Florida's viral load is so great if it was a country the US would consider blocking travel there

I know we all like to pretend Covid is over but that's the headline I woke up to, in Florida, this morning, along with these:

I know we all like to pretend Covid is over but that's the headline I woke up to, in Florida, this morning, along with these:

As Delta Variant Spreads, Florida Hospitals Race to Find Open Beds

As Florida experiences a steep rise in coronavirus cases, AdventHealth’s “mission control” staff monitor data to stay ahead of a new flood of patients.6 min read

And it's true. People are starting to talk about who died from Covid in a way that didn't happen in the first few waves. This is worse – it feels worse. Even Oil Traders know it's worse as Oil (/CL) fell to $65 this weekend, back where we were at the start of the summer. These are demand concerns – these are lockdown concerns – and the market is still ignoring them.

Oil began falling long before the market last year as oil trader DO care about what's happening in India and China and Africa. Oil is a truly global commodity that is actually used and produced every day so any changes in demand (or supply) quickly ripple through the price structure. Oil can be like a thread of a spider's web for the Global Economy, signaling us to danger as soon as it gets touched.

Warnings only work if you heed them so I would trade very carefully at the moment and make sure you are well-hedged. Beijing health authorities said last week that the city would cancel all large-scale exhibitions and events for the remainder of August. China is the world’s biggest importer of oil and “while some countries seem to be flipping to learning to live with the coronavirus, it is adopting a zero-tolerance policy” with stricter travel rules and quarantine measures, said Norbert Rücker, head of economics at Swiss private bank Julius Baer.

Last year we pretended things that were happening in China wouldn't affect the rest of the World – how did that work out for you? Worries about the economic impact of China’s measures were felt across commodities markets, with metals prices also heading lower. Copper futures, often seen as a bellwether for global economic growth, were down 1.2% at $9,354 a metric ton on the London Metal Exchange. The prices of aluminum and nickel also fell.

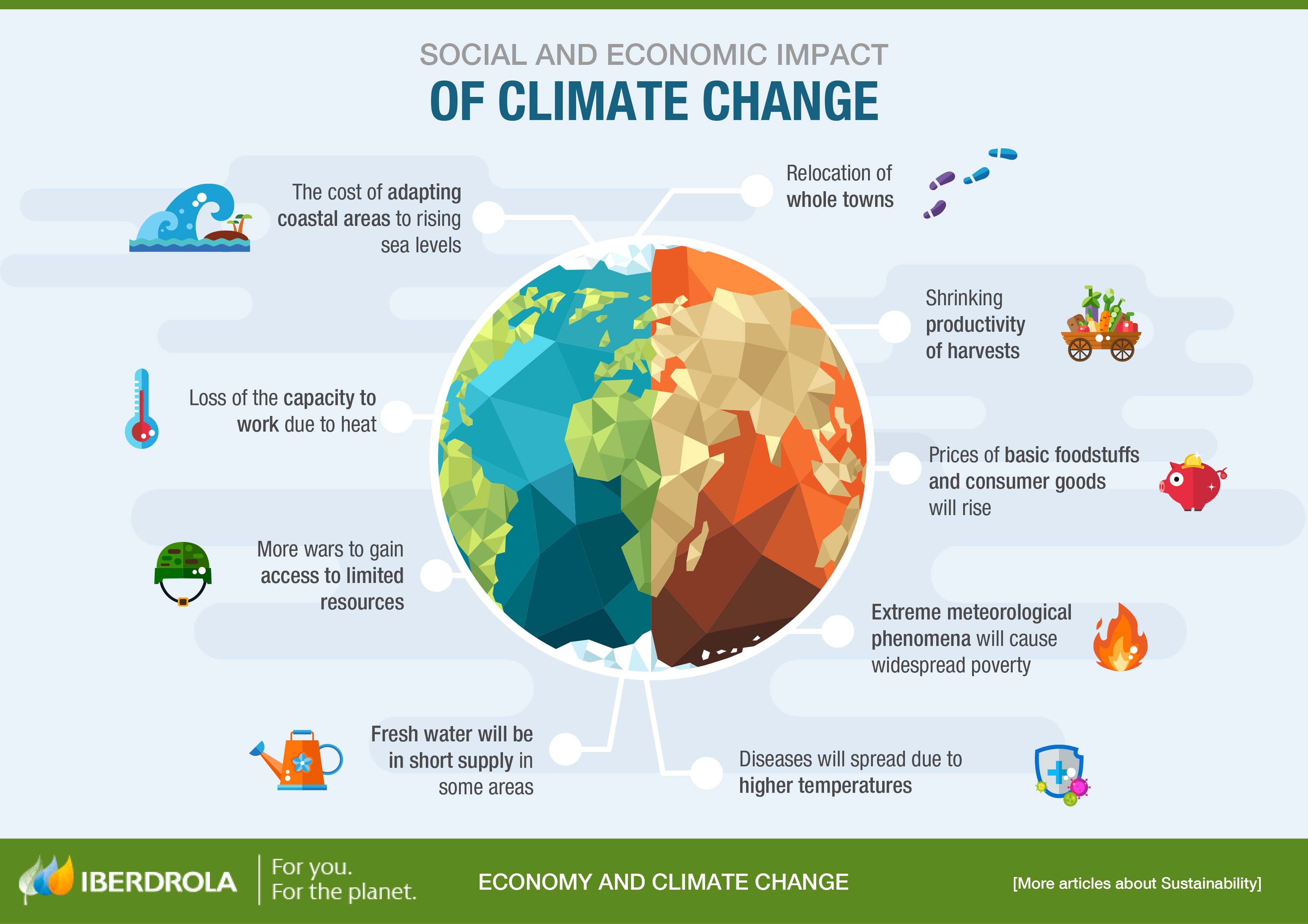

“We’ve known for decades that the world is warming, but this report tells us that recent changes in the climate are widespread, rapid and intensifying, unprecedented in thousands of years,” said Ko Barrett, vice chair of the panel and the senior adviser for climate at the Office of Oceanic and Atmospheric Research at the National Oceanic and Atmospheric Administration. “Further, it is indisputable that human activities are causing climate change.”

Dan Lunt, a climate scientist at the U.K.’s University of Bristol and one of 234 co-authors of the report, said, “It is now completely apparent that climate is changing everywhere on the planet.” A global agreement resulting from a 2015 climate summit in Paris called on nations to take steps to limit future global temperature increases to 1.5 degrees Celsius (2.7 degrees Fahrenheit). But the efforts are falling short. “This report tells us that we probably need even more action by all the major economies to work together to avoid even worse impacts than we’re already seeing now,” said Jane Lubchenco, deputy director for climate and the environment at the White House Office of Science and Technology Policy.

Greenhouse-gas emissions from human activity have raised global temperatures by 1.1 degrees Celsius since around 1850, the report said. Without rapid reductions in emissions, global temperatures could rise more than an additional 1.5 degrees Celsius over the next 20 years, the report forecasts.

The report reflects new scientific methodologies honed in an era of growing climate disturbances. It draws on a better understanding of the complex dynamics of the changing atmosphere and greater stores of data about climate change dating back millions of years, as well as a more robust set of satellite measurements and more than 50 computer models of climate change.

The report reflects new scientific methodologies honed in an era of growing climate disturbances. It draws on a better understanding of the complex dynamics of the changing atmosphere and greater stores of data about climate change dating back millions of years, as well as a more robust set of satellite measurements and more than 50 computer models of climate change.

Last year, global temperatures tied for the warmest on record, capping the warmest decade in modern times. Oceans are warming, and sea level is increasing by 3.7 mm, or about 0.1 inch, a year, the scientists said in the report. Mountain glaciers, sea ice and polar ice sheets are steadily melting. Weather around the world has grown more extreme by many measures, the scientists said, with more frequent heat waves and prolonged droughts in some regions and heavier rainfall and flooding in others.

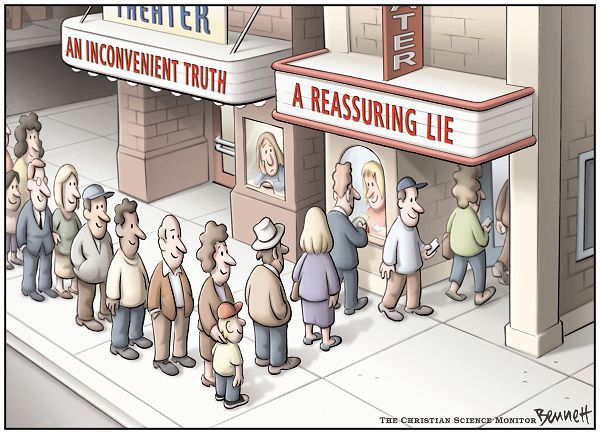

I'm sorry to have to bring these things up – I know they are depressing to think about but we're tried VERY HARD to ignore it and that certainly didn't make it go away, did it? And yes, it DOES affect our investing as changes will have to be made… eventually.

I'm sorry to have to bring these things up – I know they are depressing to think about but we're tried VERY HARD to ignore it and that certainly didn't make it go away, did it? And yes, it DOES affect our investing as changes will have to be made… eventually.

As we discussed last week in our Live Member Chat Room, we've stayed away from investing in insurance companies as the payouts for early deaths, sickness and "natural" disasters are accelerating, that coupled with low interest rates on their insurance reserves make them far less attractive than usual – especially at these ridiculously inflated market prices.

Speaking of inflated prices: Consumers borrowed $37.7Bn to pay for inflated goods and services in June and that's up 10.6% from last year, keeping pace with inflation. A survey of leading Economorons expected spending to go up $23Bn, so they were only off by $14.7Bn (64%) this time. Overall, consumers are roughly $4.3Tn in debt – about one full year of retail spending – adding 2.5% since Q1, pretty much keeping pace with our 10% inflation.

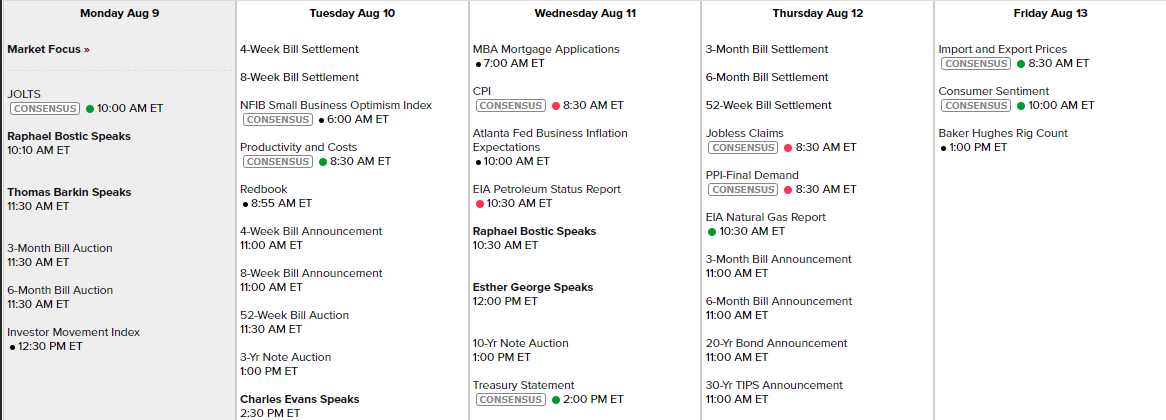

Paying more money for the same stuff is pretty much the theme in our economy and in our markets. We only have 5 Fed speakers this week, 2 of them just ahead of Wednesday's 10-year auction that has become a farce with the Fed buying up whatever the Government wants to sell so they can calll it a success. The Job Openings and Labor Turnover Survey (JOLTS) is out this morning on the heals of Friday's excellent NFP Report and we get Small Business Optimism and Productivity tomorrow and then CPI could be ugly on Wedensday with the Atlanta Fed Inflation Report followed by PPI Thursday and Consumer Sentiment on Friday:

The earnings keep coming and, so far, guidance has not reflected any major concerns about Covid or Global Warming. If our Corporate Masters aren't worried about it – why should we be?