$2,152,571!

$2,152,571!

That is up $10,166 since our last review and, rather than pull the plug entirely we simply elmintated about half our longs, leaving us 80% in CASH!!! and we let all our hedges ride, which leaves us in a net short position as our Short-Term Portfolio (STP) has $585,435 of downside protection and we halved the need for that protection in the LTP, leaving us farily bearish for the moment.

If we want to get less bearish now, we can either cut back on our hedges or buy more longs so, on the whole, we've simply made a bearish turn that leaves our paired portfolios a lot more flexible for whatever storm lies ahead.

And we're over 80% in CASH!!! and CASH!!! is the ultimate hedge. We've been pretty cashy all year and being cashy does not stop you from making money as an options trader – since we get astounding leverage in a bull market – it just keeps you flexible and allows you to take advantage of opportunities.

It's easy to make money in a bull market. Apple (AAPL) is at $146.70 and you can buy the 2023 $140 ($24)/$150 ($19.25) bull call spread for $4.75 and you will get back $10 if AAPL is simply over $150 in January of 2023 – which is very likely to happen. That would be a gain of $5.25 of 110% in just 16 months – that should keep you well ahead of inflation, right? So we're not at all worried about making money if the market stays strong. What we are worried about is having trouble getting out of positions if the market crashes and, at this particular moment – that risk outweighs the potential reward of staying in.

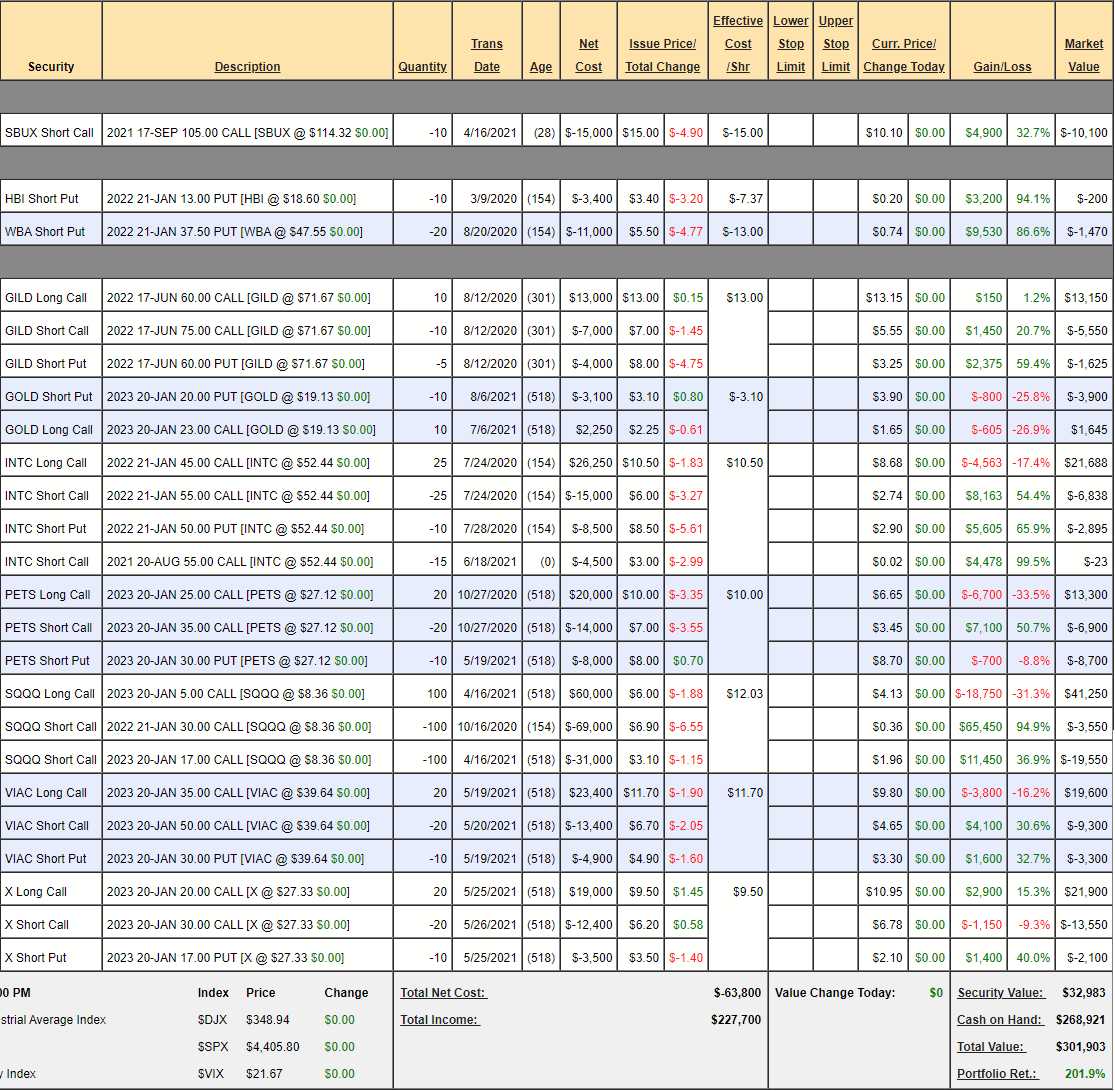

Earnings Portfolio Review: $301,903 is up $4,502 since our last review and we touched nothing at the time but recently added a trade on GOLD – but that's it. We already have $268,921 (89%) in CASH!!!, and we have already pared this portfolio down to positions we love AND this portfolio has it's own SQQQ hedge – so it's in great shape.

- SBUX – This is a bearish leftover from a spread we already cashed out at the top and now we're up nicely on this too. SBUX model does not do well in Covid lockdowns so this is a KEEPER!

- HBI – At 94.1% profit it's very, very unlikely to hurt us but it's also nice to clear the decks. Kill it.

- WBA – Same deal as it's a 2023 trade and we're already up 86.6% so not worth holding 15 more month to make 13.4%. Kill it.

- GILD – It's a $15,000 spread at net $5,975 so we have $9,025 upside potential and our worst-case obligation is owning 500 shares at $60, which would be wonderfull on this ridiculously undervalued company. KEEPER!

- GOLD – A new, fun trade and gold should do well if the market crashes again AND it's an inflation hedge. KEEPER!

- INTC – We're up about $14,000 and it's a $25,000 spread with only a few months left so it's a bird in the hand thing – as much as we love the stock. Kill it.

- PETS – I like them for the long-term but is that enough of a reason to hold them and risk being assigned 1,000 shares at $30? This spread was a net $2,000 credit so if we roll the 2023 $30 puts, which are now a crazy $8.70 to the 2024 $20 puts at whatever costs less than $2,000, THEN we would be in the spread at net $0 and I'd LOVE to own up to 2,000 shares at $20 which means YES!, this is a KEEPER! and we'll also be happy to roll the Jan $25 calls to the Jan $15 calls for $5 ($10,000) and then we'd be in the $15/35 bull call spread ($40,000 potential) with 20 short $20 puts for net $10,000. Yes, we can live with that "worst case" and the best case is that doesn't happen and we make more than $20,000 leaving it alone….

- SQQQ – We brillianly pre-sold the 2023 $17 calls and now the Jan $30 calls will go worthless, as expected so this is essentially a free $120,000 hedge currently at net $18,150 – great bang for the buck as it's in the money by $33,600. KEEPER!

- VIAC – Why waste time, you know I won't sell this. KEEPER!

X – So glad they haven't fellen yet. Kill it. Too risky going forward with China shutting back down.

We managed to kill 4 of our 10 positions so I'm very proud of myself. Plus we have that hedge so there's no worries here.

IN PROGRESS