$2,274,065!

$2,274,065!

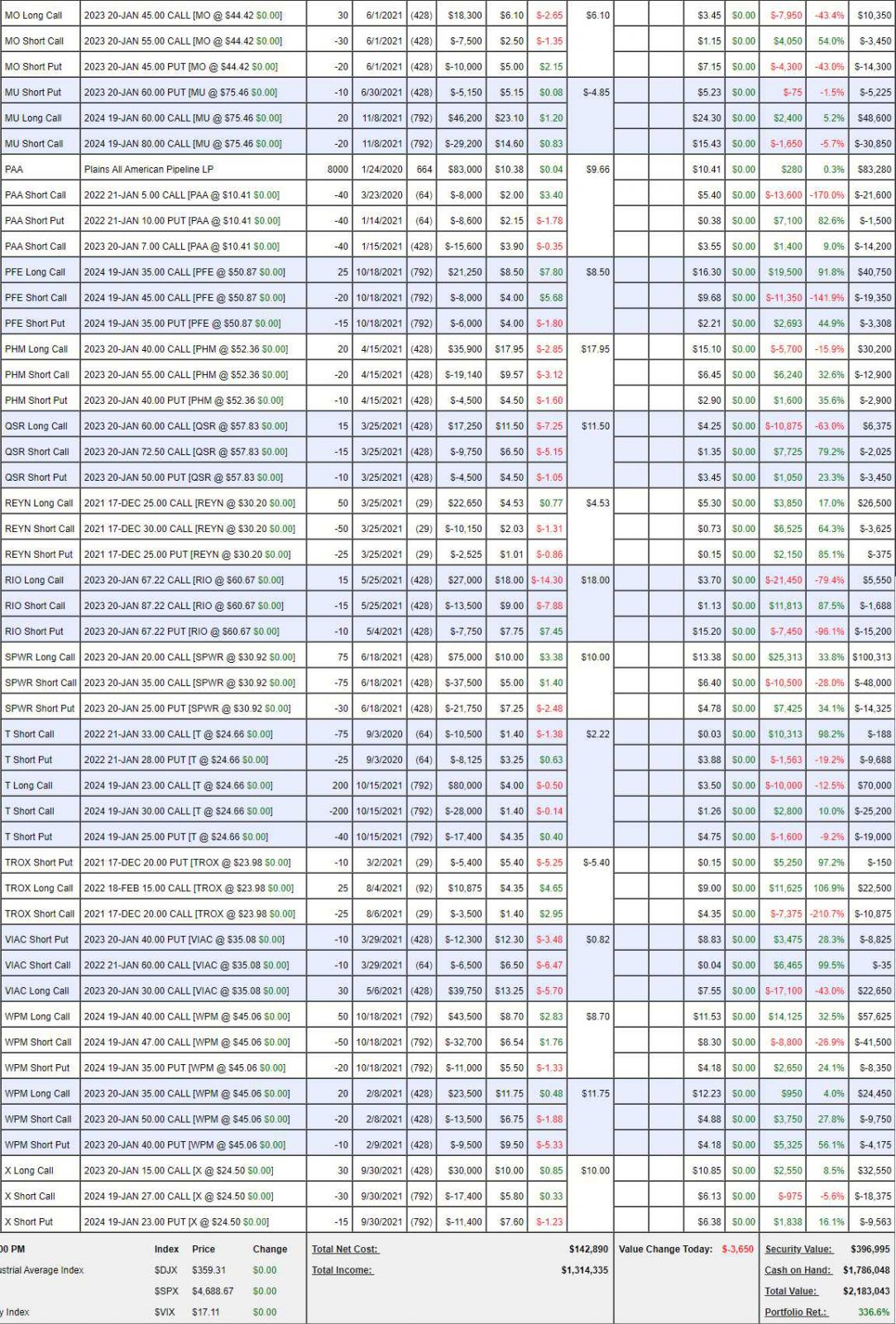

That's up $39,533 for our paired portfolios (LTP and STP) since our October 15th Review and that's great considering $1,942,247 of it is in CASH!!! We are VERY flexible as we wait for the pullback that never comes but, while we're waiting, we find some ways to put our unused trading power to good use.

On Tuesday, we bumped up our hedges (it's been a bad month for hedges as the indexes went back to their highs) in our Short-Term Portfolio (STP) but we also added several new positions to the Long-Term Portfolio (LTP) which should more than pay for any losses we take – should those hedges fail to pay off.

The ideal situation is when we get a pullback, cash in our STP profits and add to the LTP positions which then recover. That has happened several times since we started our LTP/STP pair with $600,000 (500/100) on October 1st of 2019 and look at us now, welll over $2M after two years. Obviously this is not normal – so we need to enjoy it while we can.

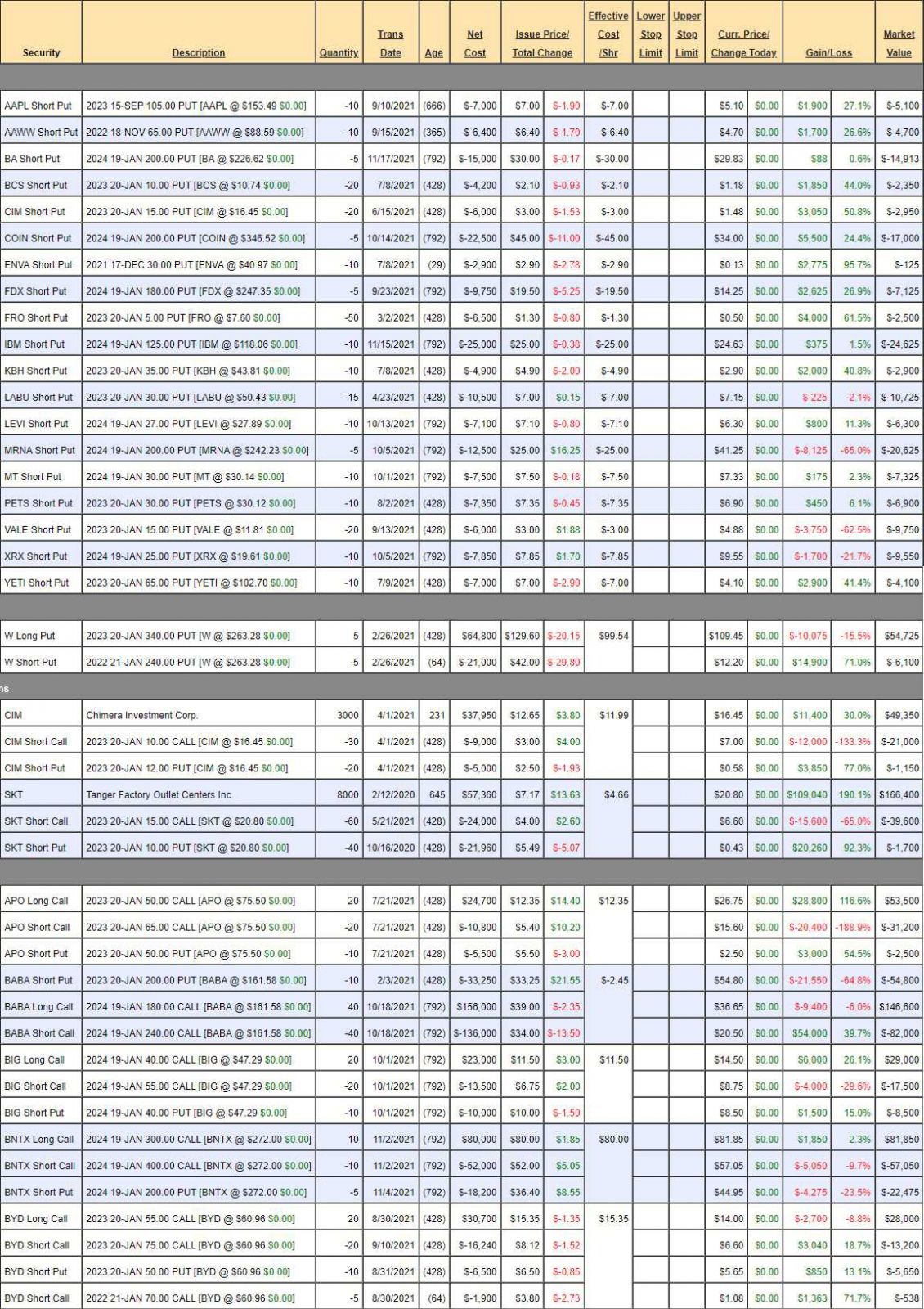

We cut half our positions in August but now we're back with 19 short puts and 36 spreads (W is the only bearish play in this portfolio). In the last two months, we added short puts on BA, COIN, IBM, LEVI, MRNA and XRX – taking advantage of earnings dips to plant a flag in stocks we'd like to have full positions in down the road. We collected $97,450 for promising to buy those stocks at lower prices – getting paid to wait is the key to our very patient strategy.

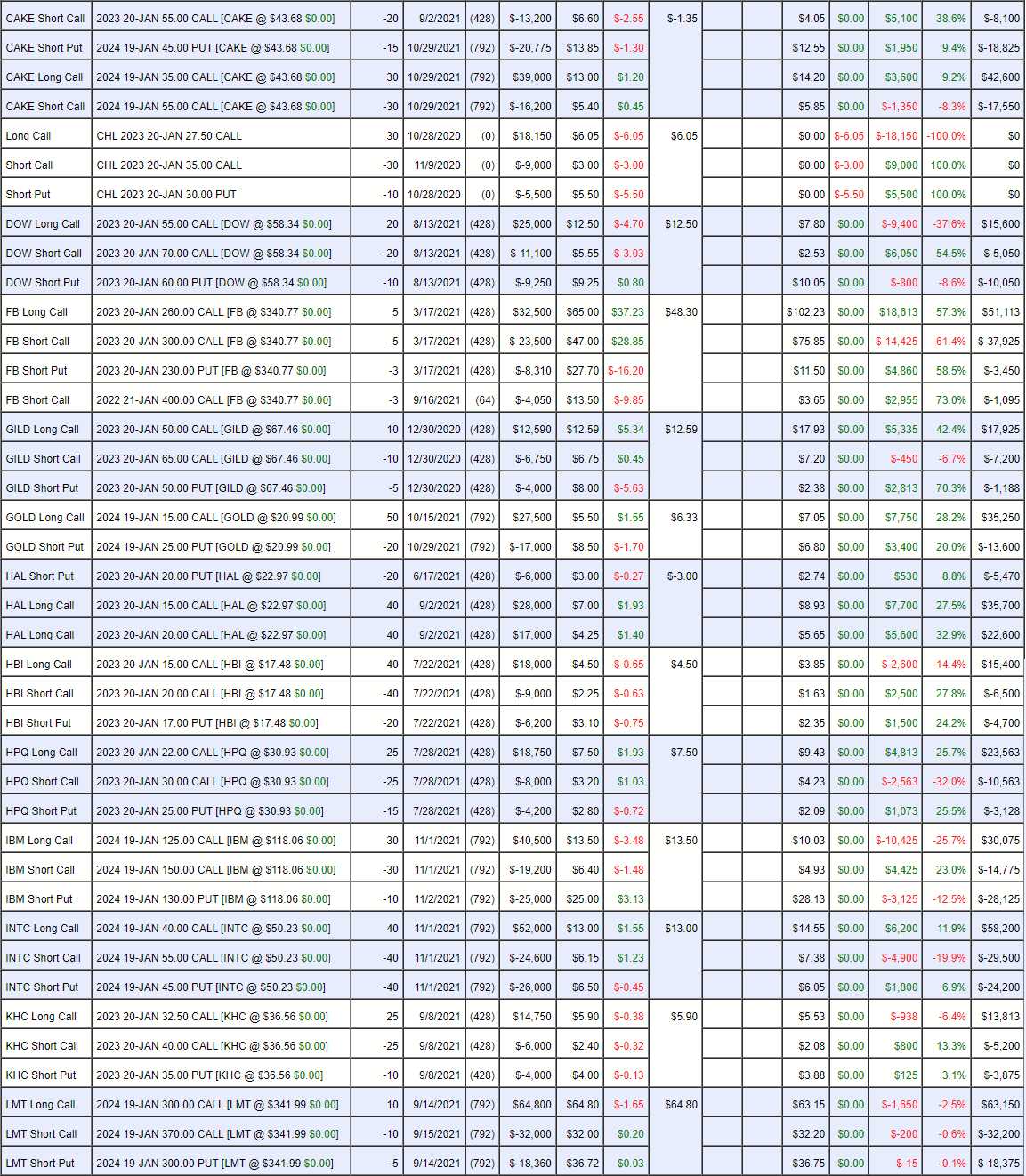

Also in the past two months, we've added longs on BIG, BNTX, CAKE, GOLD, IBM, MU, PFE, T and WPM so we're certainly not resting on our laurels either. That's 15 positions added since October 1st just in the LTP – earnings season is always busy for us but, otherwise, there's not much to do but see how things play out at what we still believe is a very toppy market.

Short Puts – Mostly on track and this is how we keep an eye on stocks we would REALLY like to make long positions in – ESPECIALLY if they get cheaper – so the ones that are in the red are the ones that are most interesting to us. We sold the MRNA $200 puts for $25 so, if assigned, our net entry would be $175 on 500 longs. From there we would build a position selling more puts and calls, probably dropping the cost another $50. So, at $240, the question is whether we want to commit to owning 1,000 shares (when we sell more puts) for about $125? Yes, we would like to buy 1,000 shares of MRNA if they are 50% off – so we keep the position for now. Very simple.

W is the only short position in the LTP as the market has little tendency to go down. What's important here is the short puts should inspire worthless in 64 days, leaving us with the long puts at net $43,000. We'll sell more short-term short puts and hopefully end up with free long puts into next year.

- CIM – Pays a nice dividend and well above our target.

- SKT – They are back to paying dividends (3.5%) so a great bonus for this successful spread.

- APO – Over our tarrget.

- BABA – Back to $150 this morning after missing on earnings and cutting guidance. Depends what we come up with when we analyze the results but most likely we'll buy back the short calls and roll the long calls lower as I have long-term faith in them.

- BIG – Still has that new trade smell. It's a $30,000 spread still at net $3,000 so $27,000 more to gain if BIG can hit $55 in two years.

- BNTX – Off to a poor start but certainly a long-term trade idea. It's a $100,000 spread at net $2,325 so huge potential gains but it's a bit speculative. What sells it for me is the short put is conservative ($200) so I don't consider it too risky of a shot at making $97,675 (4,200%) in 2 years.

- BYD – They took off quickly but have now pulled back so it's back to being a reasonable new entry at net $8,162 on the $30,000 spread. We sold $1,900 worth of calls in August and they are going worthless so maybe 3 more sales will knock out most of the cost of the spread along the way.

- CAKE – Doing very well already.

- CHL – Waiting for resolution on this one, where the government halted the trading last year.

- DOW – Cheaper than when we bought it. How can we have an economic recovery without DOW? Per their earnings, this is all about supply chain issues and price adjustments will be made going forward. We spent net $4,650 on the spread and committed to owning 1,000 shares for $60 and it's now $58.30 – so nothing to panic about but 2024s are now out so we may as well roll the 10 short 2023 $60 puts at $10 ($10,000) to 10 short 2024 $55 puts at $11 ($11,000) and we'll roll our 20 2023 $55 calls at $7.80 ($15,600) to 30 of the 2024 $50 ($12)/65 ($5.50) bull call spreads at $6.50 ($19,500). So, for net $2,900 we've rolled from a $30,000 spread that was $6,000 in the money to a $45,000 spread that's $24,000 in the money and we'll put a stop on 1/2 (10) short 2023 $70 calls at $4 ($4,000) to make sure we don't get burned on the way up.

- FB – My first thought is "Why is FB here, I don't even like them?" but then I remember it's an income play, where the long spread is simply to backstop our short call selling. We paid net $9,000 for the spread and we sold $12,360 worth of calls and puts against it so we're just waiting for the puts to expire so we can sell more.

- GILD – 100% in the money but only net $9,537 out of a potential $15,000 so worth keeping.

- GOLD – Still in the running for Stock of the Year. I'm not inclined to cover the longs yet.

- HAL – Coming back down so maybe a chance to get in if you missed it the first time.

- HBI – I love these guys, nice and steady, great value. Good time to get in at net $4,200 on the $20,000 spread.

- HPQ – This would have been my Stock of the Year if they hadn't popped. Still stupidly cheap

- IBM – A former Stock of the Year and even cheaper than our entry, now a net $12,825 credit on the $45,000 spread so $57,825 upside potential if IBM can make it back over $150 by 2024. Worst case here would be owning 1,000 shares of IBM at net $117.175 – that's right where we are now.

- INTC – Was our 2022 Stock of the Year and we sure like it again down here. Notice this is a super-conservative spread but it's a $60,000 spread at net $4,500. Aren't options fun?

- KHC – Nice boring play and another conservative spread. This one is net $4,738 on the $18,750 spread and all KHC has to do is hit $40 at the end of next year.

- LMT – Our Stock of the Century! That means we expect at least a 10x return over the next 78 years but way more than that if they come up with a working fusion reactor. This is just a $70,000 spread playing for a 10% gain in 2 years and only net $12,575 at the moment. It's amazing to me how they just give money away like this!

- MO – Not doing well so far but we like them so we'll buy time by rolling the 30 2023 $45 calls at $3.45 ($10,350) to 50 of the 2024 $40 ($7.50)/$50 ($4) bull call spreads at net $3.50 ($17,500) so we're spending net $7,150 to move from a $30,000 spread at the money to a $50,000 spread that's half in the money.

- MU – We sold the puts a while ago but it's essentially a new $40,000 spread at net $12,525 – a very good deal as it's 75% in the money!

- PAA – Just paid out 0.18 dividend ($1,440) but we'll be called away in January so this is done.

- PFE – We went back in on last month's dip and already over our target. It's already up $5,475 from our net $7,250 entry and a great example of how a "boring", conservative, long-term play can still pay great money in the short-term – but they are so much safer to play than gambling on short-term trades.

- PHM – Near out goal already.

- QSR – Disappointing so far after a good start. Let's roll the 15 2023 $60 calls at $4.25 ($6,375) to 25 of the 2024 $55 ($7.70)/70 ($3.25) bull call spreads at $4.45 ($11,125). We'll see how that goes.

- REYN – Blasted up to our goal and now 30 days left at net $22,500 on the $25,000 spread. It's not worth risking the gains so may as well kill it.

- RIO – Down and down they go but I still like them going forward so let's roll the15 2023 $67.22 calls at $3.70 ($5,550) to 30 of the 2024 $55 ($10)/70 ($4.20) bull call spreads at $5.80 ($17,400) and let's roll the 10 short 2023 $67.22 puts at $15.20 ($15,200) to 20 of the 2024 $60 puts at $15.60 ($31,200) so an overall $4,150 credit to make this adjustment.

- SPWR – Another Stock of the Year contender. The only reason they aren't it is because they popped from $20 to $35 in the past month but below $30 they are back in contention. Meanwhile this $112,500 spread is 100% in the money at $30 but still only net $37,988 – amazing!

- T – Yet another contender under $25 – such a bargain! We just rolled to take advantage last month so watching and waiting now.

- TROX – I love these guys and I wish we could keep playing but Apollo is buying them out so we'll have to let them go.

- VIAC – Yet another Stock of the Year contender (this is why our portfolio does so well, I guess). Ridiculously cheap at $35 so we'll take advantage and roll our 30 2023 $30 calls at $7.55 ($22,650) to 50 of the 2024 $30 ($9.35)/47.50 ($3.75) bull call spreads at $5.60 ($28,000) and we'll sell 10 of the 2024 $35 puts for $7.50 ($7,500) to pay for it so net $2,150 goes in our pockets as we move to the $87,500 spread.

- WPM – So nice we played them twice and I like bothe of them.

- X – As with DOW – how can they not be doing well in a booming economy? Right on track here at net $4,612 on the $36,000 spread. With the Infrastructure Bill passed – this is free money!

IN PROGRESS