We're shorting the S&P (at 4,512 avg so far) ahead of the GDP Report next Thursday..

We're shorting the S&P (at 4,512 avg so far) ahead of the GDP Report next Thursday..

As noted yesterday, the Fed's estimates for Q3 GDP have come down from 6.25% in July to 0.5% as of last week yet the consensus among leading Economorons is still for a 3.75% gain and those are the guys who are yapping on TV and writing the articles you read in the MSM – you know, idiots…

Part of the discrepancy is, of course, laziness. 3.75% is the average of the Top 10 and Bottom 10 forecasts in the GDPNow Survey and a lot of people still in the Top 10 simply haven't revised their opinion since July, failing to follow the advice of John Maynard Keynes, who said: "When the Facts Change, I Change My Mind. What Do You Do, Sir?"

Facts have definitely changed in the past 3 months as inflation has spiked, Covid has resurged, shipping has backed up, disrupting supply chains, labor is in short supply and we're even flat out failing to deliver some commodities, causing spikes in Natural Gas, Gasoline, Copper, Uranium… In short – it's a mess!

BILLIONAIRES ARE LEAVING THE PLANET, yet we thing everything is fine? China is certainly not fine as Dollar-bond defaults from Chinese property developers are rising quickly as the country’s housing market slumps, and the problem could worsen as a wave of debt from the beleaguered industry comes due in the coming months. Real-estate developers dominate China’s international high-yield bond market, making up about 80% of its total $197 billion of debt outstanding, according to Goldman Sachs.

BILLIONAIRES ARE LEAVING THE PLANET, yet we thing everything is fine? China is certainly not fine as Dollar-bond defaults from Chinese property developers are rising quickly as the country’s housing market slumps, and the problem could worsen as a wave of debt from the beleaguered industry comes due in the coming months. Real-estate developers dominate China’s international high-yield bond market, making up about 80% of its total $197 billion of debt outstanding, according to Goldman Sachs.

Since Evergrande and Fantasia defaulted on payments earlier this month, at least four other Chinese developers have either defaulted or asked investors to wait longer for repayment. A 30-day grace period for Evergrande to pay international bondholders, meanwhile, runs out this weekend, and investors are expecting the company to default on close to $20 billion in outstanding dollar debt.

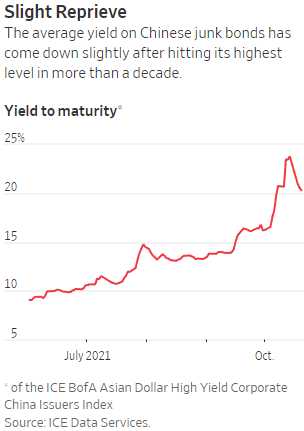

That is just a drop in the bucket as Evergrande alone is over $300Bn in debt and, if they want to borrow more – 20% is the going rate. Does that sound sustainable to you? The extreme market dislocation raises the risk of a vicious cycle, in which companies can’t refinance coming debts because borrowing costs are too high, leading to more defaults and further hits to investors’ and home buyers’ confidence.

Even if you are dumb enough to put down a deposit on an Evergrande development project – will you be able to find a bank dumb enough to lend you the rest? Kill the cash flow and you kill the developer – it's inevitable at this point. China Properties Group Ltd. defaulted on $226M in three-year notes that matured on Oct. 15. And on Tuesday, S&P Global Ratings downgraded Sinic Holdings (Group) Co. to a “selective default” rating, after the Shanghai-headquartered company failed to repay $250M of bonds that came due a day earlier.

And keep in mind that's $526M of losses for someone – money removed from the economy as it was scheduled to be returned to the investors at this point and it's already been spent – so it's a pure negative to the current GDP. Most developers are just skipping debt payments at the moment to preserve cash since it will be difficult to refinance upcoming maturities in the international bond markets if yields remain elevated. The refinancing pressure is likely to intensify, with more than $6 billion of dollar debt maturing in January. At the same time, sales are down 20-30% for developers.

And keep in mind that's $526M of losses for someone – money removed from the economy as it was scheduled to be returned to the investors at this point and it's already been spent – so it's a pure negative to the current GDP. Most developers are just skipping debt payments at the moment to preserve cash since it will be difficult to refinance upcoming maturities in the international bond markets if yields remain elevated. The refinancing pressure is likely to intensify, with more than $6 billion of dollar debt maturing in January. At the same time, sales are down 20-30% for developers.

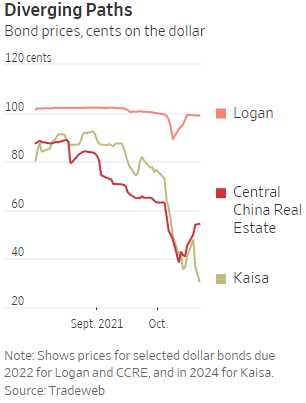

Even China's strongers developers, like Logan are getting pulled down while mid-ranger players like Kaisa and Central China are collapsing – even before they have actually had an incident. “Investors are not looking for bargains yet because the selloff has become pretty damaging,” said AXA’s Mr. Veneau. “There’s probably more of a mind-set of assessing the damage.”

We've been getting horrific housing data all this week and, like China (and most countries) Real Estate tends to drive our economy, so it's getting very hard to believe these issues won't spill over into our economy – especially as Congress can't even pass a paired-down version of the stimulus package. What did we have in Q1 and Q2 that we didn't have in Q3 – $1.2Tn in stimulus! $1.2Tn is 12% of our first half GDP – no wonder it LOOKED like it grew 6% per quarter!

So the main reason the GDP expectations are down 6% is that we did not pass another 6% stimulus for the quarter – isn't math easy? That means 12% of our GDP is fake, Fake, FAKE!!! and that means 12% of the market's forward expectations are likely to be disappointed too. We just got the Philly Fed Report this morning and that's down to 23.8 from 30.7 last month. Slowing economy, rising inflation…

TSLA and IBM are taking hits this mornning but HPQ, which was featured as a Top Trade Alert on July 28th and again on October 13th (it was still cheap) just reported nice earnings and guidance and is back over $30 – congrats to all who played along on that one!

As we were discussing in yesterday's Live Trading Webinar, value investing requires both conviction and patience – something most traders have little of and, if you learn to play it correctly – it gives you a tremendous advantage in the market. That's an advantage we are able to capitalize on with our option selling techniques – selling premium to all the impatient investors that lack conviction!

That recent Top Trade Alert featured 6 trade ideas from our Future is Now Portfolio that are using $32,903 in cash to make up to $109,107 (331%) over the next 16 months – HPQ is one of those trades so don't tell me there are no bargains to be had in this market – you don't have to chase after overpriced BS to make excellent returns.