The 4-day work-week.

The 4-day work-week.

I've long been an advocate for working 4, 10-hour days instead of 5, 8-hour days and, if this virus has taught us anything (other than the Government will print all the money you need), it's that work can be much more flexible than it has been. Going back to the arbitray, rigid Monday through Friday, 9am to 5pm, spending two hours in rush hour traffic would be like going back to sharecropping at this point. Having all 3-day weekends would greatly improve leisure travel for the struggling hotel and airline industries as well.

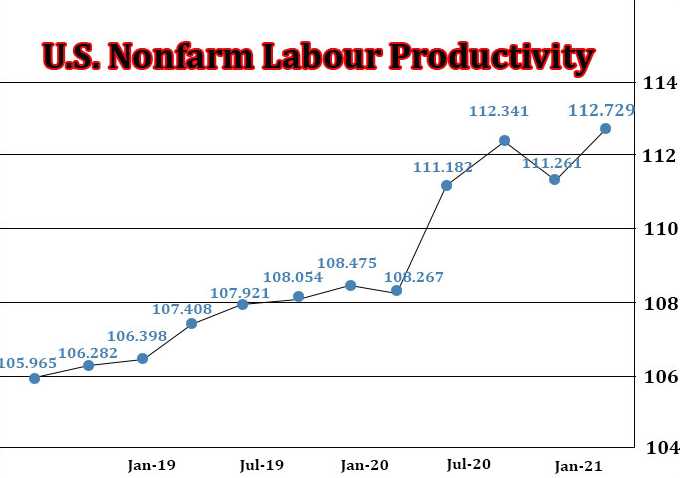

There are a lot of aspects of our work-life balance we'll need to rethink as we begin to normalize. A lot of companies will be more inclined to let people work at home (which does not bode well for Commercial Real Estate). The reality of the pandemic is that productivity is UP significantly since the pandemic started – in great part because so many people were laid off and the remaining workers were forced to pick up the slack and, for those of us who end up working CONSTANTLY from home – that's not necessarily sustainable but it clearly is possible.

There are a lot of aspects of our work-life balance we'll need to rethink as we begin to normalize. A lot of companies will be more inclined to let people work at home (which does not bode well for Commercial Real Estate). The reality of the pandemic is that productivity is UP significantly since the pandemic started – in great part because so many people were laid off and the remaining workers were forced to pick up the slack and, for those of us who end up working CONSTANTLY from home – that's not necessarily sustainable but it clearly is possible.

43% of the workers surveyed said they were more productive at home vs 15% who said they were less productive at home. If we can just get those 15% to be honest with their bosses, the rest of us can keep working at home! Now that the Zoom idiocy has died out, I think a lot of the productivity gain comes from having less meetings

President Biden had a useful meeting with President Xi this morning and that is perking up the markets and should get Gold (/GC) back over $1,800 along with rising copper as US/China tensions had been weighing on metals. Xi largely blamed the U.S. for deteriorating ties but expressed optimism that the two powers could find ways to improve their relationship and work together on issues of global concern, including the Covid 19 pandemic, according to a readout of the call provided by the Chinese embassy in Washington.

Despite largely contentious relations, the call Thursday night represented an attempt to maintain the relationship, a senior administration official said. The U.S. views competition with China as its top foreign policy concern but also wants to work on common interests—such as climate change—and not let matters spiral into direct conflict. Biden is facing pressure from the business community to restart negotiations with China and cut tariffs on imports, saying they are a drag on the U.S. economy.

Barrick Gold (GOLD) was our 2020 Trade of the Year as we initiated that trade in November of 2019, when the stock was down at $17 and it was hitting $30 by August, miles ahead of schedule so we took it off the table.early.

Barrick Gold (GOLD) was our 2020 Trade of the Year as we initiated that trade in November of 2019, when the stock was down at $17 and it was hitting $30 by August, miles ahead of schedule so we took it off the table.early.

We added a new trade on GOLD in our Long-Term Portfolio back in February, when it was back under $20 and now it's back again so here's another great opportuntiy to play Barrick while it's cheap. $19.50 is a $35Bn market cap for Barrick and they make about $2.2Bn per year but they are also a great hedge against inflation as they already own the gold (70M ounces) – they just have to dig it out of the ground – so they greatly benefit from higher prices.

As a new trade on GOLD, I would go with the following spread:

- Sell 20 GOLD 2023 $20 puts for $3.40 ($6,800)

- Buy 50 GOLD 2023 $20 calls for $2.80 ($14,000)

- Sell 50 GOLD 2023 $25 calls for $1.40 ($7,000)

That is net $200 on the $25,000 spread so you have $24,800 (12,400%) upside potential if GOLD is over $25 in 16 months. The worst case is you are forced to buy 2,000 shares at $20 and lose the $200 so net $20.10 would be the entry but then we would sell the 2024 or 2025 puts and calls for $4.20 and our basis would be net $15.85, which is 19% below the current price. So, if you aren't EXCITED to possibly own 4,000 shares of GOLD for $15.85 – don't sell the puts, just the call spread can return 250% with no margin required. However, if you REALLY wouldn't mind owning GOLD for the long-run, this is a fantastic way to start.

In our LTP, we are far more aggressive than that, with the 2023 $18 calls and no short calls yet (we are waiting for the next rally):

| GOLD Short Put | 2023 20-JAN 20.00 PUT [GOLD @ $19.69 $0.00] | -20 | 1/8/2021 | (497) | $-7,400 | $3.70 | $-0.30 | $-3.80 | $3.40 | $0.00 | $600 | 8.1% | $-6,800 | ||

| GOLD Long Call | 2023 20-JAN 18.00 CALL [GOLD @ $19.69 $0.00] | 50 | 2/26/2021 | (497) | $21,250 | $4.25 | $-0.65 | $3.60 | $0.00 | $-3,250 | -15.3% | $18,000 |

Speaking of runaway inflation, the PPI just came out and it's over 8% (8.3%) for the first time EVER and that's way up from 7.8% last month DESPITE Oil prices being almost 10% lower in July than August (they were blaming oil in July and saying it was "transitory"). If you think August was bad – wait until you see September as Natural Gas prices (/NG) are up 20% since August. And, of course, Goods are up almost 13%, Services are holding the average down as wages lag finished products – but not for long!

What inflation, right?

Have a great weekend,

– Phil