Courtesy of ZeroHedge View original post here.

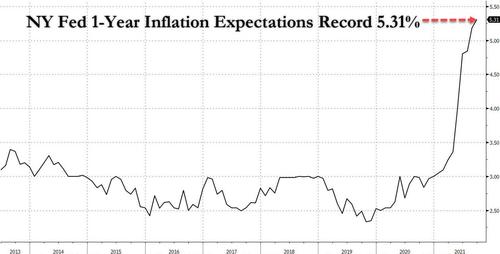

Another month, another record high in consumer inflation expectations.

While central banks, tenured economists and the financial media are doing everything in their propaganda power to convince ordinary Americans (who don't have the privilege of charging their Federal Reserve debit card when shopping at the grocery store) that the current phase of galloping inflation – to avoid the far more dreaded "h" word – is merely transitory, the shocking reality on the ground is that the Fed has effectively lost control over near-term inflation expectations, as the NY Fed's latest survey of consumer expectations reveals.

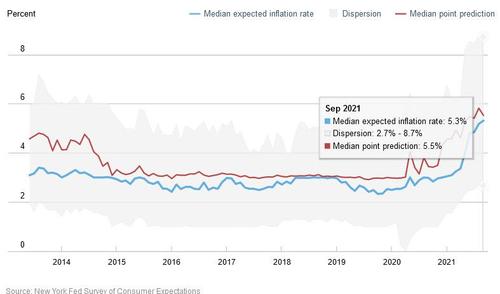

According to the September installment of this closely watched survey, consumer inflation expectations for one year ahead hit a fresh all-time high for this series of 5.31, up from 5.18 in August. "Median short-term (one-year-ahead) inflation expectations increased by 0.1 percentage point in September to 5.3%, the eleventh consecutive monthly increase and a new series high since the inception of the survey in 2013" the NY Fed said without a trace of irony even as its economists plead with the public that this spike will last at most a few more months, hence "transitory."

But while the median 1 Year expected inflation rate was a "modest" 5.3%, the upper end of the 25%/75% dispersion range was a mindblowing 8.7%, meaning that at least 25% of respondents see inflation surging to nearly double digits!

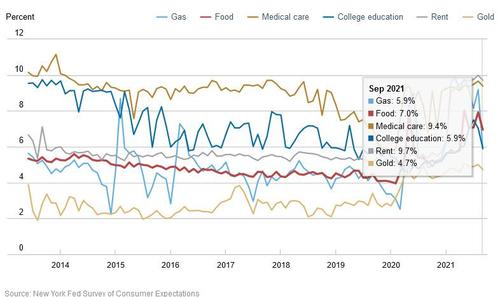

The Fed survey showed that Americans are expecting higher rates of price increases for virtually all items, like rent and food, that make up a big chunk of the consumer-price basket, and can’t be substituted. Looking at a breakdown of inflation expectations by component, over the next year consumers expect gasoline prices to rise 5.9% (expect this number to surge with oil hitting a 7 year high); food prices to rise 7%; the price of a college education to rise 5.9%; rent prices to rise 9.7%; medical care to increase by 9.4%. Curiously, the price of gold is expected to rise 4.7% (down from 5.0% last month) after being in the 2% range for much of the past decade.

There were a few silver linings: expectations that wages will keep pace with the acceleration in prices reversed from last month's drop, and the median one-year-ahead expectation for earnings growth rose 0.4 percentage point to 2.9%, reversing the August drop, with respondents over the age of 40 largely driving the decline. There was a modest improvement in labor market conditions too, with the mean perceived probability of losing one’s job in the next 12 months decreased from 12.45% to 11.09%.

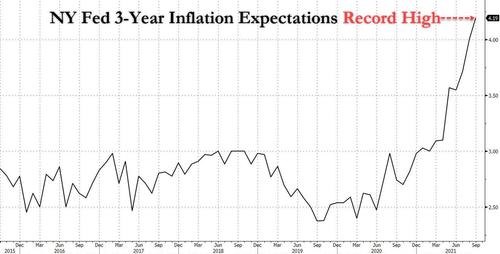

Going back to inflation, unfortunately it was not just 1-year expectations that hit new all time highs: consumers' median inflation expectations for the three-year horizon also jerked higher with the median 3-Year inflation expectation surging to 4.19% from 4.0% in August, which was also the highest reading in series history!

Remarkably, both the Fed's 1-Year and 3-Year inflation expectations are now above those observed most recently in the UMich consumer sentiment survey, where the 1Y expectations were flat at 4.6% while the 5-10 inflation expectations rose to 3.0%. Expect both numbers to rise in coming months.

Well aware that it would get substantial criticism for deanchoring inflation expectations – as the charts above clearly show – the report authors write that inflation expectations remain "anchored." How do they reconcilte this ludicrous claim with the data which is clearly showing that expectations are anything but anchored through 3 years ahead? Simple: by moving the goal posts of course: "longer-term (5-year ahead) inflation expectations still appear to be as well anchored as they were two years ago, before the start of the pandemic."

In other words, yes, inflation will surge for 3 years, probably 4, but on year 4 at end of the 12th month, all shall be well, and 5 year inflation will be back to normal. Said otherwise, we may have soaring inflation but it's only for the next 5 years.

We doubt this will be a comfort to anyone except those who can use their Fed debit card to charge all purchases for the next 5 years.

Some other observations from the report:

- Median year-ahead home price change expectations decreased by 0.4 percentage point in September to 5.5%, the fourth consecutive monthly decrease. The decrease was driven mostly by respondents who live in the “West” and “Northeast” Census regions.

- Expectations about year-ahead price changes decreased for all the commodities considered in the survey. The median one-year-ahead expected change in the price of gas decreased sharply from 9.2% to 5.9%. The median one-year-ahead expected change in the cost of a college education and in the price of food decreased by 1.1 and 0.9 percentage points, to 5.9% and 7.0%, respectively. Finally, the median one-year-ahead expected change in the cost of medical care and in the cost of rent each fell 0.3 percentage point to 9.4% and 9.7%, respectively.

Labor Market

- Median one-year-ahead expected earnings growth rebounded in September, increasing 0.4 percentage point to 2.9%, substantially above its 12-month trailing average of 2.2%. The decrease was driven mostly by respondents over the age of 40 and respondents without a bachelor’s degree.

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—increased 0.8 percentage point to 35.8%, slightly above its 12-month trailing average of 35.7%.

- The mean perceived probability of losing one’s job in the next 12 months decreased from 12.5% to 11.1%. The decrease was more pronounced among respondents below the age of 40 and those with less than $50,000 in household income. The mean probability of leaving one’s job voluntarily in the next 12 months also decreased, from 20.0% to 18.9%. The decrease was more pronounced among respondents above the age of 60, those with no more than a high school diploma, and those with more than $100,000 in household income.

- The mean perceived probability of finding a job (if one’s current job was lost) rose to 55.2% from 54.9% in August. Despite the increase, the September reading remains below its pre-pandemic levels.

Household Finance

- The median expected growth in household income remained unchanged at its series high of 3.0% in September.

- The median household spending growth expectations was unchanged at 5.0%, remaining above its 12-month trailing average of 4.3%.

- Perceptions of credit access compared to a year ago were mixed, with fewer respondents finding it easier to obtain credit now than a year ago, but also fewer respondents finding it harder to obtain credit now than a year ago. Similarly, expectations about future credit availability were mixed, with fewer respondents expecting it will be easier or harder to obtain credit in the year ahead.

- The average perceived probability of missing a minimum debt payment over the next three months increased by 0.3 percentage point to 9.9%, but remains just below its 12-month trailing average of 10.1%.

- The median expectation regarding a year-ahead change in taxes (at current income level) decreased by 0.3 percentage point to 4.3%.

- Median year-ahead expected growth in government debt decreased to 14.4%, from 15.1% in August.

- The mean perceived probability that the average interest rate on saving accounts will be higher 12 months from now decreased to 27.3%, from 27.4% in August.

- Perceptions about households’ current financial situations compared to a year ago deteriorated slightly, with more respondents reporting being financially worse off than they were a year ago. In contrast, respondents were more optimistic about their households’ financial situations in the year ahead, with more respondents expecting their financial situation to improve a year from now.

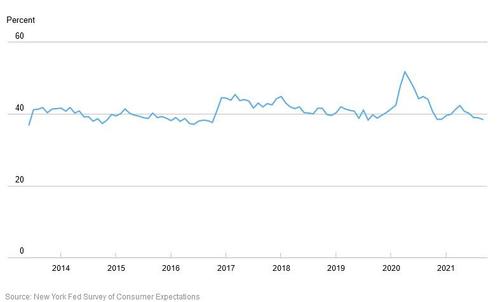

- The mean perceived probability that U.S. stock prices will be higher 12 months from now decreased by 0.5 percentage points to 38.5%.

Finally, one for the market: perhaps sensing that risk-killing stagflation pressures are rising, the mean perceived probability that U.S. stock prices will be higher 12 months from now dropped again to 3.85%, from 39.0%, tied for the lowest in 2021.