Our Money Talk Portfolio has 6 strong trades that are all good for new with huge upside potential!

Our Money Talk Portfolio has 6 strong trades that are all good for new with huge upside potential!

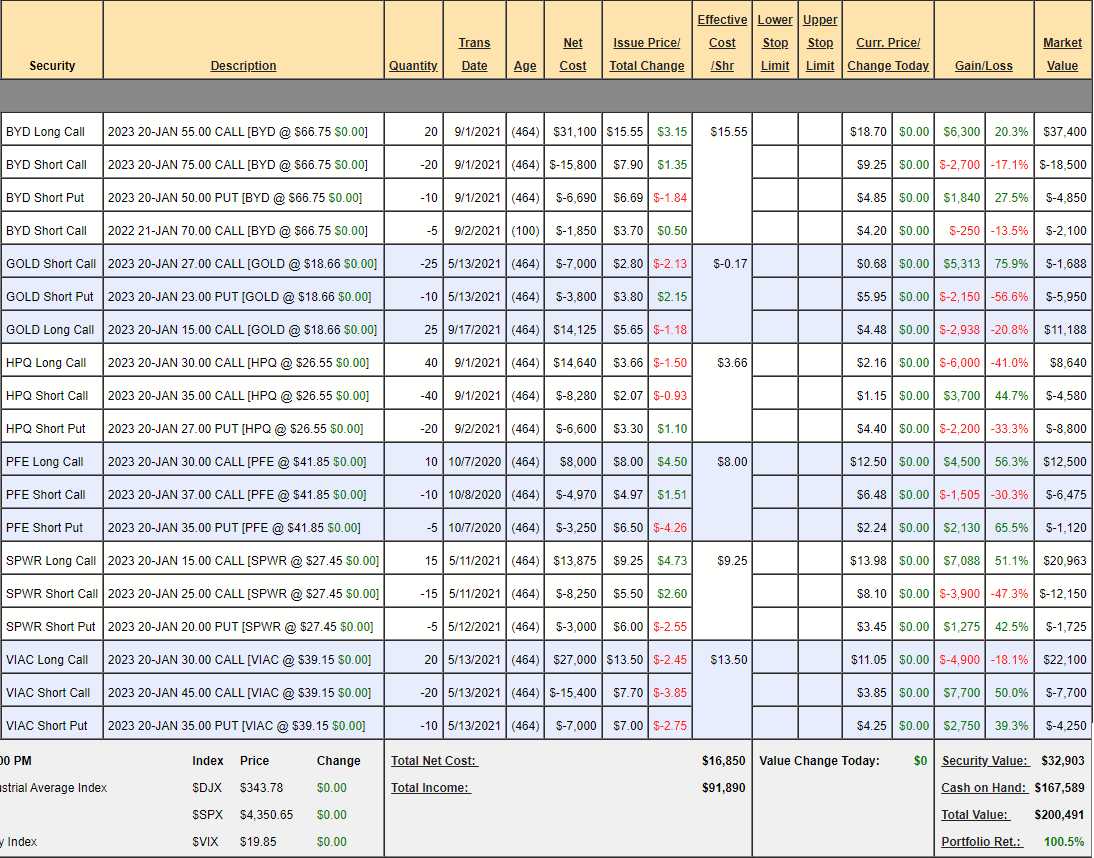

Money Talk Portfolio Review: This one is easy as we can't touch it between shows and I was last on TV on September 1st, when we added BYD and HPQ while cashing out of IBM. At the time, the porfolio was up 95.9% at $195,906 and, at last month's review, we had made no progress at $194,944 but this month we're up 100.5% at $200,491 so congratulations to all who played along at home.

We have $167,589 (83.5%) in CASH!!!, so we're not too worried about the market dropping. I should be on the show again around Thanksgiving, where we'll be picking our 2022 Trade of the Year, which is likely SPWR, which we already have, though T is becoming a contender as it gets cheaper and cheaper.

- BYD - Great gains already as we sold plenty of premium and the stock popped already. It's a $40,000 spread we paid just $6,760 for and it's already at net $11,950 for a $5,190 (76.7%) gain on cash in 6 weeks. There's still $28,050 (234%) left to gain so still good for a new trade and it's designed to make even more money by selling more short calls along the way.

- GOLD - Another potential candidate for stock of next year having slipped back below $20. This is a $30,000 spread at net $3,550 and we may need to buy more time down the road but I'm confident in the target. Earnings are November 4th and we'll be very interested in what they have to say. Upside potential is $26,450 (745%) so great for a new trade.

- HPQ - Another new trade but this one took a bad turn to start. It's a $20,000 spread and currently a net $4,740 credit so the upside potential is $24,750 (522%) from here - very nice if it works out.