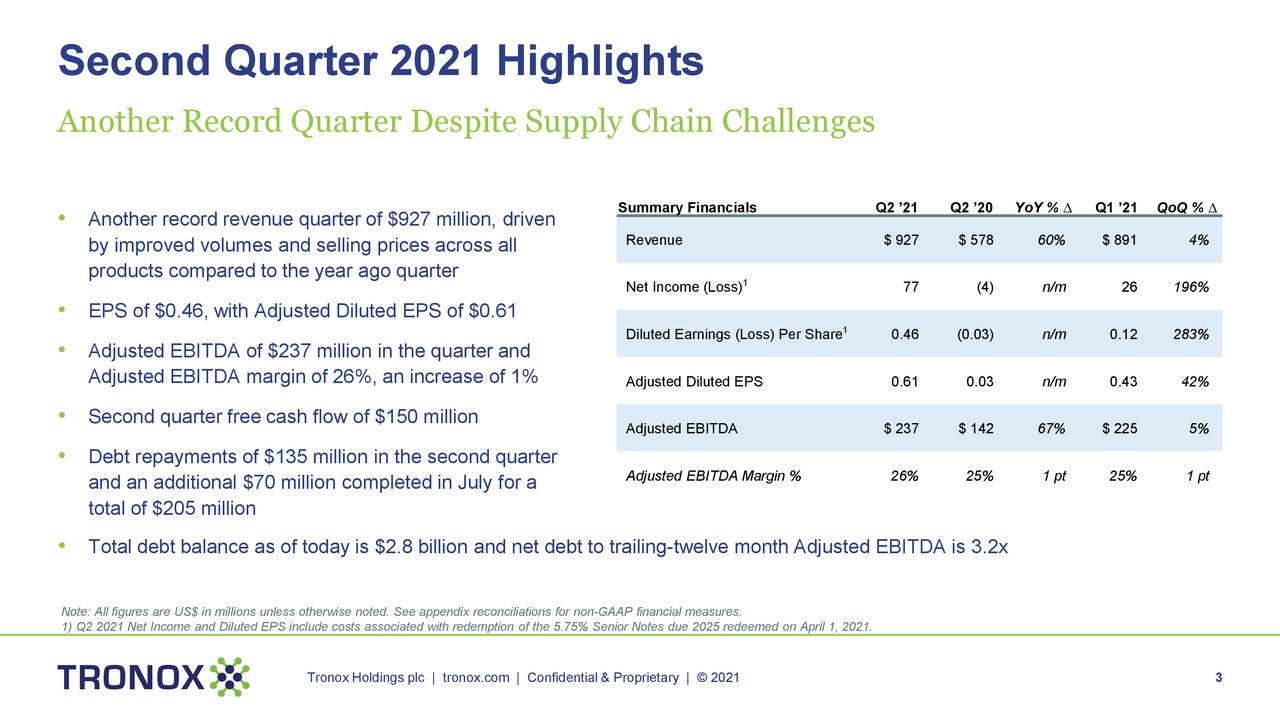

I love specialty industrial suppliers and TROX (Titanium) is stupidly cheap at $18.02 ($2.7Bn) and they just made $77M for the Q so say $300M for the year puts them less than 10x earnings and this is a fast-growing company (60% more than last year, last Q was 5% lower).

We already have a short put on TROX in the LTP (10 short Dec $20 puts we sold for $5.40 ($5,400)) but those will expire soon and we REALLY do want to own the stock for net $14.60 so happy to sell more. At the moment, those puts are $3.50 ($3,500) and the Feb options just came out and those $20 puts are $4 - so no point in selling those just to get 0.50 more for 2 months.

So, as a full play on TROX in the LTP, let's:

- Buy 25 TROX Feb $15 calls for $4.40 ($11,000)

- Sell 25 TROX Dec $20 calls for $1.40 ($3,500)

That's net $7,500 on the $12,500 spread so not a huge upside but we already sold the short puts for $5,400 which drops the net to $2,100 and now you see why I don't mind scaling into this as we'll end up making $10,400 (495%) if all goes well as opposed to "just" $5,400 if the puts ran out.

As a new trade, if you pair the above spread with 15 short Feb $17 puts at $2.25 ($3,375), that drops the net to $4,125 on the $12,500 spread with $8,375 (203%) upside potential in less than 200 days. That's a nice rate of return