Government shut-down (again)?

Government shut-down (again)?

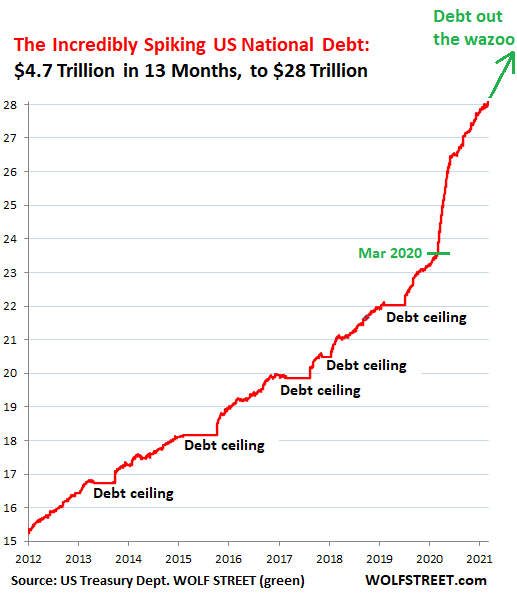

The Senate Republicans blocked a bill last night to fund the Government and raise our borrowing limit (you can't have one without the other as we're already running a $3.2Tn deficit this year). It is now just days before the Government runs out of money and the GOP is determined to bring this Government down one way or the other and insurrection didn't work so maybe bankruptcy will do the trick?

Senate Democrats sought to pass a House-approved stopgap measure that funds the government through Dec. 3, 2021, and suspends the debt limit through Dec. 16, 2022. They are racing to send the legislation to President Biden’s desk before the government’s current funding expires at 12:01 a.m. Oct. 1st which, rumor has it, is Friday.

Treasury Secretary Janet Yellen has notified lawmakers that the government may be unable to keep paying its bills on time as early as next month if Congress doesn’t authorize additional borrowing. “Social Security checks, Medicare benefits, veteran’s benefits, small business, all this and more are now on the chopping block because Senate Republicans are playing games with the full faith and credit of the United States,” Senate Majority Leader Chuck Schumer (D., N.Y.) said.

A vote to raise the debt limit doesn’t authorize new spending, instead essentially allowing the Treasury Department to raise money to pay for expenses the government has already authorized. About two-thirds of federal spending is automatic on programs such as Medicare, Medicaid and Social Security, while the other third is discretionary and annually approved by Congress. A default on the debt could have catastrophic financial consequences, and the pressure on both parties to resolve the issue will likely grow as Congress nears the deadline.

Now we are all very excited by the 6% GDP growth that is forecast for 2021 but that's 6% of $19.5Tn or $1.17Tn, which is a lot of money but, when you have to go $3.2Tn in debt to get $1.17Tn in growth – it's not quite as impressive, is it?

So next year we'll be $30.2Tn in debt with a $20.7Tn economy but a $1Tn spending bill and a $3.5Tn infrastructure bill would put us another $1.35Tn in debt (the $3.5Tn is over 10 years) on top of our usual $1Tn so we're up to $32.55Tn at the end of next year IF ALL GOES WELL and MAYBE the economy is at $21.7Tn and that means we would, in fact, 150% of our GDP in debt (IF all goes well).

That's why the 30-year notes have plunged 5% in the past two weeks – even though the Fed put off their tightening. At this point, the Fed has no choice but to raise rates (sending bond values lower) because, if they don't, they will appear to be ineffective if rates keep rising DESPITE their target. The Fed is nothing more than a confidence game – God forbid people realize how powerless they are to actually control the economy and we're all screwed!

That's why the 30-year notes have plunged 5% in the past two weeks – even though the Fed put off their tightening. At this point, the Fed has no choice but to raise rates (sending bond values lower) because, if they don't, they will appear to be ineffective if rates keep rising DESPITE their target. The Fed is nothing more than a confidence game – God forbid people realize how powerless they are to actually control the economy and we're all screwed!

September has clearly been a road to nowhere for the market and, rather than say it again, I'll just cut and paste my comments from last month in: "Toppy Tuesday (Again) – S&P 500 Tests 4,500 (Again)":

An endless series of low-volume rallies is not enough to get you over a major level on the S&P 500 so, once again, we are being rejected at the 4,500 level. On the surface, things look good with a projected $1.8Tn in earnings for the S&P 500 and that's up 28% from $1.4Tn in 2019 but our Government (money borrowed by you and I on their behalf) has spent over $10Tn so our Corporate Masters could make that extra $400Bn – which will be the ANNUAL interest on what we borrowed at 4% (which will be more profits for the banks).

This is like playing Monopoly when the Banker is cheating – there's no way you can win…. Meanwhile, in 2019, the S&P 500 was topping out at 3,000 so 4,500 is 50% higher than we were, not 28%, which would be 3,750. So, EVEN IF there were no stimulus and this were an honest 28% increase in earnings – we are still 20% too high at 4,500. This is not sustainable – especially if the Government isn't going to throw in another few Trillion Dollars to keep things humming next year.

This was the chart on August 24th:

And here is the chart today:

As you can see, it took the S&P 4 years to get from 2,000 to 3,000 (up 50%) and that 1,000 point rally had two 500-point pullbacks along the way. This is our first attempt at 4,500, less than 2 years after crossing 3,000 and that's a 1,500-point rally and the pullback we'll be looking for is 3,750 at some point, which is only down 16.66% – so not too big a deal if it happens (and we hold it).

Again, I'm a bit skeptical because of all the stimulus but stimulus there is so 4,500 we have – for the moment. Now it's up to the Fed and the Government to decide how much they want to spend to keep Corporate America making this kind of money (while not taxing them) at the expense of the American people. In situations like this – you know better than to expect our Government to be there for the people….

Of course we cashed out at the top – so we don't care. We're just sitting back and watching the fun for now. On October 13th we get earnings from JPM, BLK, PGR and UAL and Thursday, the 14th, it's Bankapalooza for earnings and the season begins in earnest the week of the 18th but that's about 3 weeks away so, for now, we stay focused on the data and, as I predicted yesterday based on the Fed Speaking Schedule, we would turn down this morning (aleady started) and there's no one to put a floor in until Williams speaks Wednesday at 5pm.

Perhaps the Democrats and Republicans can resolve their differences and pass a spending bill by then to restore confidence… Perhaps…

Speaking of confidence, Dallas Fed President, Robert Kaplan and Boston Fed President, Eric Rosengren are resigning over the trading scandal, though both are claiming other issues. As I noted yesterday, Kaplan is a major dove on the Fed while Rosengren is a centrist – it will be interesting to see who replaces them.

Meanwhile Powell is going to speak to the Senate Banking Committee this morning about inflation and, so far, "transitory" inflation looks like it's going to be around for quite a while – so we'll see what he has to say for himself.

Meanwhile Powell is going to speak to the Senate Banking Committee this morning about inflation and, so far, "transitory" inflation looks like it's going to be around for quite a while – so we'll see what he has to say for himself.

“Inflation is elevated and will likely remain so in coming months before moderating,” Powell will say. “As the economy continues to reopen and spending rebounds, we are seeing upward pressure on prices, particularly due to supply bottlenecks in some sectors. These effects have been larger and longer lasting than anticipated, but they will abate, and as they do, inflation is expected to drop back toward our longer-run 2 percent goal.”

The remarks are part of mandated testimony Powell must give to Congress regarding the Fed’s economic response to the Covid-19 pandemic. He will speak Thursday to the House Financial Services Committee.