Here we are again.

Here we are again.

It's been quite a run for the Nasdaq – up 50% since last July and it only took $8Tn (40% of our GDP) in stimulus spending to get there. 9,736 was our pre-Covid high so all this hoopla is over and above where we were. In fact, in 2019, the Nasdaq was generally at 7,500, so we're up 100% in two years – yay!

The current PE for the Nasdaq is 38.37 times earnings. The S&P 500 is at 36.6 so just as crazy and the P/E for the Russell 2,000 has now broken the meter at the Wall Street Journal – having passed 100 times earnings. Of course everyone ESTIMATES they will do better in the next 12 months and the last 12 momths were pretty bad but even the forward estimates of the Nasdaq peg them at 27.43 times forward earnings while the Russell is at 33.81 times earnings.

That's a very long time to wait for payback on your investment. In December, 2018, the PE ratio of the Nasdaq was 20.34 so going from 7,500 to 15,000 over the past 2 years has NOTHING to do with earnings growth and everything to do with price inflation. You are simply paying twice as much money for each Dollar of earnings. That is Fundamentally unsound as it's very unlikely to continue over the long-run but, in the short run – anything can happen.

Corrections can come hard and fast when the market is in a bubble so please be aware that this is NOT normal – even as "not normal" continues to be the norm. We are back to Dot Com and 2008-high levels of valuation and, if you remember, people were partying until the very last minute then as well. I have to call the Nasdaq a good short here on the /NQ Futures. Below the 15,000 line with tight stops above would be the way to play.

In our Short-Term Portfolio, which we reviewed last week, we're going to take advantage of this Nasdaq high to roll our 200 SQQQ Jan $10 calls at $1.25 to 200 2023 $5 ($4)/20 ($1.70) bull call spreads at net $2.30 so we are spending about $1 ($20,000) to move $60,000 into the money and buying another year of protection.

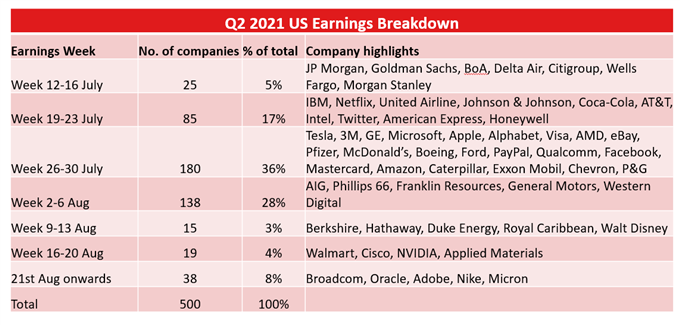

We are 1/4 of the way through Q2 earnings and nothing has blown up yet, so that's nice. Next week and the week after are the big ones and we'll try to see if there's any way to justify the kind of valuations we're seeing but, outside of expecting more and more free money from the Government – I'm just not seeing the justification so far.

"Just a song before I go

To whom it may concern

Traveling twice the speed of sound

It's easy to get burned" – CSN

- Senate Infrastructure Deal in Sight After Medicare Agreement.

- U.S. Median Home Price Hits New High

- Global Home Prices Are Rising At The Fastest Pace On Record

- Federal Reserve Ramps Up Debate on Taper Timing, Pace

- The "Transitory vs Persistent Inflation" Debate

- A Tale of Two Recoveries

- Italy Requires Vaccine Pass for Dining and Leisure as Cases Rise

- Jim Cramer says near-term Covid delta variant concerns won’t threaten long-term stock market gains

- How Much More Will Your Oreos Cost? Companies Test Price Increases

- Intel CEO Says Chip Shortage Could Stretch Into 2023

- Amazon-Backed Rivian Automotive Plans Second U.S. Electric-Vehicle Factory

- Bitcoin Is Failing Its First Inflation Test

Have a great weekend,

– Phil