Pay no attention to that dip behind the curtain!

Pay no attention to that dip behind the curtain!

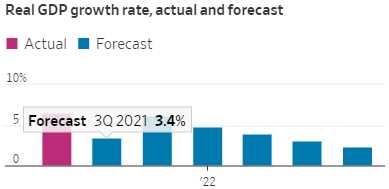

On Friday we talked about how leading Economorons were way off base in their Q3 forecasts and now the consensus has dropped way down – back to 3.4% for tomorrow's report, which is only a little higher than the Fed's 3% forecast butthat hasn't caused them to change their Q4 forecast, which is still predicting 6.2% – about where Q3 was predicted to be as recently as a month ago.

It would be nice just to say "so we don't pay attention to them" but, as Keynes said: ""The ideas of Economists and Political Philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood." These idiots are the people who steer the conversation – they are the ones who set the agenda for borrowing and spending based on their predictions about what will have what effect – AND THEY HAVEN'T GOT A CLUE!

We make fun of primative cultures who ask the village "wise man" for avice on planting crops, etc. but I bet those guys weren't wrong 80% of the time or they'd be run out of town. In America we give them TV shows! We run our entire economy based on the advice of people who routinely miss their projections by 100% and more…

And don't get me wrong, predicting is hard. A month ago I predicted the S&P 500 would top out at 4,500 and it topped out at 4,550 on September 3rd but yesterday we finished at 4,352, so I don't feel too bad and 1% is a lot less than 100%. Of course, I'm not casting bones or reading tea leaves like most economists and I'm certainly not looking at charts (I do use them to illustrate) – I'm just using math – and the Fabulous 5% Rule™.

And don't get me wrong, predicting is hard. A month ago I predicted the S&P 500 would top out at 4,500 and it topped out at 4,550 on September 3rd but yesterday we finished at 4,352, so I don't feel too bad and 1% is a lot less than 100%. Of course, I'm not casting bones or reading tea leaves like most economists and I'm certainly not looking at charts (I do use them to illustrate) – I'm just using math – and the Fabulous 5% Rule™.

We did the math back on August 24th and that told us to look for a correction to 3,750 on the S&P 500 and that's still down 600 points (13.7%) from where we are now. In the shorter run, we'll look for bounce lines to see if we can shake off the correction for another month (which only makes it worse when it comes) and, since we topped out at 4,550 and our low (so far) has been 4,300, that's a 250-point (5.5%) drop and our 5% Rule tells us to expect 20% (of the drop) bounces so those would be 50 points to 4,350 (weak) and 4,400 (strong) and we have to hold strong through Friday or the correction is very likely to continue next week.

- Dow 35,500 to 33,600 was a 2,000-point drop so the bounce lines are 34,000 (weak) and 34,400 (strong)

- Nasdaq 15,700 to 14,740 was a 960-point drop so call it 200-point bounces to 14,940 (weak) and 15,140 (strong)

- Russell 2,350 to 2,150 was a 20-point drop so 40-point bounces to 2,190 (weak) and 2,230 (strong)

That's how we track our bounce lines – no chart required. Very simply, more red than green is bad and extreme cautioun is required – like driving under a yellow flag at Indy.

- Democrats Hit Impasse on Biden Agenda, Debt Ceiling Increase

- At Least Some in Congress Are Getting Behind the Trillion-Dollar Coin

- 10-year yield continues rapid climb, hits the highest since June.

- Stocks Selloff to Extend to Asia as Yields Spike: Markets Wrap.

- Stocks could slide further as interest rates rise and Big Tech drags the market

- Owner-Equivalent Rent Shock On Deck As Actual Rents Surge By Most On Record

- CEOs worried about corporate tax hikes as Dems push bills

- Port Of Los Angeles Demands More Federal Funding As Cargo Backlog Looms

- Wall Street Banks Questioned by Fed On Evergrande Exposure

- Evergrande Crisis Highlights Funding Risks for Other Developers

- Warren Cites Fear Over Another 2008 Meltdown in Opposing Powell

- 131 Federal Judges Broke the Law by Hearing Cases Where They Had a Financial Interest

- T-Shirt And Jean Inflation Coming With Decade High Cotton Prices

- Micron earnings forecast disappoints amid concerns about memory-chip prices, stock tumbles.

- Dollar Tree Tiptoes Away From $1 Limit in Test of Higher Prices

- Hurricane Forecasters Expect Two Storms To Form In Atlantic Basin This Week

- WTI Extends Losses After Surprise Crude Build