I don't know what people think is going to happen?

I don't know what people think is going to happen?

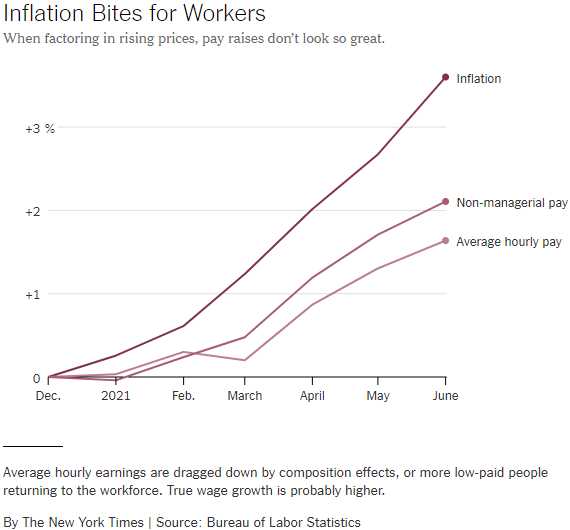

The Fed meets next week and they certainly aren't going to LOWER rates, are they? According to Powell and others, they are in no hurry to raise them but, as you can see from this chart, inflation is rising about twice as fast as wages so our workers are falling further and further behind in buying power. This effect is, however, masked by stimulus checks that boost spending power – that's the key to our "great" economy this year.

Labor supply shortages are still evident across all sorts of industries. The latest survey of manufacturers from the Institute for Supply Management cites complaints from makers of furniture, chemical products, machinery and electrical products about the difficulties of fulfilling demand and that hurts growth and growth is what the economy is all about, right?

Rents are starting to rise sharply, according to a range of data sources. And businesses facing higher prices for Supplies and Labor may be in the early stages yet of passing on those higher costs to consumers. The Producer Price Index, which tracks the costs of the supplies and services that companies buy, rose 1% in June, an acceleration from April and May. This is a signal that inflationary forces may still be working their way through the economy.

It is supposed to be the Fed's job to prevent prices from going up more than 2% by raising rates but, with inflation up 4% in the first 6 months of the year, the Fed is too busy lying to us about how strong (but weak) the economy is, which gives them the excuse to keep printing up $120Bn per month and distributing it to their Bankster Buddies (keep in mind the Fed is not a Government body but a banking cartel that is blessed by the Government – after many contributions from Banksters).

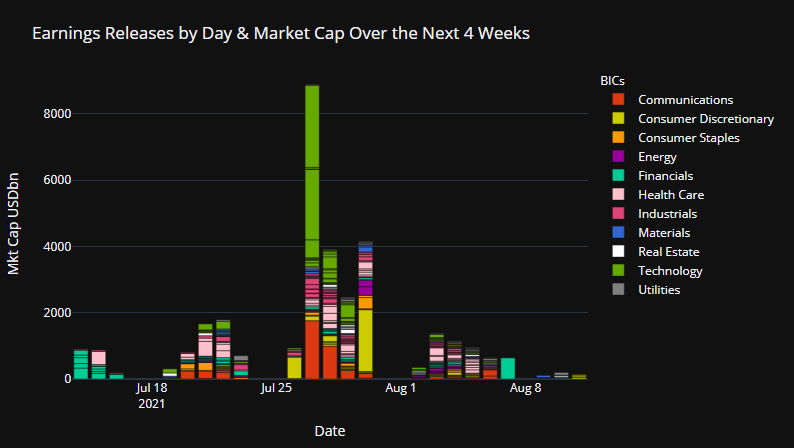

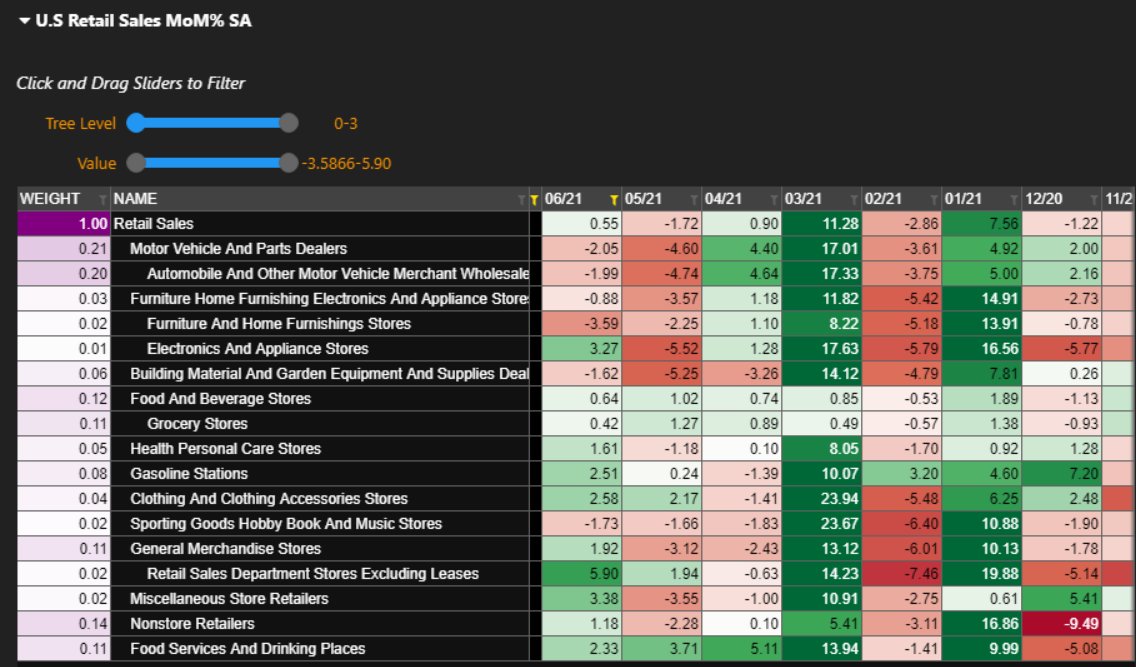

Stocks are not supposed to be graded on a curve but it's easy A's all around this quarter with $8Tn worth of stimulus added to the mix. In fact, if you want to get an idea of how much stimulus drives this economy and who is benefiting – just take a look at the monthly Retail Sales numbers:

You can see the months after the stimulus checks came out – they are the green ones. The rest is pretty red or barely green but watch out for Furniture, which was down 3.5% last month (we're short Wayfair) and gasoline sales may be up 2.5% but gasoline was $2.18 last year and now it's $3.15 so figure 50% more expensive at the pump and ONLY a 2.5% increase in sales – that is NOT an indication of healthy demand growth.

Still, there IS stimulus and it WILL continue so we will continue to add bullish positions until those bounce lines we discussed on Tuesday finally do begin to fail. For the moment, however, all is well and even the russell is well over 2,160 so, as long as we hold that into the weekend – it should be smooth sailing into the Fed next Wednesday.

|

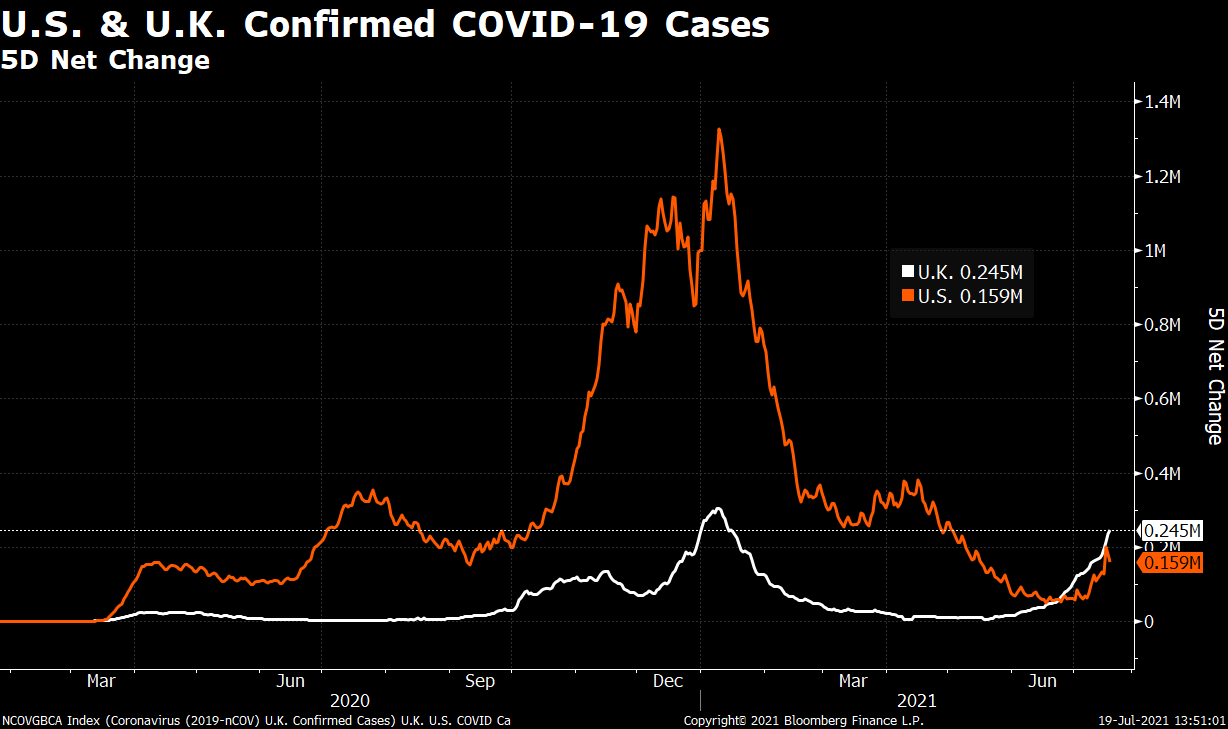

And, by the way, if I asked you if you thought the US was doing better or worse on daily covid infections than we were last July – what would you say?

How about now?

The UK is actually back to it's HIGHEST level of daily infections already.

Be careful out there.