Traders have short memories but – WOW!

Traders have short memories but – WOW!

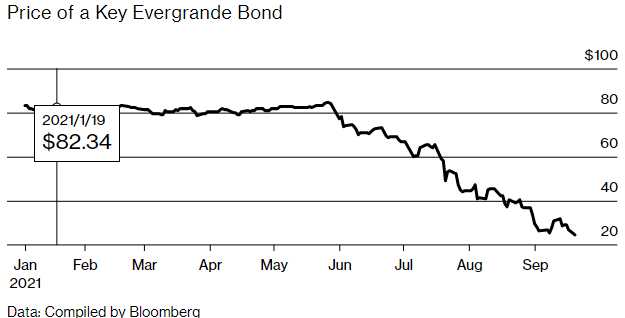

China Evergrande Group, until recently the world’s largest property developer, owns dozens of stalled sites like Sunny Peninsula in Guangzhou – all across China. Buckling under more than $300 Billion in liabilities, the company is close to collapse, leaving 1.5 million buyers waiting for finished homes and leaving it's lenders on the verge of insolvency as well. Furious retail investors who helped fund Evergrande’s expansion have turned up at the company’s Shenzhen headquarters to complain about delayed repayments on wealth management products it sold.

Evergrande is China’s largest issuer of high-yield dollar-denominated bonds, and bills are coming due to an array of banks and suppliers. Given its footprint in the housing market, there’s also a risk of a disorderly collapse triggering a broader decline in property prices—bad news in an economy where 27% of loans are for real estate.

China may be willing to let Evergrande fail if it thinks it can engineer a soft landing for the real estate sector. The $56 Trillion domestic financial system is dominated by state-owned lenders, which give the government extensive power both to squeeze borrowers and to manage the impact of defaults. But the stakes are enormous. When industries such as construction and property services are included, real estate accounts for at least 15% of the nation’s gross domestic product, and more than 70% of urban China’s wealth is stored in housing.

At the end of 2016, the ruling party’s Politburo unveiled a new slogan: “Houses are for living in, not for speculation.” One policymaker complained the following year that the economy was being “kidnapped” by the housing sector. Since then, China has changed the rules to discourage housing speculation and that, unfortunately, is what Evergrande built their business on. They have attempted to build more low-cost housing – but there are entire luxury projects that sit half-started and abandoned – like this soccer stadium in Guangzhou.

At the end of 2016, the ruling party’s Politburo unveiled a new slogan: “Houses are for living in, not for speculation.” One policymaker complained the following year that the economy was being “kidnapped” by the housing sector. Since then, China has changed the rules to discourage housing speculation and that, unfortunately, is what Evergrande built their business on. They have attempted to build more low-cost housing – but there are entire luxury projects that sit half-started and abandoned – like this soccer stadium in Guangzhou.

China's landscape is littered with projects like this that have ground to a halt and it's not just affecting the financial market but also the commodities market as all that copper, iron, steel and lumber are not going to be used after all and, since Chinese builders usually secure supplies in advance – all that supply will hit the market again via bankruptcy sales – competing with the new materials the miners are trying to sell.

That's one of the reasons the Fed did not tighten anything yesterday – we may be walking headlong into another global liquidity crunch. This is very much like 2008, when a few property and banking defaults overseas were NEVER going to affect the US markets, were they? Brazil's Central Bank, on the other hand, has just raised rates for the 3rd consecutive meeting, now 6.25% as inflation in that country is at 10% and they are promising to raise rates yet again at the next meeting.

The Brazilian economy is further reopening as the pandemic eases in the country. Brazil’s seven-day rolling average for virus-related deaths has fallen below 600 (about 1/2 of what the US suffers daily), compared with roughly 3,000 in April. Meanwhile, Brazil's economy is picking up so tightening is not a death-knell for the economy – it's just an end to the Free Money Party the markets have been enjoying and not every Government runs themselves for the benefit of the Top 1%.

EWZ is Brazil's ETF and makes a nice play down here. The Jan $31 ($3.75)/34 ($2.15) bull call spread is only net $1.60 on the $3 spread and you could buy 10 of those for $1,600 and sell 5 of the 2023 $25 puts for $3 ($1,500) and then you'd have net $100 in the $3,000 spread with $2,900 of upside potential and your worst case is owning 500 shares of EWZ for net $25.20, which is $8.15 (24%) below the current price. Aren't options fun?

Our own Fed is refusing to take their foot off the gas, despite the US coming into a very sharp curve in the road with inflation hovering around 10% into the Holiday Shopping Season. At least we are out of the house, right? U.S. retailers will face an extra $223Bn in costs of goods sold this holiday season, Salesforce predicts, which include year-over-year jumps in the costs of freight, manufacturing, and labor. Raw material shortages, logistics barriers, and challenges in the labor market, in which workers fight for better pay and the digital economy uproots traditional roles, have put a strain on retail operations and, consequently, on consumer shopping experiences.

Our own Fed is refusing to take their foot off the gas, despite the US coming into a very sharp curve in the road with inflation hovering around 10% into the Holiday Shopping Season. At least we are out of the house, right? U.S. retailers will face an extra $223Bn in costs of goods sold this holiday season, Salesforce predicts, which include year-over-year jumps in the costs of freight, manufacturing, and labor. Raw material shortages, logistics barriers, and challenges in the labor market, in which workers fight for better pay and the digital economy uproots traditional roles, have put a strain on retail operations and, consequently, on consumer shopping experiences.

According to Salesforce's Shopping Index Data, the Average Selling Price (ASP) for merchandise in discretionary categories, such as apparel, footwear, and furniture, spiked by 11% over Q2 2020. This is by far the largest increase ever seen in their data. Average Order Value (AOV) was up 17% year-over-year, while the number of units consumers purchased decreased by 1% – so consumers are getting less stuff for more money, overall. From the Report:

Simply put, consumers are spending more on fewer items. As retailers fight for wallet share among experiential categories such as travel, entertainment, and dining, the value of the dollar is becoming even more strained. Consumers face rising prices across all sectors of the economy, which may impact consumer confidence over time.

The global shipping process is being slowed not just by delays, but also by steep prices. While Home Depot is renting its own cargo ships and Walmart is pre-buying containers, this is not realistic for most brands and retailers. Container prices and capacity, along with labor issues, is causing a glut at the ports that is adding costs and lead time to inbound shipments. We predict U.S. companies will spend $163 billion more on ocean freight in the second half of 2021 than they did in the second half of 2020, roughly tripling their costs from the same period last year. With prices this high, we expect that some larger companies will turn to air freight as an alternative.

In total, we predict that the retail industry will see an additional $223 billion in the cost of goods sold this holiday season. While we forecast that year-over-year consumer prices will continue to rise by an additional 8% to 10% each quarter, suppliers and retailers should plan for incremental margin hits with inflationary pressures.

As I noted in yesterday's Webinar, we will be paying very close attention to Conference Calls and Guidance in the upcoming earnings reports – especially from the retailers. The Retail ETF (XRT) is still hovering at it's highs and makes a very nice short below the $95 line – with tight stops above. This is more than double where it was in Christmas of 2019 and, even last Christmas, the index was only at $64 – what on Earth can justify this move?

The XRT March $100 ($11)/90 ($5.50) bear put spread is net $5.50 (10 for $5,500) on the $10 spread and you can whittle away at that cost by selling 3 Nov $90 puts for $2 ($600) and 3 Nov $100 calls for $1.60 ($480), which would drop the net to $4,520 with $5,480 (120%) upside protential if shopping disappoints. If the first short sale goes well, we can sell subsequent months as well.

Meanwhile, 4,400 is the strong bounce line on the S&P off our recent dip so we'll see how we close out the week tomorrow.