800 in cash on the $25,000 spread, giving us $20,200 (420%) upside potential over the next 18 months so we should make a good 20% a month ($950) if all goes well, which is more than the dividend - every month - and we're only laying out $4,800 vs $19,800 (the margin would be the same as the stock play above). If assigned at $12.50 and we lose the whole $4,800, that adds $2.40/share so net $14.90 means we risk overpaying for the stock by $1 on 2,000 shares as our worst case.