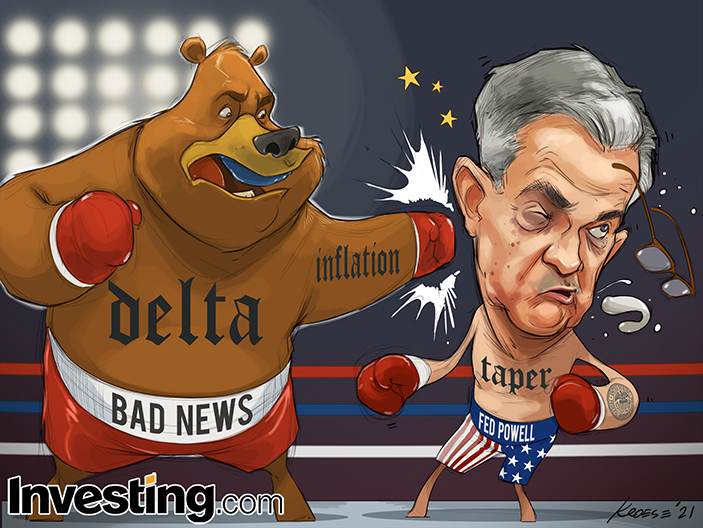

To taper or not to taper?

To taper or not to taper?

That is the question today as the Fed makes their next rate announcement at 2pm and we'll hear from Chairman Powell at 2:30. A rate hike seems out of question but tapering the Fed's $120Bn monthly bond and asset purchases is very much on the table and it's almost a certainty that the Fed will cut their monthly easing down to $110Bn and see how that goes. Just yesterday, our Government sold $24Bn worth of 20-year notes and the Fed, did in fact, buy most of them.

$4Tn worth of Treasuries are being sold in 2021 and that number will rise if the Government passses another stimulus bill. Some of that is rollover debt but $3Tn of it is our current deficit for the year and we've hit the debt ceiling, which is why it hasn't grown this quarter but Congress is working hard to extend it, so we can go 4 or maybe $5Tn into debt in 2021 – which would be bigger than the entrie GDP of any other country on Earth besides China.

$5Tn is also 1/4 of our own entire GDP which means 25% of our economy is deficit-funded. How long can that really last? Much longer than we ever dreamed is already the answer and will there ever be any consequences to our now $30Tn in total debt – that's a question we don't really ever want to know the answer to.

We'll see what Powell and the Fed have to say this afternoon but, meanwhile, on Capital Hill, the Democrats are pushing to raise or at least suspend the Debt Ceiling as we have 30 days before we default on our own loans, not to mention the overall Government shutdown. With Republicans firmly against anything that allows a Democratic Government to run – the best we can hope for at the moment is an extension through December 3rd.

The GOP is also holding up Disaster Relief for Wildfires, Hurricanes and $6.3Bn needed to help resettle the people who fled Afghanistan along with the US Army. The 2019 bipartisan debt ceiling deal was approved by both parties and the Trump administration in conjunction with increased budget caps on regular domestic and military spending but this time it's different because a Democrat is in charge so the Republicans suddenly care about debt again ($8Tn later).

BitCoin crashed below $40,000 and a Treasury committee of Bond Dealers and Investors have warned Secretary Yellen that there are "dire risks to the financial system if Congress fails to lift or re-suspend the debt limit."

“If left unresolved, this situation would put the U.S. government at risk of missing debt payments — an outcome that would have severe consequences for the U.S. Treasury market and, ultimately, for the U.S. economy,” Beth Hammack, chair and Brian Sack, vice chair of the Treasury Borrowing Advisory Committee wrote in the letter posted on the Treasury’s website. “Even if default were avoided, continued negotiations over the debt limit could cause needless volatility, create additional operational expenses for market participants, and do lasting damage to the Treasury market.”

“We encourage you to continue working with Congress to raise, suspend, or eliminate the debt ceiling immediately,” Hammack and Sack wrote. “To default would be unthinkable, but even to risk that outcome would be reckless and irresponsible.”

Something else for the market to ignore?