Courtesy of ZeroHedge

Another day, another abrupt reversal in stocks which bounced overnight only to slide the moment markets opened for trading, suggesting some latent weakness in technicals. Just how big is this weakness is what bulls want to know.

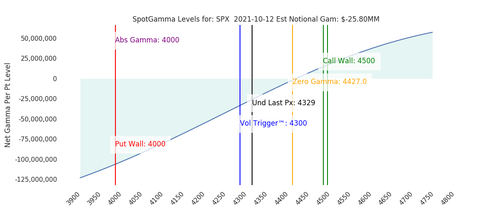

As we discussed earlier this week, with payrolls in the rearview mirror and the next major catalyst not due until the FOMC meeting next month, technicals have taken over and as SpotGamma writes this morning, "a move back to 4400 is just as easy as a move to 4300" but the the key factor for today's trading is waiting for implied volatility (VIX) to tilt and signal market direction (vol down, market up/vol up, market down)."

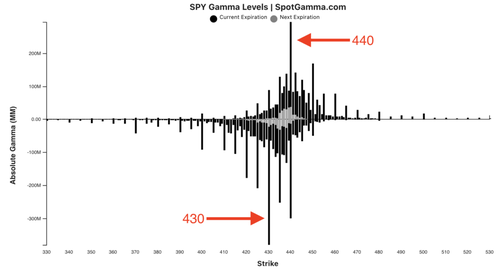

Until that happens, the market remains trapped between and trying to find “fair value” between the large gamma strikes of 4300 & 4400. According to Spotamma, due to the negative gamma position (zero gamma is currently at 4,427) markets are not sticking to one of those strikes (i.e., no +gamma pin close to spot), "and so markets just bounce back and forth between large options strikes." Furthermore, "when the market is dominated by puts things are much more volatile due to more frequent hedging adjustments (puts sensitivity to vol)."

And while stocks seem reluctant to break out into positive gamma territory, which as noted earlier is above 4,427…

… there is substantial downside support at the 4300 area which is a lower bound due to the large put positions below that strike (including the Put Wall at 4,000). Meanwhile, Friday's expiration sees a fairly substantial put interest rolling off, and there is likely to be some tailwind into or from that event; whether we get “into” or “from” will depend on the price action into Friday according to SpotGamma. If markets hold near 4400 then the hedge unwind will be less impactful then if markets hit the 4300 mark.

Either way, as SpotGamma concludes, "the more critical point here is that the markets hedge position will reduced into 10/15 Monthly OPEX which could remove support into end of month. The concern is that if there is still no real bid (ie no reflexive vol shorting), then removal of ~4300 support “matters more”.

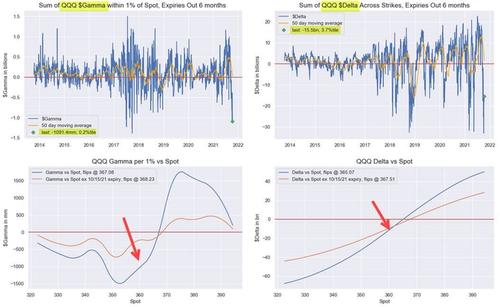

Nomura's Charlie McElligott sees a similar "Greek" dynamic for today's market, and warns that the substantial negative dealer gamma remains an “instability issue” for markets (both ways), as a prerequisite behind the chase-y “crash up, crash down” behaviors of the past few weeks, particularly as implied Vols on the index-level stay remarkably firm despite the various attempted rallies off the lows. His key levels to watch are the following:

- SPX / SPY “Gamma flip” positive above 4405; “Delta flip” positive above 4374

- QQQ “Gamma flip” positive way up at $367.08; “Delta flip” positive above $365.07

- IWM “Gamma flip” positive above $222.67; “Delta flip” positive above $224.75

Charlie also touches on the Friday opex, where he notes that a "significant amount of both the Gamma and Delta will be rolling-off, especially within the “secular growth” QQQ options space as the epicenter of the macro weakness within US Equities on the recent Rates / Inflation repricing."

How is this cross-dynamic affecting flows?

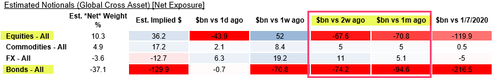

- The flows cannot be understated across systematic strategies in both Bonds and Equities over the past 1m, particularly the strategies which are “synthetic” negative gamma…and thus act as “accelerant flows” into moves

- For example, we estimate that CTA Trend has sold -$70.8B of Global Equities futures over the last 1m (-$67.6B of that over the past two weeks alone), and sold -$94.6B of Global G10 Bonds over the same 1m lookback (-$74.2B over the past two weeks), making the CTA model’s historical Net $Exposure in G10 Bonds just 2.5%ile (“short”) since 2010

But a far more important flow has been emerging from Vol Control funds, whose strategy McElligott estimates has de-allocated -$95.0B in S&P futures alone over the past 1 month (of which -$73.6B coming over the past two weeks), as historically low realized vol “trued up” to crash-y implieds.

It is here that a "big turn" in markets will likely emerge because when he looks ahead, the Nomura quant observes that it will get increasingly difficult for index-level rVol to stay “up here” moving-forward without sustainable 1.5% daily swings, as it will simply “collapse under its own weight”—while “vol softening” will only accelerate “short vol / hedge monetization” behavior, which then would encourage the “virtuous” re-leveraging / re-allocating from the Target Risk / Vol Control space.

In short, vol control selling is may be about to reverse.

Readers can begin to visualize this phenomenon in 1m and 3m rVol beginning to stall and roll shown in the Nomura chart below, which he notes "is the dynamic at the core of the aforementioned slowing of the selling from Vol Control, and the set-up for lagging forward re-allocation in coming weeks, if these “1.2%-1.5% daily changes” turn into “0.0%-0.5%-1.0% daily changes”.

Finally with option expiration on deck, SpotGamma will hold another video chat about the state of the markets. Readers can join them for free live as they talk SOFI, what's going on in the WSB crowd and all things options today at 2:00 PM ET.