4,490.

4,490.

That's the strong bounce line on the S&P 500 according to our Fabuluous 5% Rule™ after falling 100 points to 4,450 last week, which gives us 20-point bounces to 4,470 (weak) and 4,490 (strong). In the bigger picture, we round off so 4,500 is going to be the line of contention for the week and we don't want to be below it at the end and the end of this week is a quad-witching end of quarter for options and futures – could be very volatile indeed.

Last week was the worst week in the market since February and down 100 points really isn't that bad – we've just forgotten what a sell-off looks like after 7 months of not having one. The volume was high (relatively) during Friday's sharp sell-off, with 89M shares of SPY trading vs 50M(ish) the rest of the week. So, if we rally back 40 points (strong bounce) in the no-volume futures – it's not very impressive, is it?

Meanwhile, Daily Covid Deaths are now higher than the peak of last year and I hate to bring it up as it's depressing and it doesn't seem to matter to anyone but we MIGHT have to go back to lockdowns – just before the holidays or, even worse, we may not go back to lockdowns BECAUSE it's right before the holidays and our Corporate Masters are willing to sacrifice a few hundred thousand consumers rather than risk having a bad Q4.

Meanwhile, Daily Covid Deaths are now higher than the peak of last year and I hate to bring it up as it's depressing and it doesn't seem to matter to anyone but we MIGHT have to go back to lockdowns – just before the holidays or, even worse, we may not go back to lockdowns BECAUSE it's right before the holidays and our Corporate Masters are willing to sacrifice a few hundred thousand consumers rather than risk having a bad Q4.

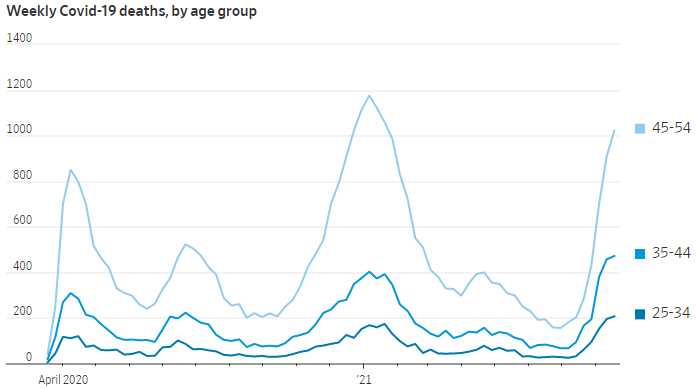

Older Americans still account for the most Covid-19 deaths, but their higher vaccination rates have helped hold down the numbers. About 54% of the overall U.S. population and 63% of eligible people ages 12 and above are fully vaccinated, while the average among nursing homes is 84% for their residents, Federal data show. Despite gains in protecting seniors, the Delta surge has presented major risks to other groups. CDC data continue to show that, compared with non-Hispanic whites, Black and Hispanic people face almost three times the risk of hospitalization and more than twice the risk of death. The rates among Native Americans are even higher.

The Delta variant has reversed some of the reopening momentum seen earlier in the summer. Rising numbers of Covid-19 cases in recent weeks have led to canceled concerts, postponed trips and the return of mask mandates.

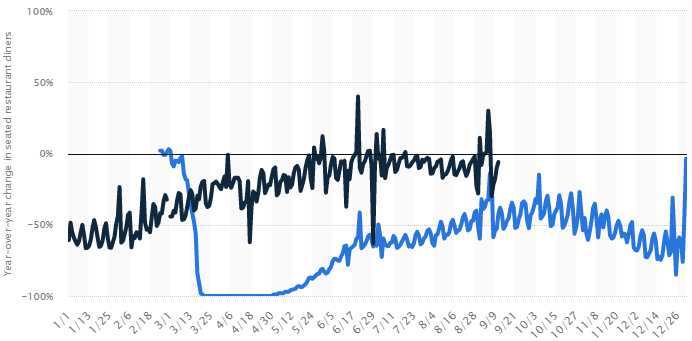

Covid-19’s resurgence is creating whiplash for restaurants, which have slogged through a year and a half of pandemic-related disruptions. Sales that had steadily grown earlier in the summer have fallen in the past five weeks, data from restaurant analytics firm Black Box Intelligence showed. Bars and restaurants lost 41,500 jobs in August, the largest monthly decline of any single sector, according to Labor Department figures released earlier this month. It was the food-service industry’s first monthly decline since December.

Shares of casual-dining restaurant chains, which depend more on dine-in sales than fast-food companies, have sagged in recent weeks. Chili’s owner Brinker International Inc. said last month that Delta had begun to depress sales, and its shares are down 16% since early June. Dave & Buster’s Entertainment Inc. shares have lost 18% and Applebee’s owner Dine Brands Global Inc.’s stock has fallen 14% over the same period. We have Chipotle (CMG) as one of our primary shorts in our Short-Term Portfolio.

Here's a chart from Statistica showing "Year-over-year daily change in seated restaurant diners due to the coronavirus (COVID-19) pandemic in the United States from February 24, 2020 to September 11, 2021":

While I would love to throw caution to the wind and run with the bulls, clearly restaurant dining has been trending down all summer (holiday spike last week) and the odds are 50/50 at best that we don't head back down due to either another lockdown or people just getting nervous and curtailing their habits. 10% of the US workforce have jobs in the restaurant industry – this is a major part of the economy and they really can't afford another winter like the last one – we have lost 17% of the restaurants that were open pre-covid already, 30% in California and only grant money is keeping many of the remaining restaurants alive as it is.

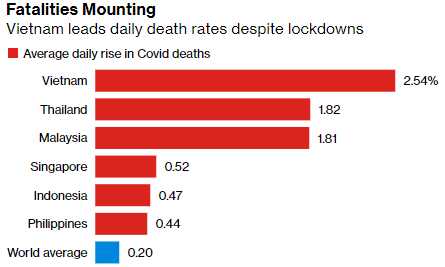

Southeast Asia is giving up on their lockdowns because they simply can't afford another round of bailouts so, despite the rising death rates, on the factory floors of Vietnam and Malaysia, in the barbershops of Manila or office towers of Singapore, regulators are pushing forward with plans to reopen, seeking to balance containing the virus with keeping people and money moving. That’s leading to a range of experiments including military-delivered food, sequestered workers, micro-lockdowns and vaccinated-only access to restaurants and offices.

Southeast Asia is giving up on their lockdowns because they simply can't afford another round of bailouts so, despite the rising death rates, on the factory floors of Vietnam and Malaysia, in the barbershops of Manila or office towers of Singapore, regulators are pushing forward with plans to reopen, seeking to balance containing the virus with keeping people and money moving. That’s leading to a range of experiments including military-delivered food, sequestered workers, micro-lockdowns and vaccinated-only access to restaurants and offices.

Southeast Asia’s factory shutdowns have rippled across the world to create supply chain hiccups, with automakers including Toyota Motor Corp. slashing production and clothing retailer Abercrombie & Fitch Co. warning the situation is “out of control.”: Tangled Vietnam Supply Chain Highlights Threat to Global Economy

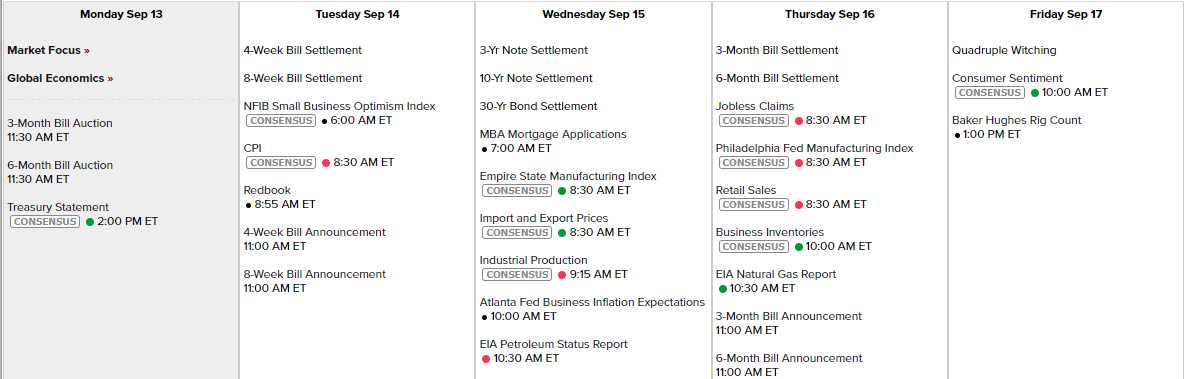

There is no Fed speak scheduled this week and today we just have the monthly Treasury Statement at 2pm but tomorrow we get Business Optimisn and hyper-inflationary CPI, Wednesday is Empire State Manufacturing, Industrial Production and Business Expectations. Thursday we have the Philly Fed, Retail Sales and Business Inventories and Friday is Quad Witching Day with Consumer Sentiment also weighing in.

We'll see how that 4,500 line performs for the week but I think most likely we're heading for a proper retracement, back to 4,200 at least – as I noted last week in our Live Member Chat Room.

Be careful out there!