26.5%.

26.5%.

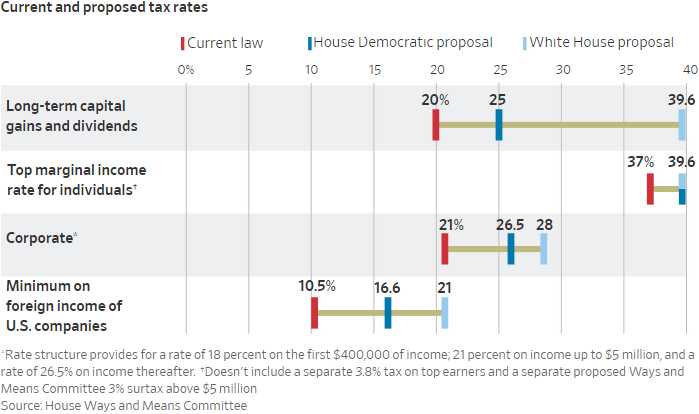

That is the new Corporate Tax Rate if the Democrats get their way, up from the current 21% that none of them pay anyway. On the personal side, if you are making over $5M per year, there will be a 3% surcharge but there will be no "Death Tax" increase so you can still take it with you when you go. Oil and Gas Companies successfully lobbied to keep their tax breaks and Banks are still being given a full year to move money around to avoid taxes – something that was supposed to be stopped.

Democrats plan a committee vote this week on the proposals, which would generate more than $2 Trillion that would go toward expanding Medicare, increasing renewable-energy tax breaks and creating a national paid-leave program, among other items. They are also are looking elsewhere to cover the rest of the $3.5Tn spending and tax-cut agenda they aim to pass this fall. Long-Term Capital gains are set to go from 20% to 25% but not the 39.6% Biden had asked for.

The proposal will test Democrats’ willingness to raise taxes, and its pieces are designed to hit those above the $400,000 annual income dividing line that President Biden set during last year’s campaign. Keep in mind, the Corporate Tax Rate in 2016 was 35% and we have more than doubled our National Debt since reducing it, so 26.5% is a half-measure at best.

The key takeaway is that, if this is passed, we are essentially chopping 5.5% off Corporate Net Income – that's going to sting – even after the cheating brings that number down further. The goal of the plan is to pay for the Democrats' $3.5Tn 10-year spending bill but it "only" raises $1Tn from Corporations and $1Tn from individuals and, as usual, the normal BS about how the taxes and spending bill will grow the ecomomy and "pay for themselves". Where have we heard that before?

Everyone knows, if you want to grow the economy – unleash a Global Pandemic. It certainly seems to be working so far, doesn't it?

We are still rockin' a 100% gain in the market since the tax cuts were put into effect in 2017 but half of those gains are post-Covid – thanks to over $10,000,000,000,000 in stimulus that has been thrown onto our $20Tn economic fire. Yes the partial withdrawal of tax breaks (not really increases) will roll back earnings somewhat but the big concern is still what will happen when 50% of our GDP isn't stimulus anymore?

No need to worry this morning as the CPI was only up 0.3% in August, less than the 0.4% expected and the 0.5% in the July report. Core CPI was just 0.1%, down from 0.3% previously. Airline fares, used cars and trucks as well as motor vehicle insurance were the categories that declined to give us a lower number as the resurgence of Covid chased more people inside during August – so I wouldn't read too much into that number – but people will anyway…

Venture capital is cuckoo. After investing $120 billion in the 2000 dot-com frenzy, and just $16 billion in 2002, U.S. venture capital invested $130 billion in 2020 and then $140 billion in the first half of 2021. Startups these days raise money as “the Uber of gardening” or “Space as a Service.” Oh wait, the latter was WeWork’s pitch, whose founder Adam Neumann declared in 2017, “our valuation and size today are much more based on our energy and spirituality than it is on a multiple of revenue.”

The Federal Reserve deserves most of the blame. Near-zero interest rates means the market has no true north to help compare stock valuations with reality. We are navigating turbulent seas with a spinning compass. So no, Fundamentals don’t matter. Well, until they do… In 1989 Tokyo real estate sold for as much as $139,000 a square foot—350 times the value in Manhattan. At that price, Tokyo’s Imperial Palace was worth more than all the real estate in California. Not anymore.

Yahoo was once worth $125 billion and AOL $200 billion during the dot-com bubble. Both are worth 99% less today. Tesla CEO Elon Musk recently tweeted, “I thought 1999 was peak insanity, but 2021 is 1000% more insane!” Remember, when the selling starts, fear of missing out turns into fear of losing everything as speculators jump like rats off a sinking ship.

Today’s negative real yields don’t reflect reality. The Fed has warned it plans on tapering bond and mortgage purchases later this year. Someone is at least reaching for the punch bowl. The compass may stop spinning soon. Until then and always, stick with Fundamentals.