This is a lot of pressure.

We have never been wrong with a Trade of the Year selection. It started back in January 2012 when Bank America (BAC) was still hovering around $6 and my premise was that there was no point to trading in 2012 and we should all put our entire portfolio into BAC and take a vacation: "Thursday Foolishness – More of the Same with One Trade":

That one worked out and, for the next 3 consecutive years our Trade of the Year was Apple (AAPL), obviously all winners and each year since we've been able to come up with a sure-fire trade and we settled on Thanksgiving as the official time to make our selection and we also began announcing them on BNN's (Bloomberg Canada) Money Talk – a show I am a frequent guest on. I'll be on the show on Wednesday but last year I wasn't on until Dec 9th, when our Trade of the Year was announced as Intel (INTC – see above video).

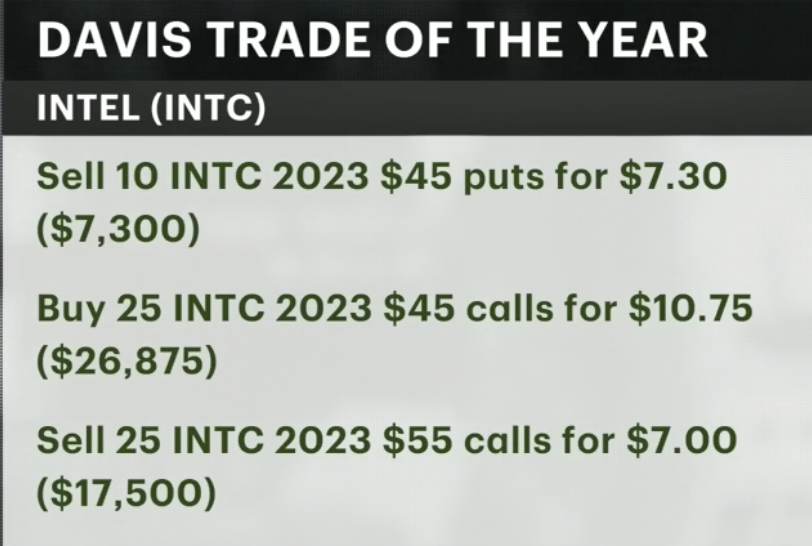

The INTC trade idea was this:

The INTC trade idea was this:

That's net $2,075 on the $25,000 spread with $22,925 (1,105%) of upside potential at just $55. Ordinary margin on the short puts should be $3,059 but, even with IRA or 401K full margin, this is a very nice way to make $22,925 in two years as the downside risk on INTC is very limited. Their main rival, AMD, has just $7Bn in sales vs $72Bn for INTC, they are 1/10th the size and no significant threat.

With another $22,925 of potential upside, we have over $60,000 of potential gains in the MTP and that means we can coast into the new year without fear of missing out (FOMO) if the rally continues and, if it doesn't, we have massive amounts of cash to deploy and almost all of our margin buying power available as well.

Intel blasted higher into April and we took an early win off the table but, even for those who rode out this downturn, the 2023 $45 puts are now $4.55 ($4,550) and the 2023 $45 ($8.80)/55 ($4.35) bull call spread is net $4.45 ($11,125) so we're net $6,575 on the spread which is up $4,500 (216%) for the year and I fully expect it will come back for the full $25,000 so there's still $18,425 to be made on the original spread – another 280% from here.

In our Trade of the Year selections, we aim for a 300% return on our cash outlay and we were miles over that in the spring so we cashed out but now INTC is cheap again – so I'm tempted to pick it again. This is what happened with AAPL – it kept getting cheap again so we kept picking it. INTC is just as undervalued now as it was when we were finalizing our Trade of the Year selections last year. As a new trade however, I would go with:

- Sell 10 INTC 2024 $45 puts for $6.50 ($6,500)

- Buy 20 INTC 2024 $45 calls for $11 ($22,000)

- Sell 20 INTC 2024 $55 calls for $7.10 ($14,200)

Here we are laying out net $1,300 in cash and promising to buy 1,000 shares of INTC for $45. If we lose all of the spread value and have to buy the stock, our net entry would be $46.30, which is still $3.46 (7%) below the current price. It's a little aggressive but I certainly don't fear owning 1,000 shares of Intel for the long haul. It's a $20,000 spread so the upside potential is $18,700 for a 1,438% return if all goes well and, as we're starting out just under $10,000 in the money – it's already going well! INTC has to fall 10% before you lose money on the spread – that's a great way to start!

At $49.76, INTC has a $202Bn market cap and, in 2021 they are on track to make $21.6Bn but next year, only $14.7Bn because they are starting a new chip investment cycle to move towards 2nm processors. As a long-term investment, I love them but are they good enough to be our 2022 Trade of the Year?

This year's Top Trade of the Year finalists are: T, VIAC, SPWR, GOLD, WBA, DIS, DOW, KHC, MO, IBM, RIO, BA, and FF and I'm tempted to add TZA to that list as I think it's more likely we get a big, fat correction than have another 20% up year in the markets.

- T was dealt with in Monday's Live Member Chat Room. It's very hard for met not to pick them but they are spinning out Time/Warner and that will make it a messy trade – the only reason they are off the list.

- VIAC I love but they have a chart from Hell. Other than their ridiculously low valuation, I don't see an immediate catalyst to turn them higher so tough to make our Top Trade without a clear story and just valuation.

SPWR – This is most likely to be my pick for Trade of the Year and it's already our Stock of the Decade (most likely to make 10x in 10 years). The catalyst is all the Green Energy money in Biden's bills and SPWR is a great growth stock but it does have a high multiple (35), so it's hard for a value player like me to get excited about it over $25 (now $30). The trick is whether or not we can construct a good, conservative sprread out of SPWR like:

- Sell 15 SPWR 2024 $20 puts at $3.55 ($5,325)

- Buy 30 SPWR 2024 $25 calls for $11 ($33,000)

- Sell 30 SPWR 2024 $32 calls for $9 ($27,000)

That's net $675 on the $21,000 spread that's $15,000 in the money to start – I like those odds! The upside potential is $21,675 (3,211%) and the risk is being assigned 1,500 shares of SPWR at $19.55, which is more than 35% off the current price. Yep, I don't see how this trade is going to be beat.

GOLD – This was a recent Trade of the Year and has come back down nicely to where we like to play it (below $20). We discussed a trade idea on Tuesday in our Live Member Chat Room:

The 2024 $17 puts are $2.50 and the $20 puts are $4.35 so $2 more for $3 in strike and, since I think $20 is a very fair price, I'd rather get paid more so:

- Sell 15 2024 GOLD $20 puts for $4.35 ($6,525)

- Buy 30 2024 $15 calls for $5.75 ($17,250)

- Sell 30 2024 $22 calls for $2.85 ($8,550)

Here we're coming in at net $2,175 on the $21,000 spread that's $12,000 in the money to start. Upside potential is $18,825 (865%) but we only need to hold $18 to end up at net $6,000, which would still be a nice $3,825 (175%) profit.

Wow, that might be better than SPWR – especially since it's still working as a hedge against a downturn, with today's action being a good example. I wasn't joking when I said I was leaning towards making TZA my Trade of the Year – this market is very unstable and very overbought.

WBA – Oh no – so many stocks I love that are cheap. We like WBA because that's where people are now getting their shots so it's a good catalyst for a value play. $46.62 is $40Bn in market cap and this year they should make about $4.3Bn and next year about 5% more. As it's already $130Bn in sales – you can't expect explosive growth. So, trading below 10x earnings means $45 should be a nice long-term floor and safety is a big factor in our Trade of the Year selection. With WBA we could:

- Sell 10 WBA 2024 $45 puts for $8 ($8,000)

- Buy 20 WBA 2024 $40 calls for $10 ($20,000)

- Sell 20 WBA 2024 $52.50 calls for $5 ($10,000)

That would put us into the $25,000 spread for net $2,000 so there's $23,000 (1,150%) worth of upside potential at $52.50. Worst case is owning 1,000 shares at net $47 (if you lose the $2,000), which is more than the current price but, as I said, I think it's way underpriced here anyway.

- DIS – Well the new virus outbreak shows why we can't play DIS but we'll see how low they get on the next drop.

DOW – Dow Was a Top Trade Alert on Aug 12th and it's even cheaper now but it formed a nice bottom at $56 and I'm very confident in that trade into our Jan 2023 target of $70. $58.63 is $43.36Bn in market cap and Dow is in track to make over $6.5Bn this year and close to $5Bn next year so $43.36Bn is stupidly cheap. As a new trade I like:

- Sell 10 DOW 2024 $45 puts for $7 ($7,000)

- Buy 20 DOW 2024 $50 calls for $11 ($22,000)

- Sell 20 DOW 2024 $60 calls for $7 ($14,000)

That's net $1,000 on the $20,000 spread so $19,000 (1,900%) upside potential and the worst case is owning 1,000 shares at net $46, still a nice $12.63 (21.5%) discount to the current price and Dow even pays a nice $2.80 (6%) dividend if you do end up owning them. Almost a no-lose situation!

KHC – I love boring companies. Unfortunately, no one believed me when I was pounding the table for KHC in 2019 and 2020 – and that was around $25. At $35, they are still a good deal as that's $43Bn in market cap and they make a pretty steady $3Bn a year but clearly not as sexy as it was when it was 30% lower. Pass unless they get cheaper again.

- MO – We looked at them on Tuesday and decided we were very comfortable buying them down here for the long-term but do they have a catalyst in 2022? Not one we immediately see, unfortunately.

IBM – Another former Stock of the Year. Also approaching 10x earnings at $115, which is just over $100Bn in market cap and IBM is good for about $9Bn/yr in earnings but they also have pricing power in an inflationary environment. They are just finishing their 3-year digestion of Red Hat and now we should begin to see the benefits of this combination moving forward. IBM has very little downside at this price and the upside could be well over $150 in two years so great risk/reward ratio on them. My play would be:

- Sell 5 IBM 2024 $100 puts for $12.50 ($6,250)

- Buy 15 IBM 2024 $110 calls for $16 ($24,000)

- Sell 15 IBM 2024 $125 calls for $10 ($15,000)

That's net $2,750 on the $22,500 spread so $19,750 (718%) upside potential if they gain $10 in two years is a pretty obtainable goal. Downside is being forced to own 500 shares at net $105.50, which is almost 10% below the current price and, long-term, I certaintly don't mind owning IBM in our portfolio.

- RIO – Just ridiculously, stupidly cheap at $61.50 this morning. It would be foolish not to sell the 2024 $50 puts for $8 – that's just giving money away. Selling 5 of them for $4,000 puts you in 500 shares at net $42 as your worst case – another 30% below the current price! Infrastructure is the forward catalyst – aside from being priced at 5x earnings.

BA – Ah, interesting. They seem to have finally gotten their new models to fly and they have a 5-year backlog of orders that will only increase as they get the green light from FAA's around the World. $210 is just $124Bn in market cap and BA was making $10.5Bn in 2018 before it all hit the fan. Over the next 5 years, they should make $50Bn unless the virus stops us from flying again and, unfortunately, we're being reminded of that risk today, aren't we. That knocks them ot for Stock of the Year contention.

FF – They got cheap again ($8) and I really like them but they are a very small cap ($353M) but they made $46.6M last year but maybe $14M this year as they lost $8.7M in Q1 – so people don't know what to make of them. Sales have been up very nicely though and Q3 sales were up 82%. What happened in Q1 was the winter storm that blasted spot natural gas prices up 14x and they couldn't shut down production as the restart costs would have been worse and they were not hedged for such a thing (unlikely as it was) so, if we view it as a on-time event – the trades who have been dumping this stock are really idiots.

These guys make enviro-friendly fuels but use a lot of natural gas to process them but again, Biden's Bills are great for FF and I don't think we'll keep seeing those price spikes in /NG so yes, there's a little risk – but I expect 2022 to be double 2021, which makes FF very interesting.

Unfortunately, they don't have long-term options – only out to May so they can only be the Trade of the Half-Year but I think they might be since you can buy the May $7.50 ($1.30)/10 (0.45) bull call spread for net 0.85 and sell some May $10 puts for $2.30 so our target is $10 (aggressive) but each short put pays for 4 longs so, let's say:

- Sell 20 FF May $10 puts for $2.30 ($4,600)

- Buy 100 FF May $7.50 calls for $1.30 ($13,000)

- Sell 100 FF May $10 calls for 0.85 ($8,500)

That is a net $100 credit on the $25,000 spread so $25,100 (25,100%) upside potential at $10 and your worst case is owning 2,000 shares of FF at net $9.95, which is 25% more than it is now. As long as $20,000 is not much of your portfolio, it's just a small risk on a small cap but, if I'm right, you get paid $25,100 in just 6 months for taking a small chance. Even at the current price of $8, you would make $5,000 on the longs and lose $4,000 on the puts so profitable at $8 is what you really need to focus on for this bet.

Definately our official Trade of the Half-Year! Trade of the Year – I'm going to have to see how the current downturn plays out into next week – sorry!