And up we go – again.

And up we go – again.

What Covid? What Afghanistan? What declining Consumer Confidence? None of this matters to the market yet the healine in today's WSJ is: "Stock Futures Edge Up Ahead of Economic Data". How does that make sense? Why would the market go up on good Economic Data when it doesn't go down on bad Economic Data?

There is a reaso for it, actually. Money keeps pouring into the market via 401Ks and IRAs, etc. The reason our Corporate Masters like to keep the population employed is because the workers then put their money back into the market in the dumbest way possible – through ETF investing.

That guarantees a constant flow of funds into stocks and, of course, even the investing class is stuck with the markets at the moment as Real Estate and Bonds are not very attractive at the moment and putting money in the bank at near-zero percent rates while inflation is 10% is also a very bad idea.

Gold has lost it's luster and fewer and fewer people have the means to start their own business these days – so it's the markets that are getting all the attention – and all the inflows. Then we have the Fed buying assets from the banks, which are mostly MBS but that allows them to push money around as well. The Government steps up and provides stimulus once in a while and then, of course, we have all those companies buying back their own stock – heading towards $1Tn this year for the S&P 500, out of $31.6Tn total that's over 3%!

The resting position for the market is to go up and, at this point, it's hard to spook investors into selling as we're already worried about everyone on Earth dying from disease before they get a chance to roast to death on the planet's surface. Oh yes, there's also an asteriod that may hit the Earth on September 24th, 2182 – if we're still around…

The resting position for the market is to go up and, at this point, it's hard to spook investors into selling as we're already worried about everyone on Earth dying from disease before they get a chance to roast to death on the planet's surface. Oh yes, there's also an asteriod that may hit the Earth on September 24th, 2182 – if we're still around…

So what do you think is going to scare investors who have already been scared by everything? Let's hope we don't find out….

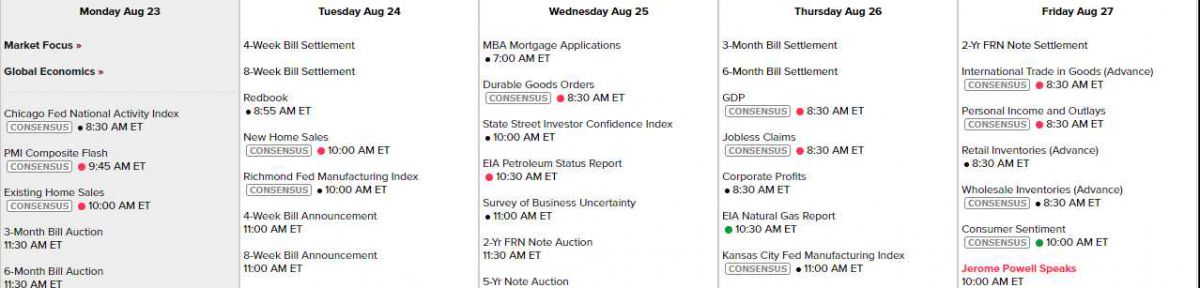

We are busy, busy this week with data starting with the Chicage Fed this morning, PMI and Existing Home Sales. New Home Sales and the Richmond Fed tomorrow with Morgage Applications, Investor Confidence and Business Uncertainty on Wednesday followed by GDP, Corporate Profits and the Kansas Fed Thursday and we finish the week with Jerome Powell speaking right after a probably terrible Consumer Sentiment Report with Personal Income and Retail Inventories earlier that morning.

And you might think Earnngs are over but they never are these days. There are still a lot of interesting companies reporting and, now that we've put a lot of cash on the side, we'll be sincerely doing some bargain-hunting this week.