We're up 2.5% for the week.

We're up 2.5% for the week.

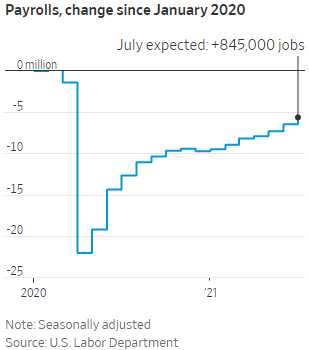

That's thanks to 943,000 jobs being added in July and unemployment droppoing to 5.4% so, in the very least, we WERE going very nicely before the Delta virus began to spread. Wages were up 0.4% in an attempt to keep up with non-existent inflation. As you can see from the Payroll Chart, we're still down about 6M jobs from where we were before the pandemic and, in 18 normal months, we should have added 4M additional jobs to keep up with population growth but, luckily, population isn't growing much so we're down perhaps 7.5M jobs below where we should be and that is about 5.4% of the labor force.

The surveys for the NFP Report are conducted in the middle of the month (so they are always lying to you when they call it July jobs) and we'll see if new lockdown restrictions are having an effect – a month from now. Meanwhile, this report is positive so the markets will jump on it and the Dollar will pop and oil will go higher and gold will go lower – all the stuff that usually happens when the economy looks stronger.

Some local governments and businesses have reimposed mask mandates, but have avoided a repeat of last spring’s broad closures. However, New York City this week said it would require people to show proof of vaccination for indoor activities, such as dining, gyms and events, and the New York Auto Show, set for later this month, was canceled because of the variant. Similar policies and cancellations, if adopted more widely, could have a chilling effect on consumer behavior.

Recent Indeed data showed job postings, which had been increasing at a slower rate this summer than the spring, declined in late July. The drop primarily reflected fewer available jobs in Manufacturing, Construction, Warehousing and Transportation sectors hit by supply shortages – rather than the Delta variant. Meanwhile, About half of states have ended participation in federal programs that allowed workers to collect an extra $300 in benefits a week and stay on unemployment rolls longer than the six months allowed in most states. Those benefits are set to expire in the remaining states in early September.

Recent Indeed data showed job postings, which had been increasing at a slower rate this summer than the spring, declined in late July. The drop primarily reflected fewer available jobs in Manufacturing, Construction, Warehousing and Transportation sectors hit by supply shortages – rather than the Delta variant. Meanwhile, About half of states have ended participation in federal programs that allowed workers to collect an extra $300 in benefits a week and stay on unemployment rolls longer than the six months allowed in most states. Those benefits are set to expire in the remaining states in early September.

With 7.5M people unemployed x $300 x 4 weeks, that's $9Bn/month or over $100Bn per year that is being removed from the economy and hopefully some of those people will find jobs but others will have their benefits expire entirely, not just the bonus so there will certainly be a dip in consumer buying power in September, no matter what.

And then we have the evictions coming. Yes, the moratorium has been lifted but the legal process to evict is long and tedious so getting 4.5M families out of their homes by Christmas is going to be a hard job (go long on Law Firms) but the landlords can't wait to get started. And bleeding heart liberal that I am, I do however see the landlords' point, as the process needs to be fixed. In theory, the landlords are supposed to get compensated for unpaid rents but, in practice, it's a paperwork nightmare and many are falling through the cracks.

That's another hit on the economy as 4.5M families not paying rent also puts $9Bn/month into the economy so another $100Bn a year of stimulus will be removed in Q4 – no wonder the Fed doesn't want to add to the chaos….

Here's a wonderful photo essay from the NY Times of THE City as it re-opened this summer. Let's hope we're all back to normal soon.

Have a great weekend,

– Phil