Things WERE going well.

Things WERE going well.

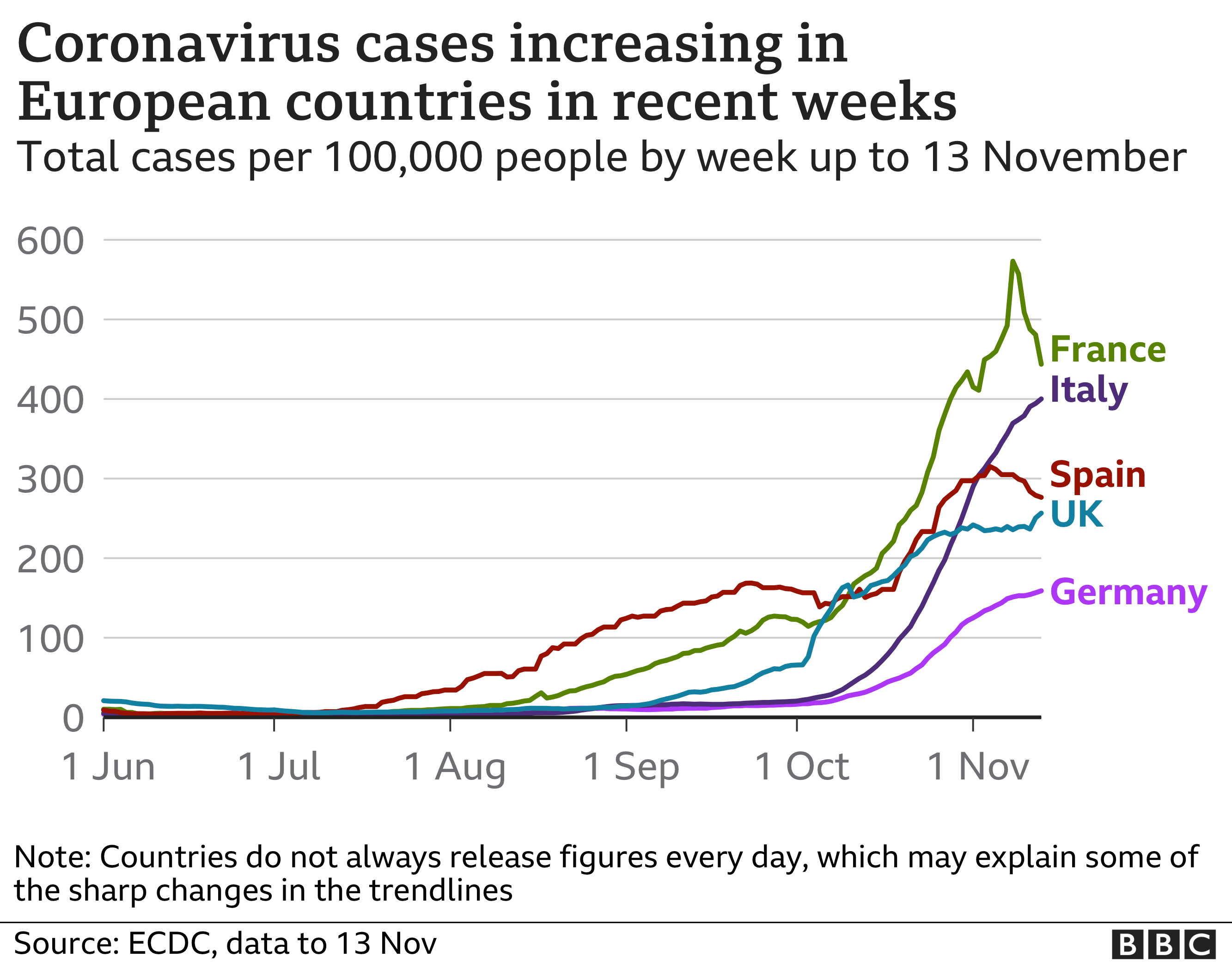

We were going to end the week at all-time market highs but then data from Johns Hopkins indicated Covid-19 (2 years now) cases were rising in Europe and Austria announced early this morning that the country would go into Nationwide Lockdown starting Monday, with Restaurants and Retail Sectors to close. Areas of Germany will also be closing this week.

And, just like that, Christmas is cancelled – again.

And, just like that, Christmas is cancelled – again.

“As Covid spreads in Europe and restrictions are strengthened in places in Germany and Austria, there’s a general recognition that things may not be going the right way,” said Sebastien Galy, a macro strategist at Nordea Asset Management. “This affects sentiment, both within markets and in households.”

The falling Euro took the Pound down with it and that caused the Dollar to rise, which then killed the rally in Oil (as does any sort of lockdown, of course) and that brought the indexes down sharply (aside from their general toppyness) and here we are – losing the whole week's market gains on a Friday morning.

The falling Euro took the Pound down with it and that caused the Dollar to rise, which then killed the rally in Oil (as does any sort of lockdown, of course) and that brought the indexes down sharply (aside from their general toppyness) and here we are – losing the whole week's market gains on a Friday morning.

We'll see if the downturn lasts the day though as we're in a low-volume, pre-holiday rally in the US (Thanksgiving is Thursday) with an effectively 3-day week ahead next week. Of course, the US tends to ignore things that go on in Europe, it's the Europeans who are trading our indexs down pre-market. Oil is down $3 (3.7%) back to $76 this morning and that makes a good line to go long on /CL (tight stops below!) as it should at least check the -2.5% line from $79, which would be $77.025, so we could get a nice $1 bounce – even if it is going to continue falling.

The rising Dollar also put pressure on Bond Yields, Metals and BitCoin, which fell another 2.2% to $56,000, 18% off the Nov 10th highs.

Austria had no choice but to shut down as hospitals in several regions had reached their capacity which means even a minor accident can become fatal with nowhere to put the patient (Texas' ICU beds are at 91% capacity at the moment). It doesn't have to be the Covid that actually kills you when it overwhelms the entire medical system. This comes despit Austria being 64% vaccinated – about the same level as the US is at – though Austria didn't have idiots in Congress preventing vaccine requirements to protect the general public.

All residents of Austria will need to take a Covid-19 vaccine as of Feb. 1 to be able to participate in most aspects of public life including working outside the home, the government said Friday. As of Monday and for a maximum period of 20 days, residents will only be able to leave their homes with a valid reason, including going to work. All nonessential businesses will close and employers will be asked to let people work from home. Schools and kindergartens will remain open, but parents are advised to enroll children into online classes.

All residents of Austria will need to take a Covid-19 vaccine as of Feb. 1 to be able to participate in most aspects of public life including working outside the home, the government said Friday. As of Monday and for a maximum period of 20 days, residents will only be able to leave their homes with a valid reason, including going to work. All nonessential businesses will close and employers will be asked to let people work from home. Schools and kindergartens will remain open, but parents are advised to enroll children into online classes.

“Despite months of campaigning and discussions, we have not managed to convince enough people to get vaccinated,” Austria’s conservative Chancellor Alexander Schallenberg said in a televised press conference.

“Now we must look reality in the eye…increasing vaccination rates is our only way out of this vicious circle of virus waves and lockdowns: We don’t want a fifth, sixth, seventh wave—the virus is here to stay and we must learn to live with it,” Mr. Schallenberg said.

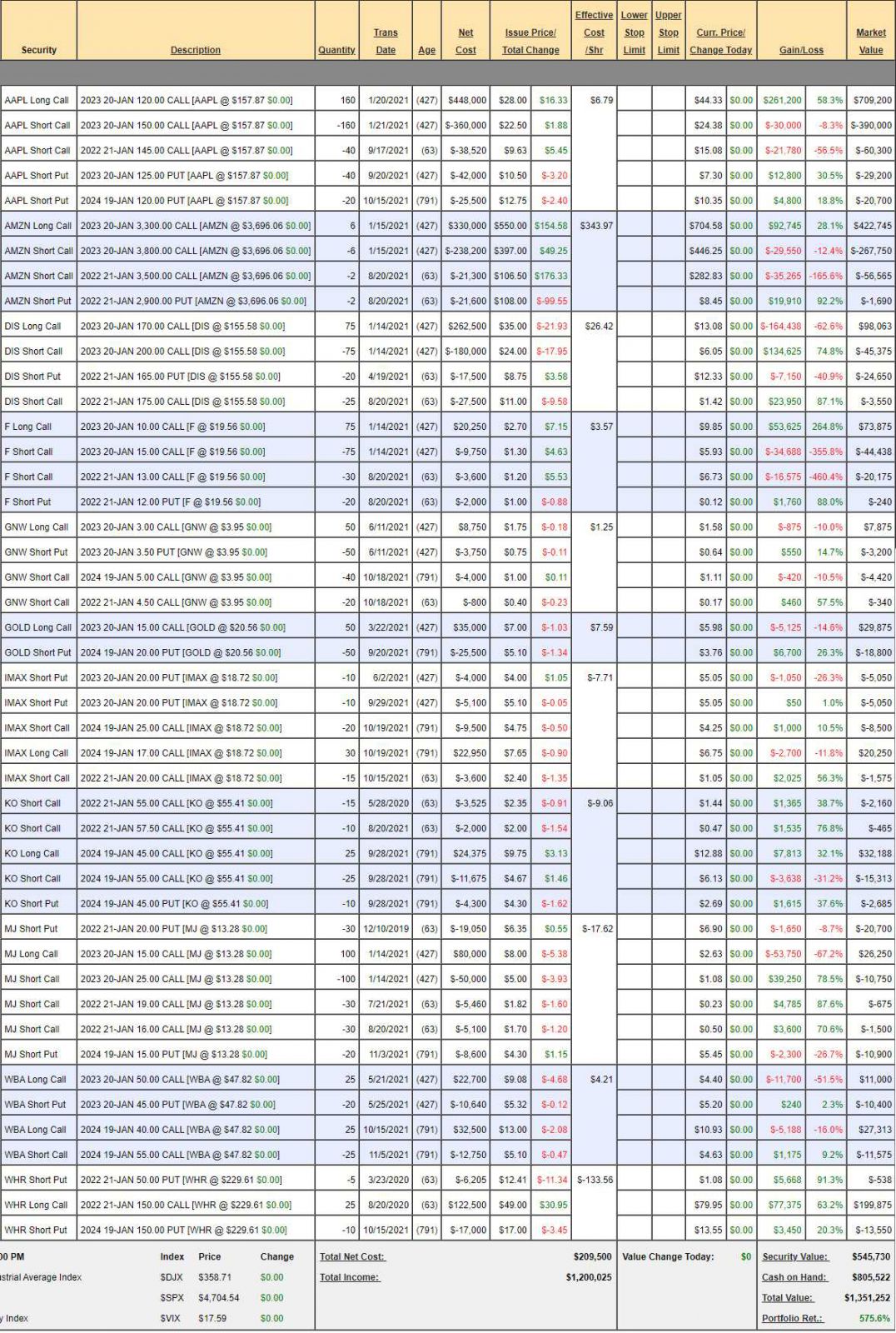

Today is options expiration day and we've been reviewing our Member Portfolios all week. Generally we're playing the market cautiously – not on the sidelines but "Cashy and Cautious" into the holidays as I'd rather miss a 10% rally than participate in a 20% drop. We're not missing a thing in our Butterfly Portfolio Review, as we're at $1,351,252 – up $67,210 (5.2%) since our October 14th review and now up 575.6% from our Jan 2nd, 2018 start in our oldest portfolio.

The reason we didn't cash out the Butterfly Portfolio along with the others in Sept of 2019 is that it's generally self-hedging – so we weren't worried about being caught in a downturn. When the downturn did come, however, the Butterfly Portfolio took a huge hit so we added $100,000 to it and took full advantage of all the bargain stocks that were on sale at the time. That then set us up to take advantage of great positions moving forward – leading to the outsized gains. Generally, this is a fairly conservative strategy that aims towards 30-40% annual gains (see "7 Steps to Consistently Making 30-40% Annual Returns") – our most consistent Member Portfolio:

- AAPL – Just blasted higher on news of their car business, which is a shame as we had the short Jan $145 calls but we're simply going to roll them along next month. It was only a 1/4 sale and we're down $34,000 since our last review but the bull call spread has gained $50,000 and now the short calls are protecting those gains.

- AMZN – Similar problem to AAPL as they blasted higher. The short calls are burning us but, overall, the spread has a nice profit and, in 60 days – we get to generate more premium sales.

- DIS – Totally tanked after earnings but a good example of how we are so neutral in this portfolio. The Jan $175 calls will now expire worthless and we'll roll the short Jan $165 puts – but they still may go worthless too. Clearly it's a good time to sell April puts so let's sell 20 of the April $160 puts for $12.60 ($25,200) and put a stop on the 20 short Jan $165 puts at $15 ($30,000). As we collected $17,500 for the Jan puts, our worst case would be a net sale of the April $160 puts for $12,700 ($6.35).

- F – Another one that blasted higher. We got blown out of the water on our short $13 calls and they are now $6.73 but the 2023 $20s are $3.50 so that's an even(ish) 2x roll and let's do that and cover the 60 short calls with 100 of the 2024 $20 ($4.80)/27 ($3.35) bull call spreads at $1.45 ($14,500). So, rather than paying $20,175 to buy back the short calls, we're spending $14,500 to buy a $70,000 spread to cover them after the 2x roll. That gives us a lot more upside potential in a still-conservative spread and we still have the original spread to cash in for a $30,000+ gain in the future.

- GNW – They were right on our target but now pulled back but fortunately we sold more calls than puts, so we're fine.

- GOLD – We're aggressively long at the moment.

- IMAX – Right on track for the Jan short $20s to expire worthless. It doesn't seem very exciting but we have 2024 longs and the spread was net $750 and we sold $3,600 worth of short calls in October and we have 8 more quarters to sell more calls!

- KO – Right on target for January short calls to expire. If they have a big pullback, we'll sell some short puts too but no pressure on that side.

- MJ – We lost $14,500 on the spread for the year but we gained $10,560 selling calls in the past 4 months, so it's a great little spread! We're a bit low in the channel to sell more calls so let's let the Jan calls go worthless (+$2,175) before we sell more. For now, let's roll the 30 Jan $20 puts at $6.90 to 20 more 2024 Jan $15 puts at $5.45. We can also salvage most of the net $3 we spent on the spread to roll our 100 2023 $15 calls at $2.63 ($26,300) to 200 of the 2024 $15 ($3.90)/22 ($2.75) bull call spreads at net $1.15 ($23,000). The purpose of the long calls is simply to protect us from the short calls popping – so this will allow us to sell more short calls than before. This is how we end up with those big positions in this portfolio – they don't cost anything – we just roll into them over time. Then, if we luck out and the position pops – we make a fortune off a very small initial investment. The problem is this strategy takes YEARS to play out and most people don't hae the patience…

- WBA – The short Jan puts should expire worthless and we're too low in the channel to sell calls at the moment. See – boring!

- WHR – We bought back the short calls last months as I was worried earnings would be too good and they popped as we expected but now it's time to reposition so let's sell our 25 Jan $150 calls for $199,875 and we already sold puts so our new spread will be 30 of the 2024 $220 ($44.50)/250 $30 bull call spreads at $30 ($90,000) and we'll sell 15 of the March $230 calls for $17 ($25,500) so it's net $135,375 off the table and we have 7 more quarters to sell $25,000 worth of premium (and that's just calls) from a spread we paid maybe net $60,000 for back in August. That's why this portfolio is a money machine! We're not selling short-term puts, of course, because we're too close to the top of the channel – so we wait, PATIENTLY, for a pullback and, if there isn't one – then our longs should do great, right?

That's all we have to do – we just make slight adjustments as required but the BE THE HOUSE system we employ in this portfolio puts the odds solidly in our favor – especially when we let things play out over time.

Have a great weekend,

– Phil