Lots of interesting things today.

Lots of interesting things today.

BlackRock (BLK), Delta (DAL), First Republic (FRC), JP Morgan (JPM) and SAP (SAP) all bet their earnings expectations this morning and tomorrow we'll hear from AA, BAC, C, CMC, DPZ, MS, PGR, TSM, USB, UNH, WAFD, WBA and WFC, so a good start to earnings but we'll pay particular attention to guidance that is given. CPI is expected to be at 0.3% this morning pub probably higher and then we have a 30-year note auction at 1pm and that will only matter if it goes poorly – indicating investors are not willing to lend us money below 3% against what is likely 6% inflation.

Fortunately the biggest buyer of notes is the Fed and the Fed will publish the minutes of their last meeting at 2pm and traders will anxiously read the tea leaves to see how long this taper/QE program will continue. It's been a whole lot of nothing since we first tested 4,350 on the S&P 500 in September and we're still there this morning. Congress finally approved lifting the debt cieling but that's hardly news and it's only good for two months – not a lot of impact there.

Looking closely at earnings, Delta is facing fuel inflation pressures and JPM made all their income gains by adjusting their loan loss reserves down by $2.1Bn – overall revenues were flat and income would have been as well, otherwise.

8:30 Update: CPI came in hotter than expected (of course) at 0.4% for the month, running at a 5.4% annualized pace but it's likely to pick up even more into the holidays.

Other than that, there's not much else going on so let's get back to our Portfolio Reviews:

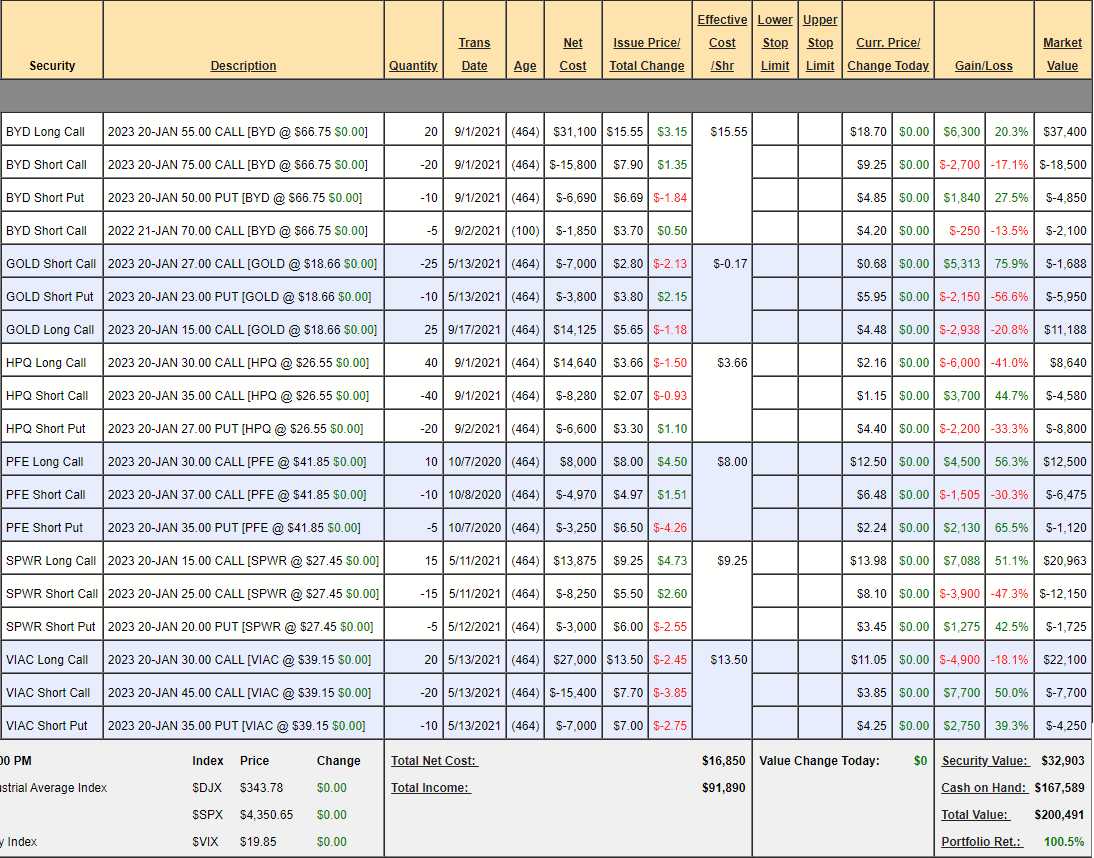

Money Talk Portfolio Review: This one is easy as we can't touch it between shows and I was last on TV on September 1st, when we added BYD and HPQ while cashing out of IBM. At the time, the porfolio was up 95.9% at $195,906 and, at last month's review, we had made no progress at $194,944 but this month we're up 100.5% at $200,491 so congratulations to all who played along at home.

We have $167,589 (83.5%) in CASH!!!, so we're not too worried about the market dropping. I should be on the show again around Thanksgiving, where we'll be picking our 2022 Trade of the Year, which is likely SPWR, which we already have, though T is becoming a contender as it gets cheaper and cheaper.

- BYD – Great gains already as we sold plenty of premium and the stock popped already. It's a $40,000 spread we paid just $6,760 for and it's already at net $11,950 for a $5,190 (76.7%) gain on cash in 6 weeks. There's still $28,050 (234%) left to gain so still good for a new trade and it's designed to make even more money by selling more short calls along the way.

- GOLD – Another potential candidate for stock of next year having slipped back below $20. This is a $30,000 spread at net $3,550 and we may need to buy more time down the road but I'm confident in the target. Earnings are November 4th and we'll be very interested in what they have to say. Upside potential is $26,450 (745%) so great for a new trade.

- HPQ – Another new trade but this one took a bad turn to start. It's a $20,000 spread and currently a net $4,740 credit so the upside potential is $24,750 (522%) from here – very nice if it works out.

- PFE – They had a big pullback but, fortunately, we bought them ages ago for a very good price and set conservative targets so we expect to collect the full $7,000 on this spread, currently net $4,905 so $2,095 (42%) left to gain over the next 16 months.

- SPWR – Should have doubled down on this one! It's a $15,000 spread that's in the money at net $7,088 so all SPWR has to do is not fall below $25 and we make $7,912 (111%). Aren't options fun?

- VIAC – Maybe this will be our Stock of 2022! This portfolio is full of amazing bargains. Here we have a $30,000 spread that's $18,000 in the money at net $10,150 so we have $19,850 (195%) upside potential if VIAC ever wakes up. If they are just going to give money away, you should take it!

Here we have 6 option spreads using very little cash ($32,903) in a portfolio we only adjust live on TV once per quarter and we're already up over 100% and the trades we have open have the potential to make another $109,107 (109%) over the next 16 months.

That means, right now, you could initiate this portfolio for a cash outlay of $32,903 and make $109,107 (331%) if all goes well so, PLEASE, don't tell me there's nothing good to trade!