Still lookin' good.

Only the Russell is dragging on the all-time high chase at about 5% off the mark. We're well into the last half of earnings season now and it's less likely we'll be derailed by Corporate Reports and no one seems to mind another wave of Covid – it's amazing what people get used to. Where I live in Florida (Palm Beach County) there are still no official mask mandates although, this weekend, we hit an all-time high for both new cases and hospitalizations. I just got back from Disney and my report to our Members was:

Well I'm back now and I'd love to tell you Disney is doing a bang-up job but really, how could they? You walk into various rooms or caves with hundreds of people that thousands more people have recently been in and there's almost always a rail that is touched by most. DIS has put up a lot of plastic walls to separate the lines as they wind around but they reach maybe 7 feet at most.

As of Thursday, masks are once again required indoors but not in the crowded restaurants (no distancing) and I do not see people wiping down the bars on the rides – so why bother at all if you're not going to do that?

DIS is a good company to watch as they care more than most about avoiding the kind of negative publicity that comes from killing your customers so we expect that, if things get really bad – they will be one of the early ones to react. Of course DIS is not shy about killing their customer's wallets. When they kids were younger we used to stay at the resort and generally took the Disney Transportation everywhere, which is free but this time we came in a car and it's $30 to park at the resort AND the hotels! Balloons are now $25!

Then I come home and read about how no one is worried about inflation? Do these people ever leave the house???

Then I come home and read about how no one is worried about inflation? Do these people ever leave the house???

That's today's headline in the Wall Street Journal and yes, it's basically a propaganda rag for Conservative Capitalism but holy cow, what factless drivel! They can't write an article claiming that inflation is easing as it's getting worse and worse but they can write an article featuring idiots who are betting that inflation will magically go away – even though there are no signs of that at all.

Consumer Prices were up 5.4% in June, the biggest rise since August of 2008 – right before the economy collapsed. Used cars and trucks play a major part in investors’ thinking. In June, their prices rose 10.5% from the previous month, driving 1/3 of the rise in overall CPI. Even if used-car prices decline, other categories such as housing could push in the other direction with household balance sheets in their strongest position in decades

Why do we have inflation? Very simply, people did not work making (as many) things for about a year and, usually, when that happens, people have less money so they buy less things and it tends to even out. This time, however, the Government paid you whether you worked or not – and so did many employers (also propped up by the Government) so the people still have money and still buy things – the things we failed to make.

As you can see from the chart on the left, when Disney first opened, a ticket was $3.50 but that didn't include the rides. $17 in 1983 and they went up to $95 in 2012. Now, 8 years later, it's $169 for a one-day ticket (no one does that). At this pace, in 2031, tickets will be over $300. Even if you get 1/2 price 3-day tickets for a family of 4, that's $1,800 in tickets alone for your vacation.

Like many companies in America, Disney has given up on even pretending they are going to service the Bottom 80% – they simply can't afford what is currently about $1,000 in tickets and $2,000 in hotels and $1,000 in food for a week vacation (and that's without any balloons!). That's because the top of the Bottom 80% make $70-100,000 a year and the bottom 60% make an average of less than $60,000 per household – they can't possibly afford to go to Disneyland.

The Top 20%, fortunately, are still 66.6M of our fellow citizens and only 21M people a year come to the Magic Kingdom in Florida and 18.6M in California so there's no room for the other 270M people in this country anway – even if they did have money and wouldn't drive away the rich people (see SIX – if you dare!). So between rich Americans and the Top Billion (12.5%) people of the rest of the planet who visit – DIS is not looking for any more park customers, thank you.

By the way, I love this new thing at hotels where you pay to be at a nice hotel but, if you want to sit in a "good" chair by the pool, it costs extra. Cabanas are the hot new(ish) things and they go for $500/day in most places and, amazingly, they fill up because the Top 1% have, effectively, infinite amounts of money to spend so the Bottom 9% (of the Top 10%) have to use the thin, striped towels and chase after pool waiters while the cabana crowd has food platters delivered and a bartender on standby and pillows on their chairs.

I did get a cabana for my daughter's birthday in Maimi last year – worth it!

Anyway, the point is that, aside from the people who got paid whether or not they worked during the pandemic, demand is also being driven by the Top 1%, who buy 3 homes and 5 cars, etc. That drives up the price for everyone else and those people are getting richer and richer by the day. Joe Biden's plan to tax them seems to have gone out the window and inflation is like a non-stop party for rich people – who make a fortune renting out their money.

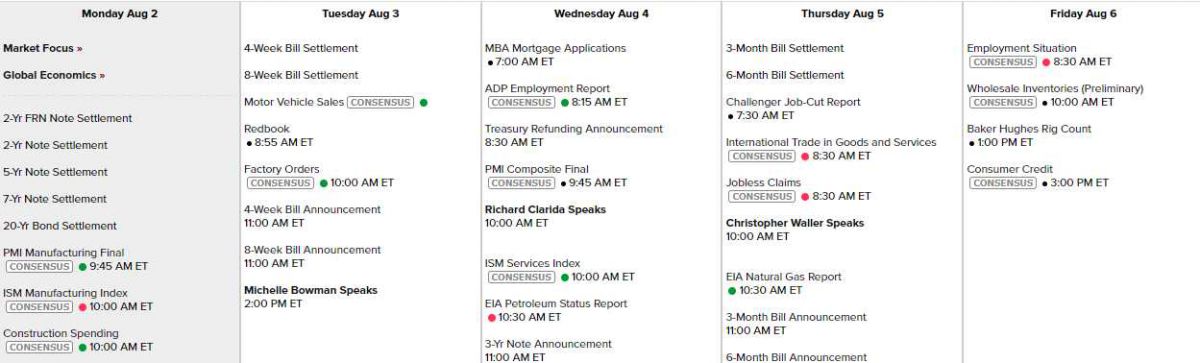

It's not a big data week and not much Fed speak either. We do have PMI and ISM and Non-Farm Payrolls on Friday but, other than that – pretty dull.

No shortage of earnings to chew over:

After months of struggle, the U.N.-backed Covax alliance will soon have many more doses, promising relief for vaccine shortages in poorer countries. But it faces a deepening crisis: difficulties getting shots into arms as the Delta variant spreads.