Everything is up.

Everything is up.

Oil is at $85 this morning but no one considers anything a crisis. Solar Wind is back, hacking more tech companies, Evergrande is still a problem in China, the Fed is likely to begin tapering at the next meeting, there's still no stimulus package and still 1,509 people died of Covid yesterday with 72,644 infected – essentially ever single person at a football stadium. What, us worry?

That's as many people infected in the US in a single day as China has had TOTAL (109,203) and they shut down their whole country over it. The US is banking on herd immunity to keep us relatively protected and that means everyone gets the disease eventually and we see who survives.

The vaccines keep your infection mild or give you an immune response without getting infected at all and, at this point, almost 200M of us are fully vaccinated and 220M of us have had at least 1 shot and 110M of us are not vaccinated at all and pretty much have no intention of getting vaccinated so, for God's sake, take your booster shots because 1 out of 3 people you come in contact with have ingored their saftey and you own and 2M of them (2%) have gotten Covid this month so, at any given time – 1 in 50 of them are actively infected.

This disease is never going to go away if 1 in 50 people at any given time are actively infected. Covid isn't a "one and done" disease – people get re-infected so, while you may personally be doing whatever you can not to get infected – 1/3 of the people living in this country are incubating the disease and future mutations to keep challenging us down the road.

This seems like an insane plot to an outrageous science-fiction movie but this is our real lives in America 2020. We are tied with El Salvadore and Turkey in the vaccination rate of our people. Sri Lanka, Fiji, Ecuador, Mongolia, Turkmenistan – even Brazil is doing better than we are – along with 100 other countries who are ouperforming our efforts.

This seems like an insane plot to an outrageous science-fiction movie but this is our real lives in America 2020. We are tied with El Salvadore and Turkey in the vaccination rate of our people. Sri Lanka, Fiji, Ecuador, Mongolia, Turkmenistan – even Brazil is doing better than we are – along with 100 other countries who are ouperforming our efforts.

This SHOULD matter to investors because getting rid of the virus is critical to future growth prospects but it's really not even facored in to the thinking of the average investor – there's just this assumption it will go away – even if we do nothing about it.

China Expects New Covid Outbreak to Worsen in Coming Days.

Endemic Covid-19 Has Arrived in Portugal. This Is What It Looks Like.

Millions of Workers Stay Home to Watch Young Children as Daycares Stay Dark

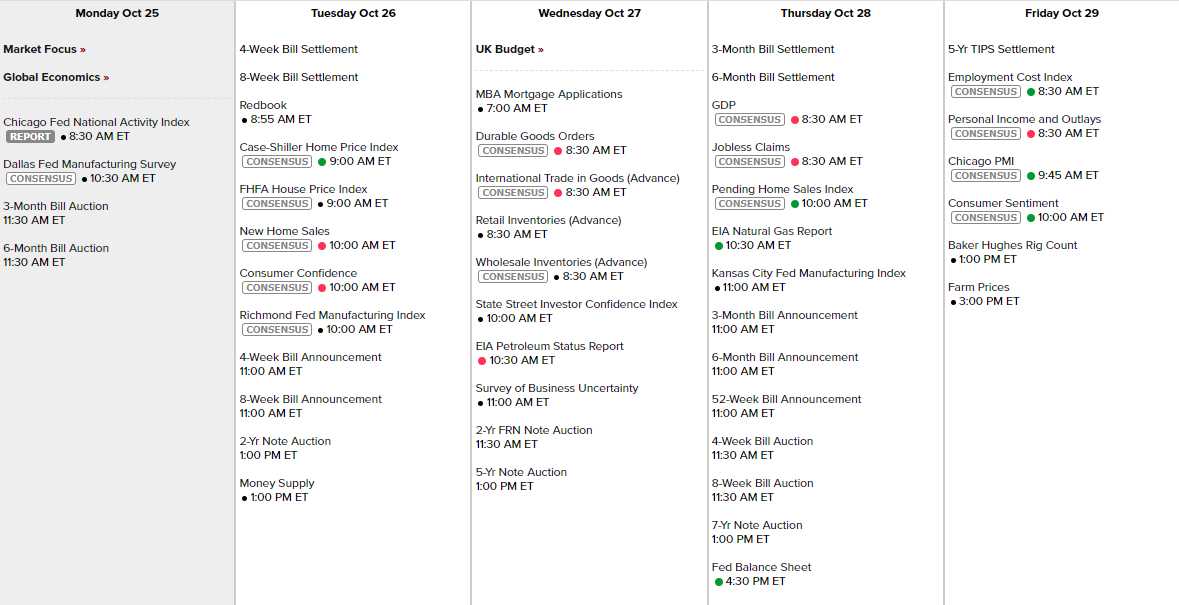

On the calendar front, we're ending October with a bang as we have our GDP Report on Thursday but, before that, we have this morning's Chicago Fed and Dallas Fed Reports. The Richmond Fed reports tomorrow along wityh Housing Data and Consumer Confidence. Wednesday we have Durable Goods, which lost a lot of momentum in August and we also get Investor Confidence and Business Uncertainty. Thursday is all about GDP but there's alos the KC Fed and Friday is Chicage PMI, Personal Income/Outlays and Consumer Sentiment – a very heavy data week:

There are many signs the Global Economy is slowing down and we still have a shipping crisis in the US that is getting worse each day. "The ports shutting down is worse than Lehman Brothers failing. Both can lead to catastrophic failures of all counterparties depending on them. But with Lehman, the government could just print tons of money to flood the banks with liquidity," Ryan Petersen, chief executive officer of logistics company Flexport, warned Friday after touring logjammed U.S. West Coast ports.

He said the twin ports have hundreds of cranes but only "seven were even operating and those that were seemed to be going pretty slow." He said the bottleneck that everyone now agrees on is "yard space" and that "terminals are simply overflowing with containers, which means they no longer have space to take in new containers either from ships or land. It's a true traffic jam."

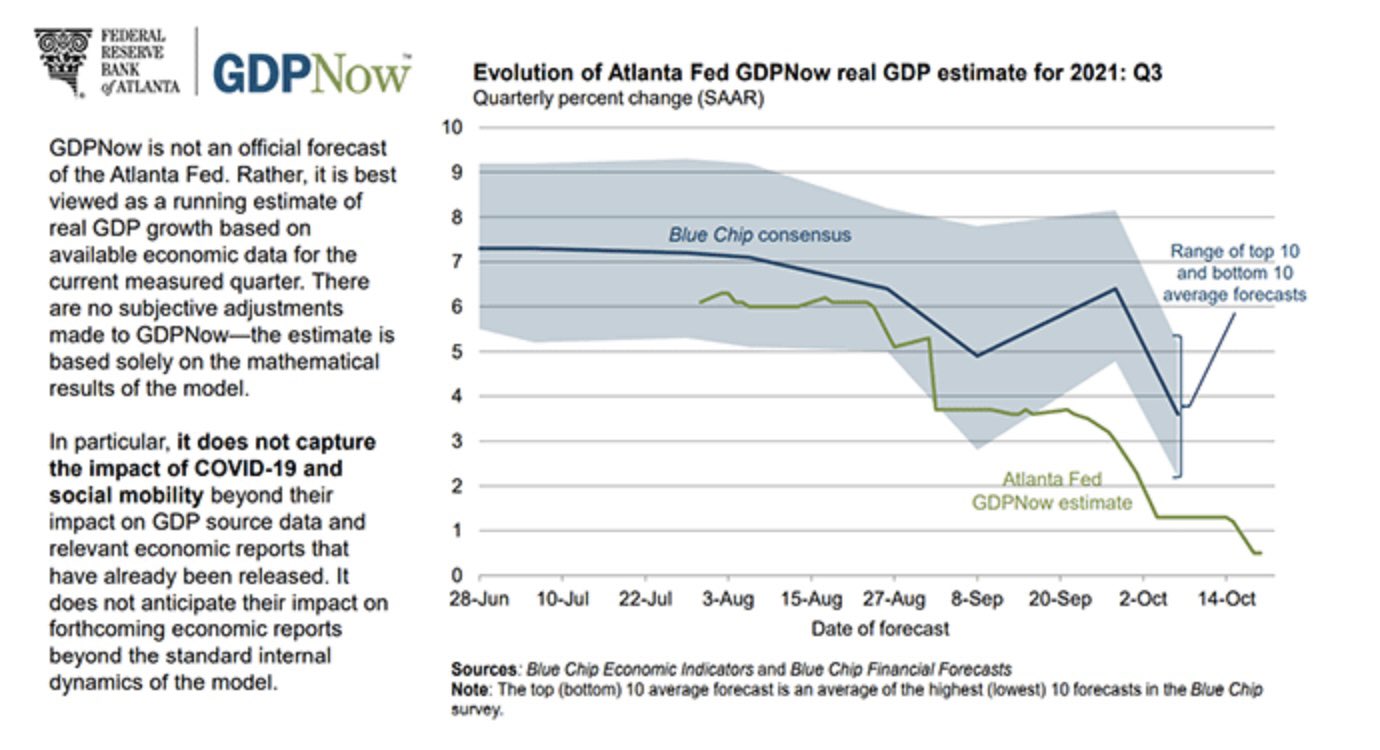

Roughly 20% into earnings season, 2/3 of the forward forecasts have missed previous guidance. The pace picks up this week with about 1/3 of the S&P 500 reporting but that trend will have to break for this maket to hit new highs – along with better than 3% GDP growth that's not looking likely at the moment: