Well, you can't say I didn't tell you so.

Well, you can't say I didn't tell you so.

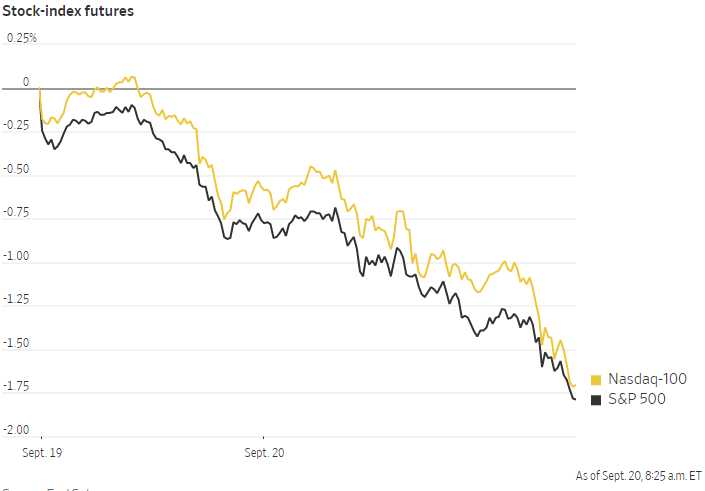

This is what we were afraid of. In a thinly-traded market, there are not enough buyers to put a floor under a sell-off and the market can drop very rapidly when there is any kind of panic selling. There were so many things that could have set this off but, this morning, it's one of the earliest ones we had bet on – China Evergrande, their largest property developer that we have warned about on many occasions, is rumored to be failing – and the State is letting it happen!

Market participants increasingly believe that Beijing will let Evergrande fail and inflict losses on its shareholders and bondholders. The company’s debt burden is the biggest for any publicly traded real estate management or development company in the world.

“Everyone is looking at Evergrande and saying ‘has the time come for a major default in that area, and then the potential for contagion into the broader property sector?’” said Edward Park, chief investment officer at Brooks Macdonald. “It’s an imminent risk now rather than being a theoretical risk as it has been for the past few years.”

Other factors weighing on markets Monday included a natural-gas shortage in Europe that has prompted the U.K. government to hold emergency talks with energy suppliers, Mr. Park said. The Federal Reserve will likely use its policy decision Wednesday to pave the way to pare back some of the stimulus it lavished on markets last year, he added.

You know I hate to be Chicken Little but Evergrande is one of those many things the market has been ignoring and, as you can see from all the links at PSW, it's something we've been concerned with for quite a while – the market just chose to ignore it – until now. Of course, any excuse for a pullback works in an overbought market and that's why we went to CASH!!! in our Member Portfolios – last month.

In fact, we've had the China Ultra-Short ETF (FXP) as one of the hedges in our Short-Term Portfolio, with 40 of the $30/50 bull call spreads giving us an $80,000 potential and we bought them for just net $7,000 at the time, as it was out of the money. Now we're $10 in the money at $40,000 with another $40,000 to gain if China melts down yet the net of the spread is still only $20,700 – aren't options weird?

| FXP Long Call | 2021 17-DEC 30.00 CALL [FXP @ $37.11 $0.00] | 40 | 6/18/2021 | (88) | $12,000 | $3.00 | $5.15 | $3.62 | $8.15 | $0.00 | $20,600 | 171.7% | $32,600 | ||

| FXP Short Call | 2021 17-DEC 40.00 CALL [FXP @ $37.11 $0.00] | -40 | 6/18/2021 | (88) | $-5,000 | $1.25 | $1.73 | $2.98 | $0.00 | $-6,900 | -138.0% | $-11,900 |

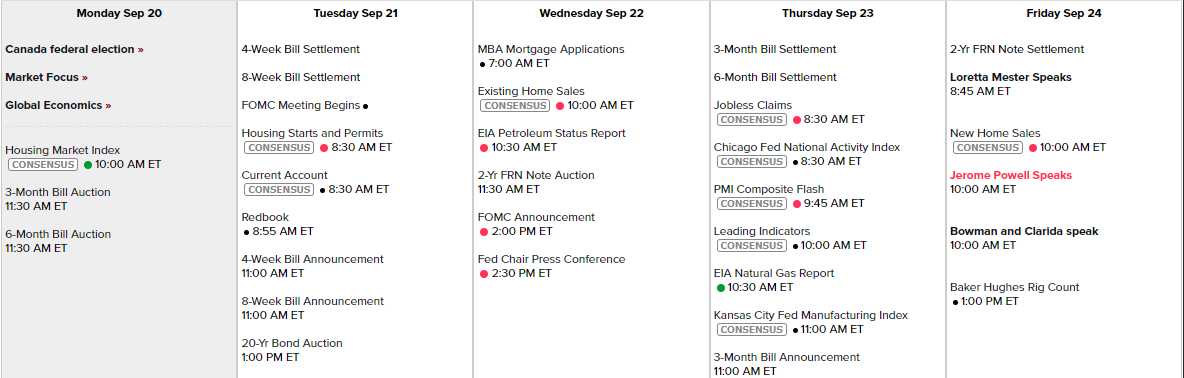

Anyway, we'll see if the selling lasts but we're very well-hedged and, frankly, we WANT to see a sell-off so we can re-deploy our cash doing some bargain-hunting. The Fed has a Rate Announcement on Wednesday and we have 4 Fed speakers on Friday – which means they are worried about our reaction to Wednesday's decision.

Other than that, it's a pretty lame data week with a little Housing Data ahead of the Fed and Thursday is busy with the Chicage on Kansas City Fed Indexs along with PMI and Leading Economic Indicators but not much else going on the whole week:

I predicted S&P 4,200 would be tested this week and it's 4,340 this morning so we're now as close to 4,200 as we are to last week's Strong Bounce line at 4,480 – exactly in the middle, in fact. Very interesting…