It's fun to ignore reality.

It's fun to ignore reality.

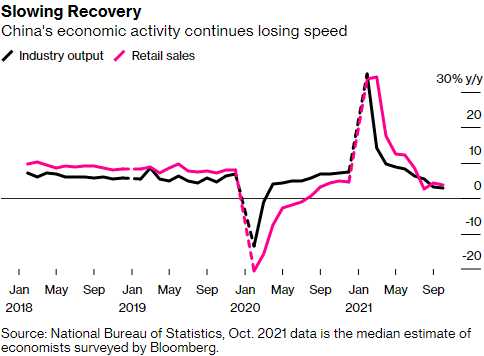

Or to imagine that the World is more fun than it is with less Covid and less Global Warming and less Inflation and better GDPs, etc. Reality, however, can be a harsh mistress and ignorning reality can be harsher still – eventually. But not this morning as our indexes are back around their record highs – even as China's Industrial Production coming in at 3% – the worst since Q2 of 2020 while their PMI is also collapsing – worst since February of 2020 – when the country was first shut down.

An energy crunch over September and October coupled with elevated cost pressures is squeezing Corporate Profits and hitting Factory Output in the World's 2nd-largest economy, yet over here we act like nothing that happens in China could possibly affect the US markets or our economy.

Falling real-estate prices and credit-market turmoil for heavily indebted developers means fixed asset investment in the first 10 months of the year is expected to have slowed to 6.2% from 7.3% previously. Chinese economists warn that the downturn in real estate — which accounts for up to 25% of output — could hurt the wider recovery. Goldman Sachs (GS) and others warn China could see sub-5% growth next year.

Falling real-estate prices and credit-market turmoil for heavily indebted developers means fixed asset investment in the first 10 months of the year is expected to have slowed to 6.2% from 7.3% previously. Chinese economists warn that the downturn in real estate — which accounts for up to 25% of output — could hurt the wider recovery. Goldman Sachs (GS) and others warn China could see sub-5% growth next year.

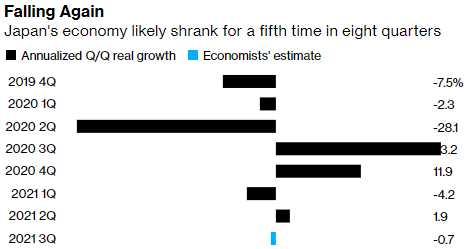

Japan releases figures on Monday that are expected to show the recovery of the world’s third-largest economy slipping into reverse after hitting a summer virus wave and global supply-side glitches. A particularly bad result could fuel even more stimulus from Prime Minister Fumio Kishida later in the week, when he decides on a package of economic measures. Trade and inflation numbers also come out from Japan this week.

JAPAN GDP DETAILS:

- Private consumption fell at an annualized pace of 4.5% from the previous quarter

- Capital spending dropped 14.4%

- Government spending rose 4.7%

- Exports fell 8.3%, but a bigger fall in imports meant trade added fractionally to growth overall

The economy has now shrunk in five of the past eight quarters. Excluding the pandemic lows, real GDP is now at its smallest size since late 2014.

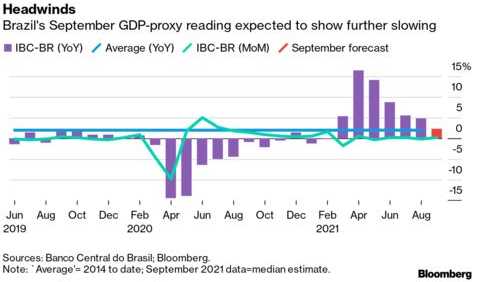

The World's 8th-largest economy is also declining rapidly – something else to ignore:

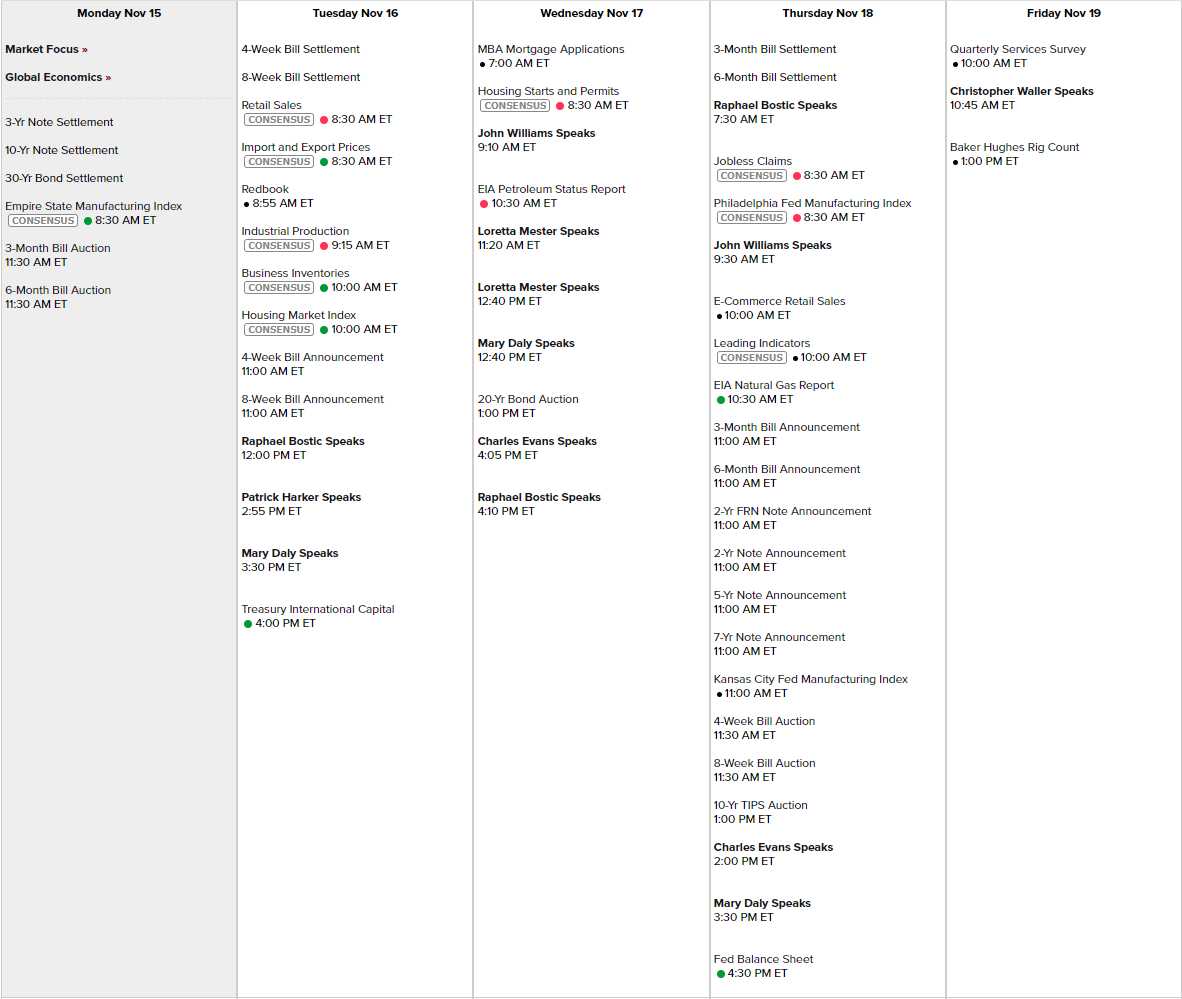

Retail sales are the headline for U.S. economic data releases in the coming week. Economists project a solid advance in the value of purchases in October, indicating a stronger pace of household spending after a soft third quarter. The week’s reports also include data on industrial production and housing starts in October, and readings on November manufacturing activity in several Federal Reserve districts. By Thanksgiving (a week from Thursday), we should also know if Powell is going to keep his job or not.

I'm betting not since Warren has been quiet recently and Biden is getting killed in the polls, mostly over the inflation that Powell refuses to see but bringing in a Fed Chair who raises rates, heedless of the dangers that that may bring – is also a recipe for disaster. We have 14 Fed speaches this week while we mull that over:

So yes, we are going to short the S&P Futures (/ES) at 4,700 again as all this pre-market joy may reverse once volume comes in at the open. There's no reason to be this giddy and over 80% of the S&P 500 have already reported their earnings – so the boosts won't be coming from there either. There are still many, many earnings reports coming in, however:

Here's a little wrap-up of the weekend news:

Wall Street Reaches Record Highs As Main Street Sentiment Hits 11-Year-Lows

China’s Slowdown Poses Threat for Global Recovery: Eco Week

COP26 Finally Set Rules on Carbon Markets. What Does It Mean?

Deal Sealed After Late Pushback by India and China: COP26 Update.

Ships Keep Coming, Pushing U.S. Port Logjam and Waits to Records

Clock Just Hours From Midnight For Overwhelmed California Ports

Workers quit jobs in record numbers as consumer sentiment hits 10-year low

A Record 4.4 Million Americans Quit Their Jobs in September

U.S. Strikes Show Workers Are ‘Fed Up,’ Labor Leader Says

More Bad News For Biden As Real Wages Plunge

US Food Banks Struggle To Feed Hungry Amid 'Perfect Storm' Of Food Inflation

Putin Masses Troops to Tell NATO to Stay Out of Ukraine

China’s Wildlife Is a Pandemic ‘Waiting to Happen,’ Study Finds

Big Short’s Michael Burry Calls Out the SEC and Fed Over Market Risks

This chart could force bubble doubters to rethink matters

Chief Strategist: Markets Are About To Be Hit With Three Shocks

Cracks Appear in World’s Biggest Bond Market as Fed Pulls Back.

Charting Global Economy: Inflation Shows Few Signs of Cooling

Summers Signals Inflation Now ‘Entrenching’ as Demand Runs Hot

Consumer Anger About Inflation Can Make a 1970s Rerun Real

Oil Was Almost $150 the Last Time U.S. Gasoline Cost This Much

Returning Renters Find Crazy Post-Covid Leasing Market.

"Its Entirely Feasible That Herd Immunity Has Been Reached In The Current Environment"

Austria "Just Days Away" From Unleashing Lockdown On The "Shameful" Unvaccinated

5 infrastructure stocks to buy now that Biden’s bill has been passed, according to Jefferies.

Opinion: 10 recommended stocks if you think value will beat growth as inflation surges.