Johnson & Johnson's (JNJ) Q3 sales were up 11% at $23.34Bn but earnings were only up 3% so IT'S TIME TO RAISE PRICES! That's right, why should JNJ suffer through inflation when they can make their custormers suffer instead? And, speaking of suffering, although they have been sued because their talc-based products seem to have been (allegedly) causing cancer all these years – it won't affect the company because they formed a new company that has no assets and assigned them all talc-related liabilities. Yes, you can do that when you are a corporation (and when the courts are packed with Conservative judges who are sympathic only to the Top 1%).

.Clever moves like that have taken JNJ to new all-time highs recently, topping out at almost $500Bn (now $421Bn at $160) last month on the heels of revenues that have been driven by their lesser-desired Covid shot (8% market share), which will still drive profits this year and next but then they will go back to being a consumer products company who also make medical devices that are featured in many lawsuits – so I'm not sure I think I'd want them for the long-term at these prices.

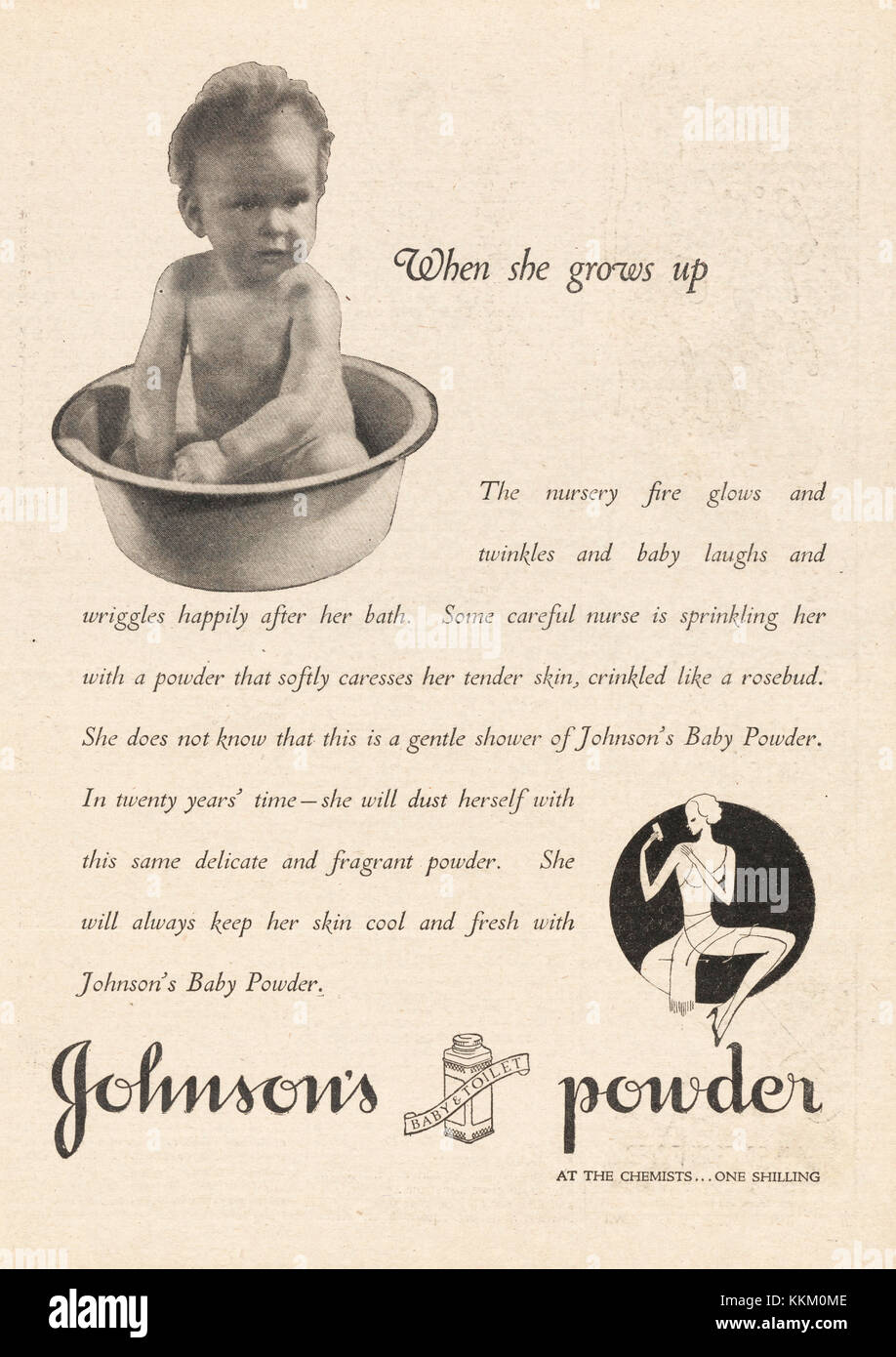

That's from 1973!

Fortunately, JNJ has discontinued their baby powder (rather than just take out the asbestos?) as of last year but Reuters claimed they knew way aback in 1972 that there were high levels of asbestos in lab tests. They were sued in 1999 but the plaintiffs couldn't seem to get access to the records they needed, so they were forced to drop the case but, 20 years later – the evidence turned up and the suit was back on. During those 20 years, the documents also depict successful efforts to influence U.S. regulators’ plans to limit asbestos in cosmetic talc products and scientific research on the health effects of talc.

The earliest mentions of tainted J&J talc that Reuters found come from 1957 and 1958 reports by a consulting lab. They describe contaminants in talc from J&J’s Italian supplier as fibrous and “acicular,” or needle-like, tremolite. That’s one of the six minerals that in their naturally occurring fibrous form are classified as asbestos. At various times from then into the early 2000s, reports by scientists at J&J, outside labs and J&J’s supplier yielded similar findings.

Still, this is all LTL Management's problem now as, during the current lawsuit, the company was formed and purchases all of JNJ's talc-related assets and liabilities and then, mysteriously, decided to stop making talc (despite insisting how safe and effective it is), so now they just have the liabilities and, finally realizing that's not likely to be a good business model – have decided to declare bankruptcy – a move that could stall any talcum powder settlements for the thousands of families that have sued the company for Billions of dollars in damages in recent years.

Linda Lipsen, one of the lawyers representing women with cancer claims, called Johnson & Johnson's move "an unconscionable abuse of the legal system."

"There are countless Americans suffering from cancer, or mourning the death of a loved one, because of the toxic baby powder that Johnson & Johnson put on the market that has made it one of the most profitable pharmaceutical corporations in the world," Lipsen said in a statement. "Their conduct and now bankruptcy gimmick is as despicable as it is brazen."

Like JNJ, Proctor & Gamble (PG) also had increased earnings due largely to increased prices, with revenue up 5% to $20.3Bn. The company expects to spend $2.1Bn on higher commodity costs and $200M on higher freight costs for the year but that's nicely offset by the $4Bn prices increase they "passed along" to consumers.

Evergrande is still a thing in China but it's a slow drip as they only default as the next note comes due so it will take a long time for a good chunk of their $300Bn in debt to default overall. It's too early to call anything in the US a crisis but September Housing Starts were down 1.6% and Building Permits were even worse – down 7.7% and even housing completions were down 4.6% but nothing to worry about yet – as there's no sign of a trend.

Tomorrw we get the Beige Book and we'll see what the friends of the Fed think about the state of the economy.