Earnings are going well so far but it's the half-point drop in the Dollar that's boosting the market.

Earnings are going well so far but it's the half-point drop in the Dollar that's boosting the market.

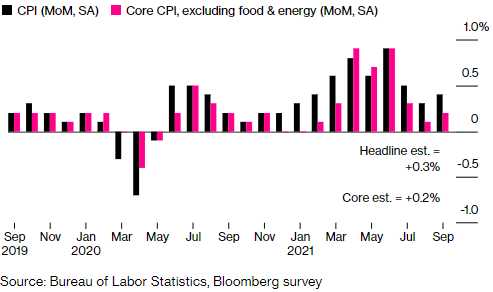

Investors are, so far, pleased about the way companies seem to be handingling inflation, pushing prices along to the consumer and that leads to more profits – even if they only reflect the inflation. PPI came in this morning showing a 0.5% increase in September, giving us an 8.6% rise for the year so far, accelerating from last month's 8.3% pace. The good news is, Fuel is up 11.6% and, to the extent that's not a long-lasting problem, prices should calm down a bit going forward – so the markets are happy today.

We may have reached Peak Pizza as Domino's (DPZ) dropped 3.5% this morning on a revenue miss but United Health (UNH) is up 3% and Walgreens (WBA) is up 2% – that's one we were betting on, of course. Bank of America is up a full 2.5% on a 58% improvement in profits over last year and Morgan Stanley is heading on the same path with a 36% increase in profits.

We will see how the Nasdaq handles the critical 15,000 line this week, the last two attempts were firmly rejected. The fall from 15,600 to 14,600 gave us 200-point bounce lines at 14,800 (weak) and 15,000 (strong) and 14,400 was an overshoot to the downside (same 200 point-zone below 14,600) so what remains to be seen is – are we consolidating for a move back up or back down?

We will see how the Nasdaq handles the critical 15,000 line this week, the last two attempts were firmly rejected. The fall from 15,600 to 14,600 gave us 200-point bounce lines at 14,800 (weak) and 15,000 (strong) and 14,400 was an overshoot to the downside (same 200 point-zone below 14,600) so what remains to be seen is – are we consolidating for a move back up or back down?

Tech earnings come next week, so these moves are just noise while we wait for them. The S&P 500 is doing a similar bounce, having fallen from 4,550 to 4,300 which makes for 50-point bounces to 5,350 (weak) and 5,400 (strong) – so that's another line in the sand to watch this morning. Unfortunately, on the Retail front, 85% of those surveyed expect supply-chain distruptions to hurt holiday sales. That's going to affect on-line sellers as well.

Based on the Fed Minutes yesterday, the taper is definitely coming but it's certainly not dissuading traders this morning. “Participants generally assessed that, provided that the economic recovery remained broadly on track, a gradual tapering process that concluded around the middle of next year would likely be appropriate,” minutes of the Sept. 21-22 Federal Open Market Committee meeting released yesterday said.

“There is a bit of a pivot happening where there is a worry that transitory inflation might be transitioning to concern that it might be structural,” said Michael Pond, head of global inflation market strategy at Barclays. “Even the doves on the committee want to make sure that inflation expectations and financial conditions don’t start to cause alarm.”

The guidance in the September FOMC minutes is clear: the cost of quantitative easing now outweighs the benefits. That means they will very likely look through the weak September jobs report. Taper will be almost certainly announced at the November meeting — and could even begin as early as that month.” — Anna Wong and Andrew Husby

“Most participants saw inflation risks as weighted to the upside because of concerns that supply disruptions and labor shortages might last longer and might have larger or more persistent effects on prices and wages than they currently assumed,” the minutes said.

U.S. consumers are now paying an average of $3.29 a gallon for gasoline, the highest level in seven years, according to the U.S. Energy Information Administration. Steeper energy bills for businesses could increase the pressure to raise prices. “Housing costs, low inventories and rising energy prices will keep inflation higher for longer,” said James Knightley, chief international economist at ING, who now expects consumer inflation to remain above 5% through the first quarter of 2022. He added inflation could prompt the Federal Reserve to act “earlier and swifter” to alter monetary policy to head off inflation.

In September, some 46% of small businesses said they planned to raise prices in the next three months, on net, according to the National Federation of Independent Business, a trade association, the most since monthly records began in 1986. As new car sales slowed for the fifth straight month, the average price for a new vehicle in September soared nearly $4,900 from a year earlier, according to Kelley Blue Book. Falling prices for used cars and airline fares masked the underlying inflationary trend, said Robert Rosener, senior U.S. economist at Morgan Stanley.

A lot of mixed signals, we are still watching and waiting – for clarity.