![Buy! BUY! Sell! SELL! [pic]: investing](http://cdn.shopify.com/s/files/1/0060/6102/products/book_buy_sell_sell_new.jpg?1293888719) Finally they are catching up.

Finally they are catching up.

Just 3 weeks after we moved our Member Portfolios to mostly CASH!!! positions, Investment Banks Morgan Stanley, Citigroup Inc. and Credit Suisse Group AG are cautioning investors about the U.S. equity outlook. Morgan Stanley slashed U.S. equities to underweight and global stocks to equal-weight on Tuesday, citing “outsized risk” to growth through October. Rising cases of the delta virus strain, and tension between elevated inflation expectations and low yields are at play during a time “that has historically poor seasonality,” strategists wrote in a note.

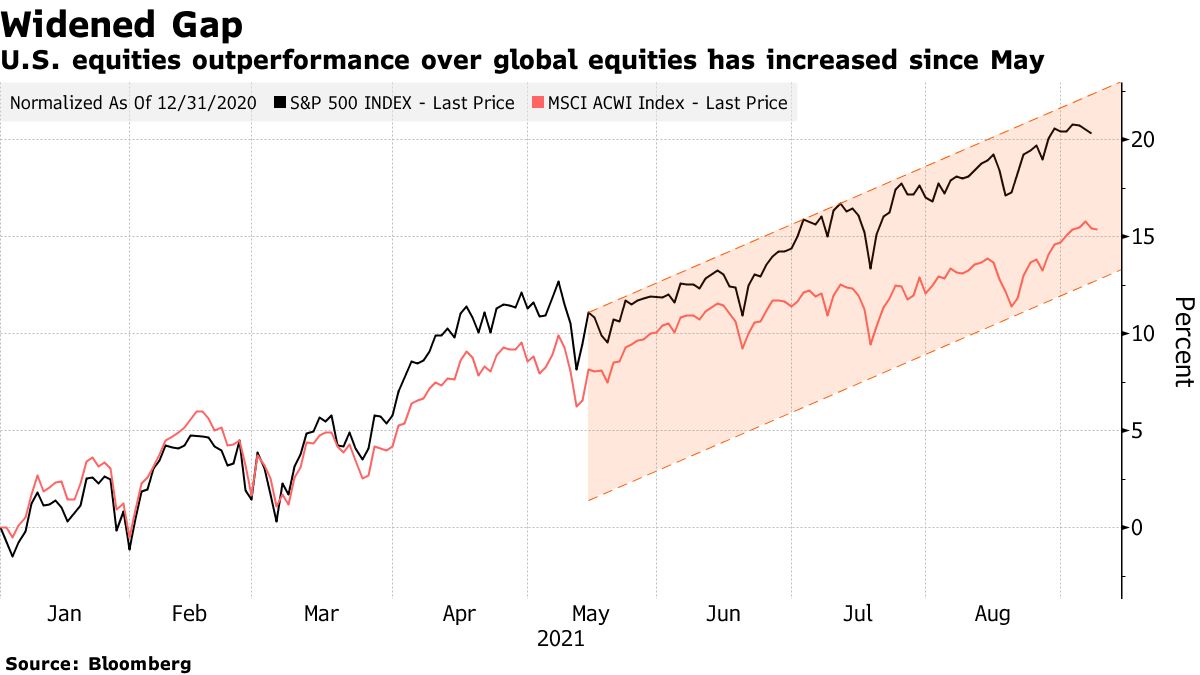

Citigroup said any minor correction is at risk of being amplified given the extent of bullish positions. And on Wednesday, Credit Suisse said it maintains a small underweight on U.S. equities due to reasons such as extreme valuations and regulatory risk. Indeed the gap between US Equity Performance and Global Equity Performance has recently hit 5% – a very extreme level.

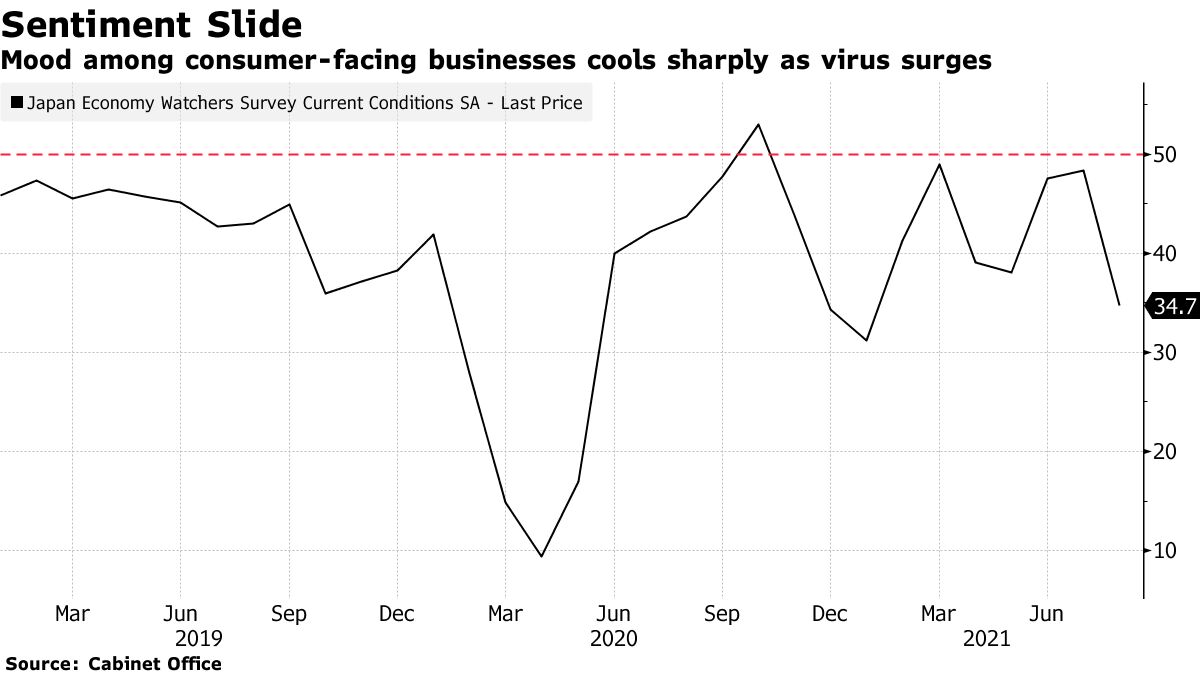

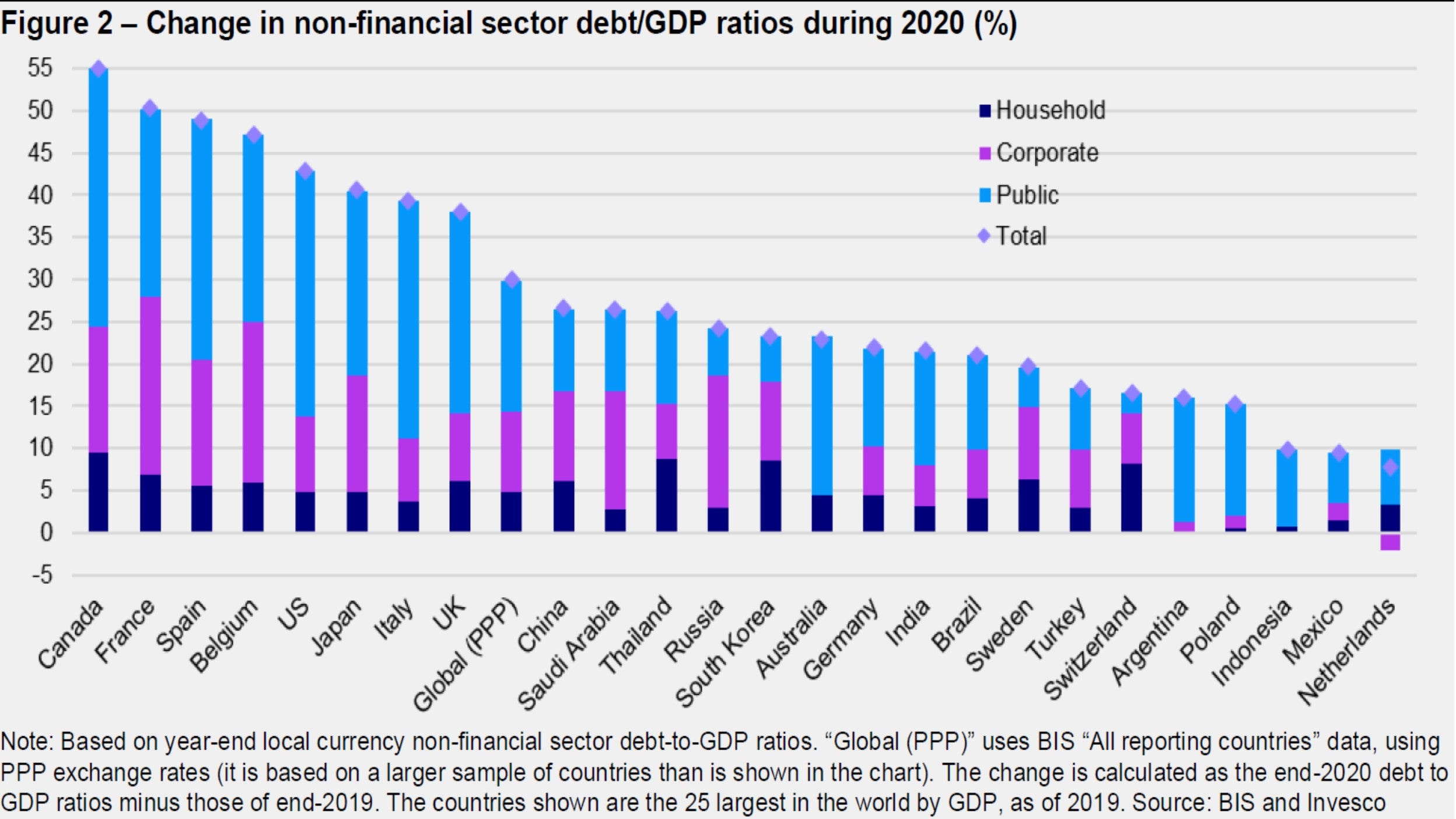

Morgan Stanley says they prefer Japan to the US but Business Sentiment in Japan fell 28% last month, from 48.4 to 34.7 and 50 is the line for optimism over there. The sharpest deterioration in a year and a half sent the gauge back to its lowest point since January when Tokyo returned to a state of emergency. The surge in virus cases that sent sentiment careening also drove Prime Minister Yoshihide Suga to announce his resignation last week. The country’s next leader is likely to call for a new stimulus package to shore up the recovery, plunging the nation even deeper into their record-setting debt.

And that's a country Morgan Stanley would rather invest in than America!

Sentiment fell in all 10 major Japanese regions tracked by the survey. The mood among bar and restaurant operators, which have endured government calls for shortened hours and a stoppage to alcohol sales, fell the most among sectors. The report cited a real estate agency in the Osaka area as saying it was dealing with an endless stream of businesses, from big to small, that were canceling leases.

The Nikkei, meanwhile, has been on a tear since the PM's resignation as it is widely expected that the new Prime Minister will distribute MORE FREE MONEY which will, like America, go directly into the pockets of the people who need it the least and the rich will get much, much richer – go Capitalism!

The Nikkei, meanwhile, has been on a tear since the PM's resignation as it is widely expected that the new Prime Minister will distribute MORE FREE MONEY which will, like America, go directly into the pockets of the people who need it the least and the rich will get much, much richer – go Capitalism!

Japan truly is an Oligarchy, a country run exclusively for the benefit of the Corporations called Keiretsu, which is a system in which the Banks and Corporations work together in interlocking relationships (Mitsubishi Manufacturing and Mitsubishi Bank are an example). The members' companies own small portions of the shares in each other's companies, centered on a core bank; this system helps insulate each company from stock market fluctuations and takeover attempts, thus enabling long-term planning in projects.

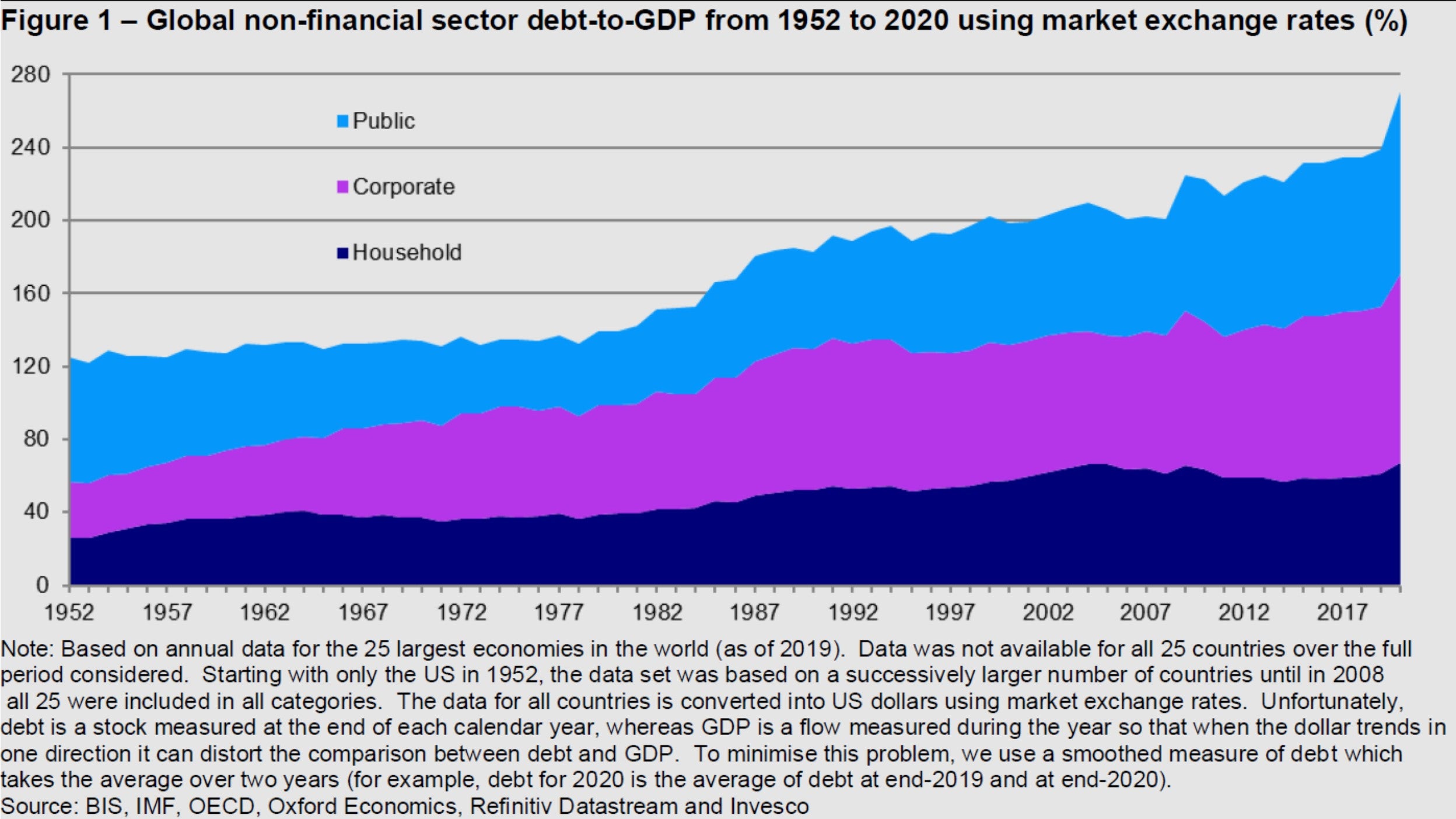

That's why a Prime Minister who refuses to turn on the printing presses isn't long for his job in Japan, which is now 266% of their GDP in debt and climbing rapidly. Japan's debt is 1,400,000,000,000,000 Yen or 1.4 Quadrillion but that's "only" $13.1Tn – less than half of the US's now $28.5Tn debt. That's why BitCoin MUST fail as a currency – if it succedes in El Salvadore and other countries adopt it – here's the problem:

- There are only 21M Bitcoins and they can't make more – that's their "value" as an instrument of exchange.

- The US is 25% of the Global GDP at $21Tn – So let's say the US has 5M BitCoins

- Japan is 7% of the World's GDP at $5Tn – Let's say Japan has 1.5M BitCoins

- So the Rest of the World has 14.5M BitCoins to run their economies with.

The US is running a $3Tn budget deficit (so far) this year and that would be 1M BitCoins. As it stands now – the US and Japan just print more money to run a deficit but they can't do that if the currency is fixed – they would have to actually go and borrow it first but then the problem is they never actually pay it back. Both the US and Japan simply pay interest on their debts and never pay down the principle.

Even if we ignore the fact that the US is already 7.5M BitCoins in debt and Japan is already 4M BitCoins in debt (which would suck up pretty much all the remaining BitCoins in the World) – how could they possibly sustain their deficit spending when there isn't enough money to go around?

It's easy to borrow money when all you have to do is print more of it. If the money is a fixed supply it becomes harder and harder to borrow it as your lenders eventually run out of BitCoins (or whatever) to give you. Fortunately, we don't have that problem – yet. The problem we do have, at the moment, is that the supply of money (M1) is 350% higher than it was in 2019 and, if you don't have 350% more money than you did in 2019 – it means somebody, somehwere is getting your share!

It's easy to borrow money when all you have to do is print more of it. If the money is a fixed supply it becomes harder and harder to borrow it as your lenders eventually run out of BitCoins (or whatever) to give you. Fortunately, we don't have that problem – yet. The problem we do have, at the moment, is that the supply of money (M1) is 350% higher than it was in 2019 and, if you don't have 350% more money than you did in 2019 – it means somebody, somehwere is getting your share!

And while that is happening, you are being paid less and less when somebody wants to borrow your money. Why? Because, unlike BitCoin, the supply of the money you have is not fixed and the Government just more than tripled the supply of Dollars – making your Dollars worth significantly less.

This is what happens when the Government pretends to cut taxes. You still get your money taken from you – just in a different way. Devaluation affects ALL of your money – not just the money you earn each year.