I will be on Bloomberg's Money Talk this evening (7pm) – on the right is my last appearance (full show here).

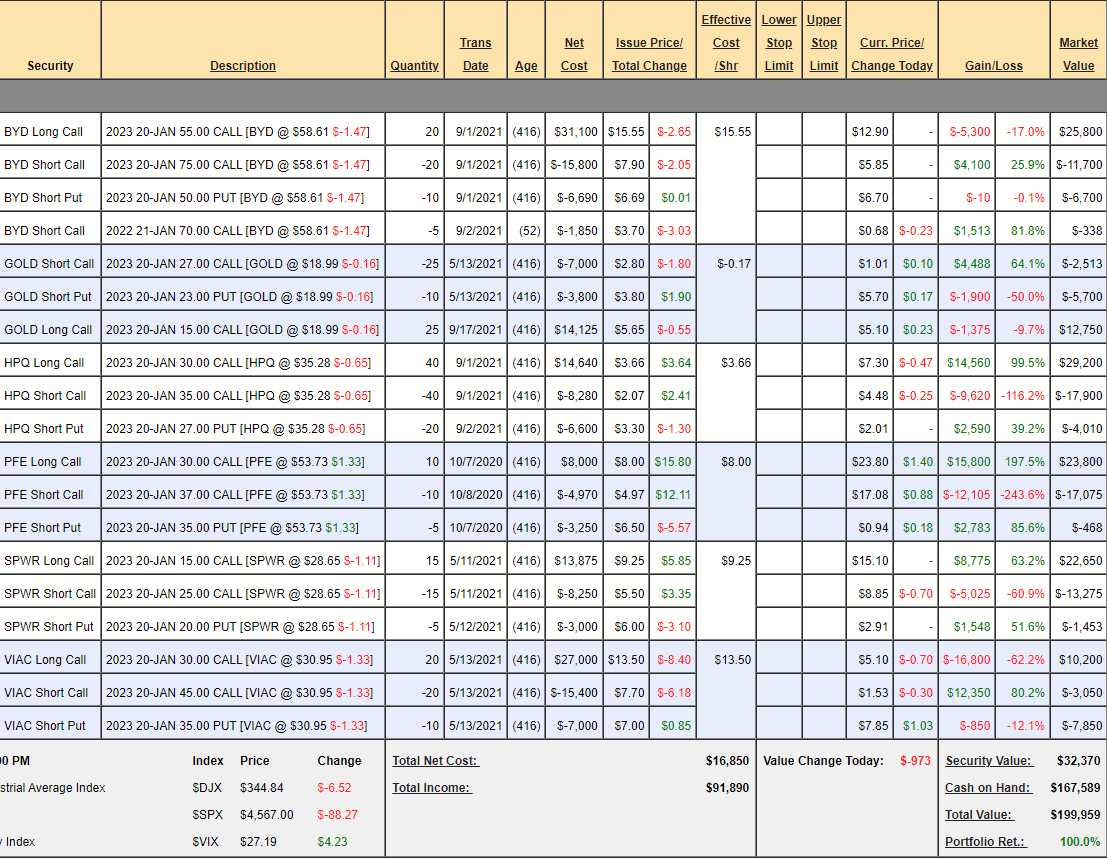

We will be officially announcing our 2022 Trade of the Year and reveiwing our Money Talk Portfolio, which we only trade quarterly, live on the show – so it's a very hands off portfolio full of fairly bullet-proof positions that I trust can be left alone. At out last review, on August 31st, we were in the process of cashing out our winners like IBM (IBM), Pfizer (PFE) and Tanger Factory Outlets (SKT), as they were way ahead of plan and the overall portfolio was at $195,900 – up 95.9% in less than two years – there was no sense risking those gains.

IBM was at $133.40 that day and was our 2019 Trade of the Year and the Jan 2022 spread was already at net $16,570 out of a potential $24,000 but we started the spread with a net $8,060 credit as we had aggressively sold the $135 puts (4 of them) and I said at the time:

- IBM – This is a $24,000 spread at net $16,570 and, if we were able to trade it every day I'd let it ride as we can make another $7,430 if IBM holds $140 into January but we're worried about the market and we already have a massive gain so it's silly to take the risk – we're going to cash this one in.

As it turned out, we were right to be cautious on August 31st:

Despite cashing in IBM, PFE and SKT, we added new positions on HP (HPQ) and Boyd Gaming (BYD) with HPQ already making a solid contribution to the portfolio. We also got more aggressive on Barrick Gold (GOLD) and, in the 3 months since, the portfolio has grown to $199,959 – up $4,059 depsite us moving to $167,589 (84%) in CASH!!! and despite the recent market pullback.

The good news is we have plenty of room to adjust and plenty of room to add new positions:

- BYD – Boyd is cheaper than where we started so great for a new trade at net $7,062 on the $40,000 spread. That means we have $32,938 (466%) upside potential if BYD can get over $75 by next January but we came in a little early last Q but fortunately we sold $1,850 of Jan $70 calls – so we are making that money but we'll hold off on selling more calls this Q and hope this is a bottom.

- GOLD – Was in contention for our 2022 Stock of the Year as a fantastic inflation hedge but we already had it so I wanted to add things we didn't have – otherwise, I love this. This is a $30,000 spread that's $10,000 in the money at $19 yet you can still buy it for net $4,537 (and again, it's $10,000 in the money!) but that's because we have very aggressive puts sold that obligate us to own 1,000 shares at $23 – but that's a target I have confidence in. Meanwhile, if all goes well, the upside potential is $25,463 (561%) against the current cash outlay.

- HPQ – Still cheap despite taking off already. I was dumbfounded at how cheap it was in September so we had to add it. Even now it's only net $7,290 on the $20,000 spread – despite already being 100% in the money so $12,710 (174%) of upside potential if we simply hold $35.

- PFE – This would have been Stock of the Year had they stayed around $40 but they took off into Thanksgiving though, fortunately, we have been in them for a long time. As it stands, we're at net $6,257 out of a potential $7,000 so it's just not worth the space in the portfolio for another year – and we can certainly make more than 10% on $6,257 so we're going to cash this out.

SPWR – This is our Stock of the Decade and also would have been Stock of the Year if we didn't already have it but the current spread has $15,000 potential and is at net $7,922. So, despite being 100% in the money already, there is still $7,078 (89%) to gain in the next year but you KNOW we can do better than that so here are the adjustments:

- Roll 15 SPWR 2023 $15 calls at $15.10 ($22,650) to 35 SPWR 2024 $25 calls at $10.50 ($36,750)

- Sell 25 SPWR 2024 $35 calls for $7.50 ($18,750)

- Sell 5 SPWR 2024 $30 puts for $10.80 ($5,400)

That roll puts $10,050 in our pockets but moves us to a potentail $35,000 spread and, since we only spent net $2,625 on the original position, we're playing with house money and a potential ($35,000 + $7,425 =) $42,425 (1,616%) upside potential at $35+ in two years.

VIAC – I am as dumbfounded as to how cheap Viacom is as I was about HPQ last quarter. You would think they are going bankrupt but no, they are making $2.5Bn a year yet, at $31, you can buy the whole company for $20Bn – and I predict someone will. When that happens, we collect sooner so we're going to close the current spread for a net $5,300 loss and add back the following:

- Sell 10 VIAC 2024 $30 puts for $6 ($6,000)

- Buy 40 VIAC 2024 $25 calls for $10 ($40,000)

- Sell 40 VIAC 2024 $40 calls for $5 ($20,000)

That's net $14,000 on the $60,000 spread that's $24,000 in the money to start and, if VIAC gets bought for $40+, we will get a quick cash out on our spread with the full $46,000 (328%) upside potential realized. That would make up for the $5,300 loss quite nicely!

So, we have cut one trade and spent net $3,950 of our CASH!!! (I love CASH!!!) adjusting our positions, which leaves us with $159,936 of upside potential over the next two years – almost another 100% gain without adding positions. But we are adding positions as we found 4 that we could not turn down in the Trade of the Year Final 4 and here they are:

Intel (INTC) was our Trade of the Year for 2021 and it did so well we cashed it out in April but now it's come back down and we'd like to add it back to our Money Talk Portfolio. They did not make the cut because 2022 is an investment year for them but, longer-term, we're very exited to own the stock under $50.

- Sell 10 INTC 2024 $45 puts for $7 ($7,000)

- Buy 20 INTC 2024 $45 calls for $11 ($22,000)

- Sell 20 INTC 2024 $55 calls for $7 ($14,000)

Here we are laying out net $1,000 in cash and promising to buy 1,000 shares of INTC for $45. If we lose all of the spread value and have to buy the stock, our net entry would be $46, which is still $3.20 (6.5%) below the current price. It's a little aggressive but I certainly don't fear owning 1,000 shares of Intel for the long haul. It's a $20,000 spread so the upside potential is $19,000 for a 1,900% return if all goes well and, as we're starting out over $9,000 in the money – it's already going well! INTC has to fall 10% before you lose money on the spread – that's a great way to start!

Altria (MO) made $4.5Bn last year so they are pretty recession-proof at $80Bn and this year they are making more like $8Bn. The catalyst we are waiting for is full legalization of marijuana but we don't know if that will happen next year – so they remain a runner up but a fabulous play at $42.50 as such:

- Sell 5 MO 2024 $40 puts for $8 ($4,000)

- Buy 15 MO 2024 $40 calls for $6.60 ($9,900)

- Sell 15 MO 2024 $50 calls for $3 ($4,500)

That's net $1,400 on the $15,000 spread so we have $13,600 (971%) of upside potential against our cash outlay and we are promising to buy 500 shares of MO at net $42.80, which is still 13% below the current price – that's our worst case, which isn't bad, is it?

Walgreens (WBA) has been a favorite of mine all year at this level. They were completing a turnaround when they were rudely interrupted by the virus last year and now it's the place we'll be getting our booster shots in the states, which should be great for business – unless they are forced to shut down again – that's the big risk here and why they are a runner -up. Still, I think $44.80 is ridiculously cheap for them so we'll add them as well:

- Sell 5 WBA 2024 $40 puts for $10.50 ($5,250)

- Buy 15 WBA 2024 $40 calls for $9.80 ($14,700)

- Sell 15 WBA 2024 $52.50 calls for $4 ($6,000)

Here we're spending net $3,450 on the $18,750 spread so we have $15,300 (443%) upside potential at $52.50 and our worst case is owning 500 shares for net $46.90 – a bit more than the current price. Here I did not feel comfortable committing to owning too many shares so we spent more cash to set up the spread. Never assume all your trades will go your way!

And that brings us to our 2022 Trade of the Year which has to be IBM (again) as we only sold it back in September because it had already made us a ton of money. Now we are being given a chance to re-enter the stock, not only at a ridiculously low price – but while the option prices are in our favor due to all the volatility!

IBM acquired Red Hat in October of 2018 and 2021 was supposed to be the year it began paying off but that's been delayed by Covid though the company did make $5.6Bn last year and is on the way to making $8.6Bn in 2021 and over $9Bn next year yet, at $117.10, you can buy the whole company for $106Bn – just over 10 times earnings – for IBM! They are big on cloud computing and leaders in Quantum Computing and there's still Watson creeping into our everyday lives – this is a great company to hold for the long-term but with near-term catalysts we like to see for a trade of the year. We also think $115 is a very strong bottom – another huge plus:

- Sell 10 IBM 2024 $100 puts at $12.50 ($12,500)

- Buy 20 IBM 2024 $100 calls at $22.50 ($45,000)

- Sell 20 IBM 2024 $115 calls at $15 ($30,000)

That's net $2,500 on the $30,000 spread so there's $27,500 (1,100%) potential upside to the cash outlay. Our worst-case scenario is owning 1,000 shares of IBM at net $102.50, which is 12.5% below the current price and, keep in mind, this trade is starting out 100% in the money and you only lose if IBM goes below $102.50 – which would be insanely cheap. All IBM has to do is not go lower than it is now and you make $27,500 in profits – now THAT is a Trade of the Year!

There's 4 brand new trade ideas that have the potential to make another $75,400 in addition to the $159,936 of potential gains in the exisiting portfolio means we can make up to $235,336 in the next two years if all goes well – but it rarely does, of course. That's why we "only" made 100% in the last two years – not everything goes according to plan but, when you plan to make $235,336 against a $199,959 portfolio – anything but a large miss is going to be a very nice return indeed.

You can follow all of our Member Portfolios live by subscribing here.