Courtesy of ZeroHedge View original post here.

In the first of two coupon auction today, the Treasury just sold $58 billion in 3Y paper in an auction that was superficially strong but actually left a lot to be desired.

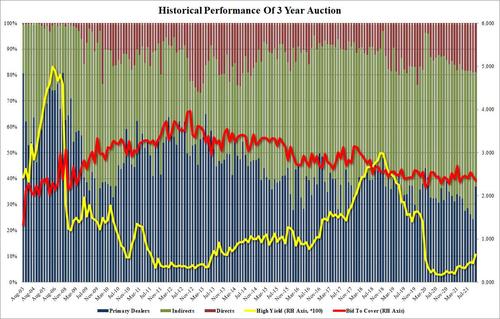

The auction priced at a high yield of 0.635%, which while almost 20bps more than last month's 0.447% and by far the highest since Feb 2020, stopped through the When Issued 0.637% by 0.2bps.

That's the good news. The bad news is that the Bid to Cover slumped from last month's 2.446 to just 2.356%, the lowest since April and well below the six-auction average of 2.434.

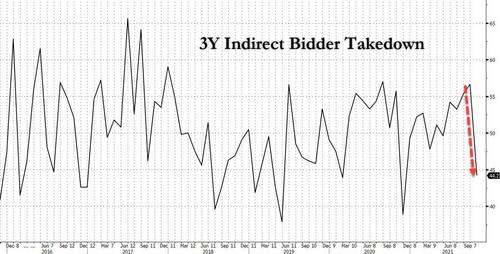

The worse news was the internals, where Dealers surged to 36.9% from 24.4%, the highest since November 20 (38.9%) and far above the recent average of 28.7%, because Indirect participation – i.e., foreign demand – tumbled from 56.7% to just 44.2%, the lowest Indirect take down since November 2020 and far below the six-auction average of 53.4%. One wonders if foreigners are once again starting to get cold feet about the short-end of the curve a time when the Fed's tapering will likely blow out yields higher in coming months.

Finally, Directs were virtually unchanged at 18.9%, just fractionally below last month's 19.0%.

Overall, a surprisingly weak auction primarily due to the sharp drop in foreign demand, even if today's concession allowed what demand there was, to price the auction below the When Issued. And with the 10Y auction in under 90 minutes, keep a close eye on Indirect participation: if a new exodus in foreign demand is starting, the US bond market will surely feel it.