- Salesforce (CRM +0.1%) will make Rocket Mortgage's (RKT +3.0%) mortgage origination technology available to banks, credit unions and other financial institutions through Salesforce Financial Services Cloud.

- The move is intended to increase Rocket's (NYSE:RKT) market share in the U.S. Of the 5,000 FDIC-insured banks and more than 5,000 credit unions in the U.S., "most have disparate partners and technology vendors that handle home loans for them," the company said.

- "This will be the first time a home lender will provide an end-to-end 'mortgage-as-a-service' solution through Salesforce Financial Services Cloud – a platform that thousands of financial institutions already heavily rely on," said Rocket Companies (RKT) Vice Chairman and CEO Jay Farner.

- The partnership builds on Rocket's (RKT) existing relationship as a Salesforce customer.

- In August, Rocket (RKT) stock surged after Q3 guidance, CFRA upgrade.

That's a pretty good model for RKT and they are reasonably priced, I think (hard to tell as they are pretty new to profits).

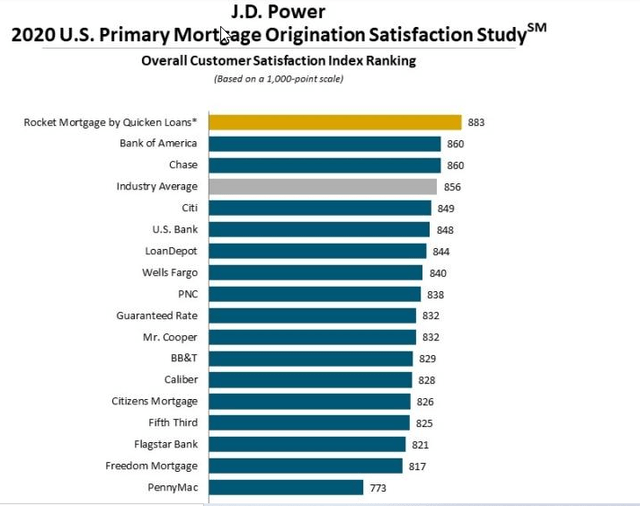

That's a good statistic to build on.

What's keeping them down is a class action lawsuit from the shareholders who bought in the spike:

These are usually BS but you do have to be careful with them.

Still, that's a great catalyst and it's a $16.13 stock so how about we promise to buy 1,000 shares in the Future is Now Portfolio and build this spread:

- Sell 10 RKT 2024 $15 puts for $4 ($4,000)

- Buy 25 RKT 2024 $13 calls for $6.25 ($15,625)

- Sell 25 RKT 2024 $20 calls for $3.50 ($8,750)

That's net $2,875 on the $17,500 spread so that's a nice $14,625 (508%) upside potential at $20 or more and anything over $15 is in profits.