$10Tn!

$10Tn!

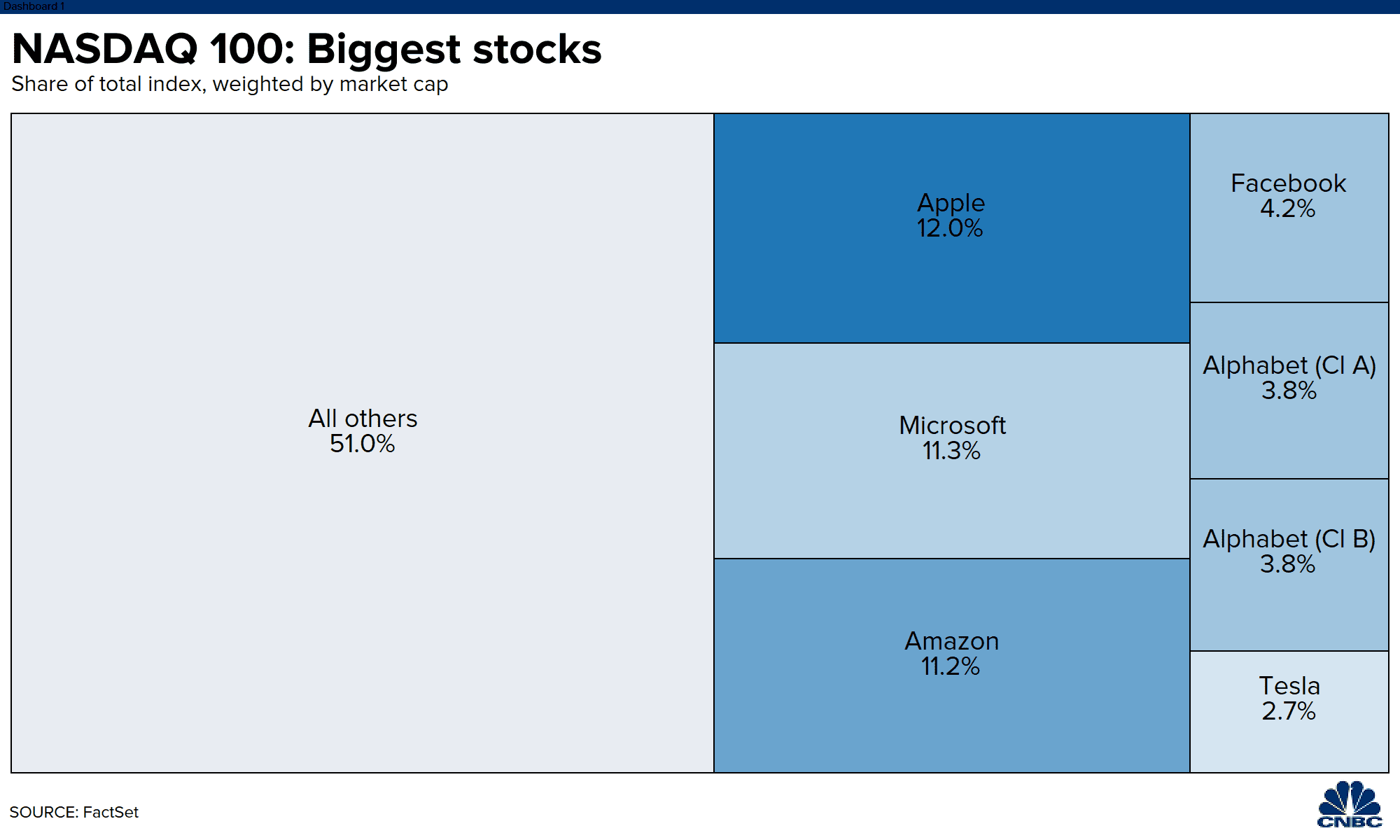

That's the market cap of Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL) Facebook (FB), Microsoft (MSFT) and TSLA these days. Not only is that 25% of the S&P 500s market cap, it's closer to 1/3 of their earnings and, over at the Nasdaq, the Big 6 make up over 50% of that indexe's market cap (this chart was from earlier in the year, when they were still a bargain 49%).

AAPL, GOOGL and MSFT report today, FB tomorrow and AMZN reports on Thursday. A slip from any of them could be a disaster. TSLA reported last night and made $1Bn for the quarter which, if they can do that consistently, means their $640Bn market cap is only 160 times their earnings so, Yay!, I guess…

FB should do well judging from SNAP and TWTR's results. AAPL is a monster you don't bet against and the others are pretty much cloud companies at this point – each with a different specialty core that gives them a user base of pretty much everyone on the planet (Software, Search and Stuff). If we are heading into that Dystopian Future where a few dozen corporations control every aspect of life on this planet – it makes perfect sense that, at some point, 6 companies should be worth 1/3 as much as the other 12,000. That's just a natural progression.

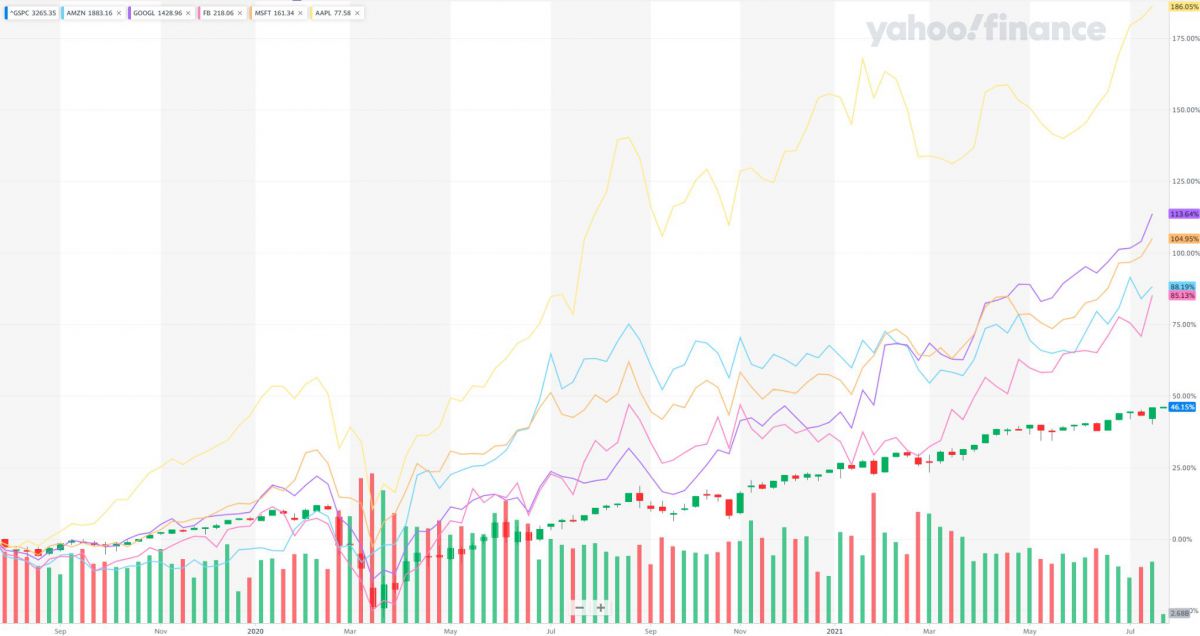

Consider the entire Nasdaq is $20Tn and it was $11.2Tn 2 years ago so it's gained $8.8Tn in market cap. TSLA (left off because it broke the chart) was at $50Bn 2 years ago and is now at $640Bn so $590Bn of the Nasdaq's gain (6.7%) came from that one stock. AAPL gained $1.6Tn (20%), MSFT gained $1.1Tn (12.5%), GOOGL gained $1Tn (11.4%), FB gained $500Bn (5.6%) and AMZN gained $900Bn (10.3%).

So our Big 6 companies gained $5.7Tn, accounting for 51% of the Nasdaq's total gain in price but NONE of those companies, except TSLA, have grown either earnings or revenues over 100% to justify the move. Even AAPL, as great as they are, are "only" on track for $86Bn in profits on $355Bn in sales while in 2019, they made $55Bn on $260Bn in sales. Yet in 2019, you could buy AAPL for $65/share – now it's $150!

Clearly the market is distorted and that makes it very dangerous to play. Also keep in mind that AAPL sales, which are becoming a significant part of the economy, get counted twice in our GDP as AAPL considers it a sale but so do Best Buy (BBY), AT&T (T) or Amazon (AMZN) when they sell you an Apple product. This is why countries like to manufacture things at home – they get to double up their GDP! Or at least the appearance of it…

Our GDP Report comes out on Thursday – stay tuned for that! Meanwhile, it's only Tuesday in our Hamburger Today Economy and first we hear from the Fed (tomorrow) and we'll see if they care about the runaway inflation that is choking the bottom 80% of this country.

Our GDP Report comes out on Thursday – stay tuned for that! Meanwhile, it's only Tuesday in our Hamburger Today Economy and first we hear from the Fed (tomorrow) and we'll see if they care about the runaway inflation that is choking the bottom 80% of this country.

We have some good data this morning with Durable Goods out at 8:30, Redbook at 8:55, Case-Shiller at 9 followed by Consumer Confidence and the Richmond Fed at 10. We were down a bit early this morning but recoving in the pre-market (so far). We'll see what the data brings.

8:30 Update: Durable Goods came in at 0.8% vs 2% expected so a bit disappointing but not terrible. Mostly it's supply and labor shortages holding things back – not a lack of orders. Last month, however, was up 3.2% so we are slowing rapidly as the latest round of stimulus wears off. This is in line with the slowdown we saw in the Manufacturing Surveys (ISM and PMI) that indicate that stimulus is driving this economy – not healthy consumers.

Attempts to craft a bipartisan infrastructure plan hit multiple obstacles that again pushed Senate negotiators past another deadline to reach a deal. Talks continued through Monday night but a resolution remained elusive, even as the White House and some Democrats expressed confidence that an accord would eventually be struck. Negotiators ended the day Monday still attempting to bridge differences over transit funding, spending levels on water projects, whether all federally-backed projects should pay so-called prevailing wages and how much unspent Covid-19 money can be used to pay for infrastructure, among other disputed items.

Earlier Monday, Republicans rejected a counteroffer advanced by the Biden administration and Democrats, saying it attempted to reopen settled issues. Democrats accused Republicans of stalling. The Debt Cieling runs out on Friday and Republicans hope to crash the Government in order to make Biden look bad. The fact that Covid is once again raging out of control in many parts of America and something needs to be done doesn't seem to enter into the equation.

Tokyo just hit a record high in daily infections – long, long after the virus was supposed to be "under control" and Europe has cities going back to lockdown as re-opening without the whole poplultion vaccinated (they have 70%) has been a disaster. In fact, Orange County, Florida (home to Disney, where I am this week), is back to over 1,000 new cases per day – as high as last year's peak rates and the mayor has declared it a crisis. 61.5% of Orange County residents over the age of 12 have been vaccinated.

Be careful out there.