Jerome Powell came out if his hole and saw no inflation, so now we have 6 more months of 0% interest rates (at least) for the Banksters. The markets loved Powell sticking to his story that the inflation that is obvious to every sentient being on this planet is only "transitory" and will go away when the virus goes away so yeah, viruses cause inflation, not the Fed – that's the ticket….

As noted by the NY Times:

"Powell repeated his longstanding belief that high inflation was mostly caused by disruptions in global supply networks and other ripple effects of the pandemic — problems that the Fed can’t do much about.

"On interest rates, Mr. Powell rejected the thinking of leaders at several other leading central banks and of a handful of his own colleagues. They think that excess demand in the economy is a big part of the inflation problem and that rate increases would help address it — and that current high inflation could become ingrained in economic decision-making, with long-lasting consequences."

It is a delicate moment. President Biden must decide whether to reappoint Mr. Powell to a second term leading the Fed. High inflation is causing economic discontent for Americans, according to surveys, and helping to drag down the president’s approval ratings. Global bond markets have been gyrating amid uncertainty about whether the era of ultralow interest rates may be coming to an end.

It is a delicate moment. President Biden must decide whether to reappoint Mr. Powell to a second term leading the Fed. High inflation is causing economic discontent for Americans, according to surveys, and helping to drag down the president’s approval ratings. Global bond markets have been gyrating amid uncertainty about whether the era of ultralow interest rates may be coming to an end.

The Bank of Canada, the Reserve Bank of Australia and the Bank of England have all indicated they will be raising rates and several Eastern European Central Banks have already raised rates, with Poland moving to 0.75% on Wednesday – 3 TIMES the rate offered by the Fed.

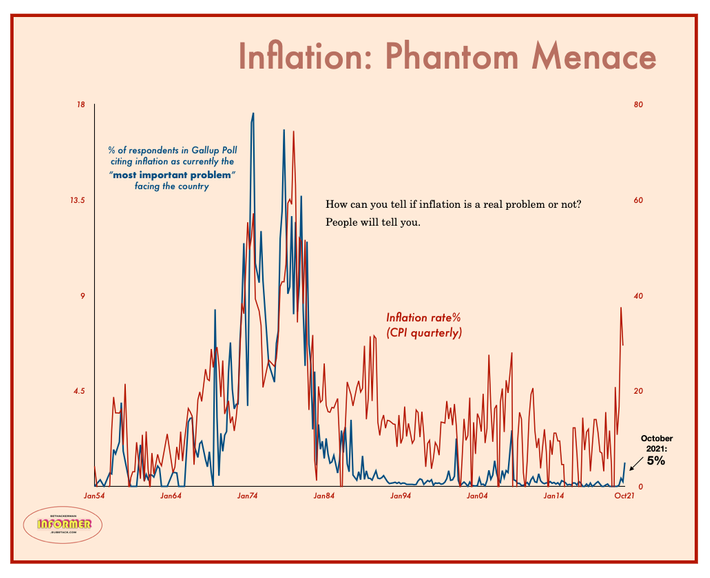

Here's an interesting chart from NY Mag which shows the correlation between inflation and concerns about inflation and you'll notice that, unusually, the people are way behind the curve in worrying about inflation, which is unusual. Now Powell is a people so you could say he's in that crowd but more likely its the endless media messaging from people like Powell that is causing the rest of the people to believe that this is some sort of persistent illusion that will vanish in the spring. If not, then those people are investing in all the wrong places, arent they?

That's putting Barrick Gold (GOLD) back in contention for our Trade of the Year for 2022 because it's a very good company that's making $2.2Bn/year with gold around $1,750 yet, at $18.62, the market cap of GOLD is just $33Bn so you are only paying 15 times earnings for them but, as a bonus, Barrick also has 68M ounces of proven gold reserves worth $119Bn. It's hardly worth mentioning their $10Bn worth of copper…

Of course, there's a cost to extract the gold and that's about $1,250 per ounce so those 68M ounces actually represent $34Bn in potential profits (at $1,750) but, if gold goes to $2,000 per ounce, the potential profits jump to $51Bn. It could go down as well if Powell is right and inflation is an illusion but I think Barrick is a great stock to hold for the long-term in any case.

We already have GOLD in our Member Portfolios and our May trade idea in our Money Talk Portfolio is even better than our entry was at the time:

| GOLD Short Call | 2023 20-JAN 27.00 CALL [GOLD @ $18.62 $0.00] | -25 | 5/13/2021 | (442) | $-7,000 | $2.80 | $-2.04 | $-0.17 | $0.77 | $0.00 | $5,088 | 72.7% | $-1,913 | ||

| GOLD Short Put | 2023 20-JAN 23.00 PUT [GOLD @ $18.62 $0.00] | -10 | 5/13/2021 | (442) | $-3,800 | $3.80 | $2.08 | $5.88 | $0.00 | $-2,075 | -54.6% | $-5,875 | |||

| GOLD Long Call | 2023 20-JAN 15.00 CALL [GOLD @ $18.62 $0.00] | 25 | 9/17/2021 | (442) | $14,125 | $5.65 | $-1.35 | $4.30 | $0.00 | $-3,375 | -23.9% | $10,750 |

The current net is $2,962 on the $30,000 spread so the upside potential is $27,038 (912%) if GOLD is over $27 at the end of next year. Even at $18.62, this trade is $9,050 in the money to start (but we would owe $4,380 on the short puts at this price) – aren't options fun? Stil, we can be more conservative with a new trade using the 2024 options as such:

- Sell 10 GOLD 2024 $20 puts for $4.50 ($4,500)

- Buy 30 GOLD 2024 $15 calls for $5 ($15,000)

- Sell 30 GOLD 2024 $20 calls for $3 ($9,000)

That's net $1,500 on the $15,000 spread so we have $13,500 (900%) upside potential if GOLD gains less than 10% over 2 years. The trade is starting out $10,860 in the money and we would owe $1,380 for the short puts at the current price. The risk on the trade is that GOLD finishes below our break-even at about $16.50 and we are assigned 1,000 shares of GOLD at $20 ($20,000), which is more than the current price.

Of course, should that happen we would then sell 2026 $15 calls for maybe $3 and $15 puts for at least $3 and our net would be down to $14 and, since I'd love to own 2,000 shares of GOLD at $14 ($28,000), I have no fear of the assignment which makes this a fairly bullet-proof trade.

Still, it it good enough to be our Trade of the Year for 2022? Probably not because we don't see that obvious catalyst with the timing that will return at least 300% over the course of the year. Powell MIGHT be right and inflation MIGHT be transitory and gold may fall back in price and GOLD will make less money (but I'd still like them for the long-term). We prefer our Trade of the Year ideas to be more certain than that – even though I'm 90% certain Powell is a fool (or maybe just lying to us).

Either way, I love this hedge against inflation.

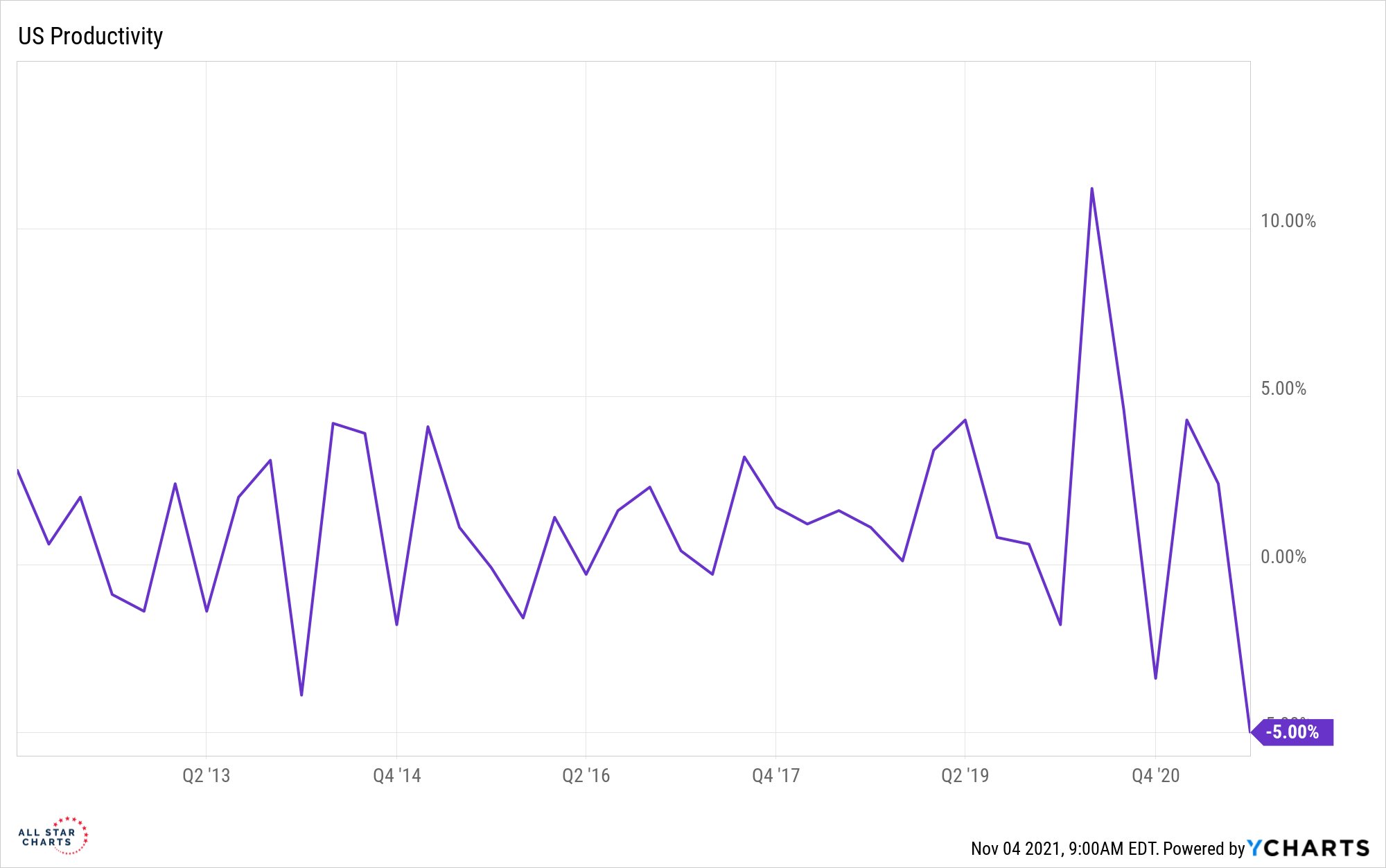

Oh look, the Productivity Report is out:

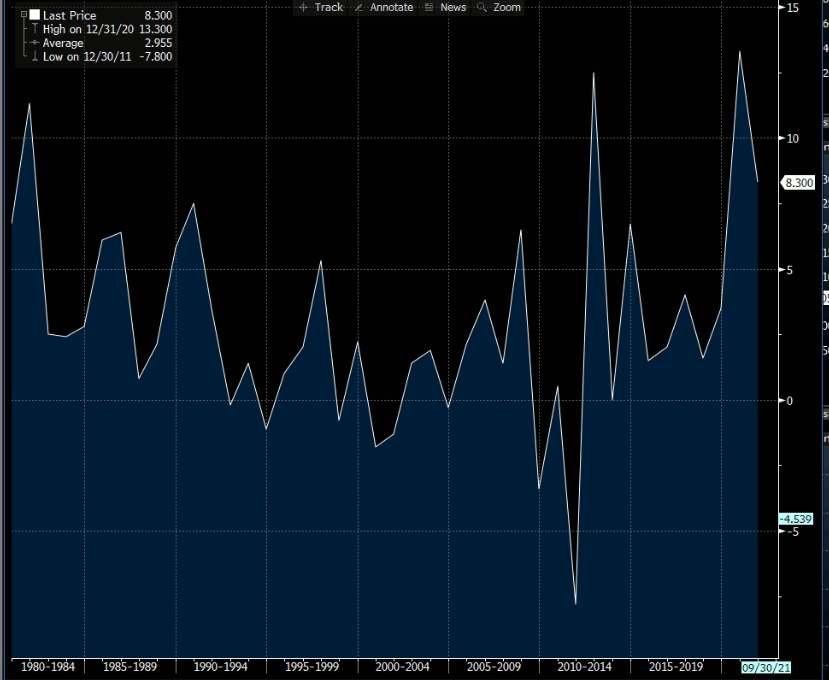

-5%? Oopsie! Well at least Unit Labor Costs must be easing so inflation will soon be under control, right?

+8.3%? Oopsie again! And last month was revised up from -1.3% to +1.1%. So labor costs are rising and productivity is slowing and the markets are at record highs because… IT JUST DOESN'T MATTER!