I love TD:

- TD Bank (NYSE:TD) declares CAD 0.89/share quarterly dividend, 12.7% increase from prior dividend of CAD 0.79.

- Forward yield 3.87%

- Payable Jan. 31; for shareholders of record Jan. 10; ex-div Jan. 7.

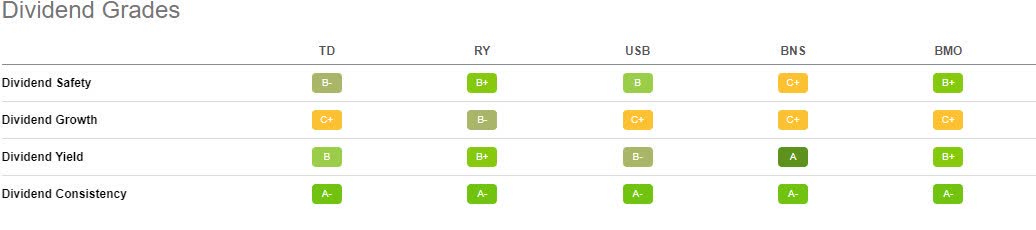

- See TD's dividend grades vs. peers CM, RY, USB, BNS and BMO:

$74.50 is $130Bn and these guys are making $14Bn a year and made $12Bn last year so rock-steady income stream. They have long-term options now and only a 3.5% dividend ($2.55), so not worth owning the stock but, for the LTP, let's:

- Sell 10 TD 2024 $70 puts for $8.50 ($8,500)

- Buy 25 TD 2024 $60 calls for $15 ($37,500)

- Sell 25 TD 2024 $75 calls for $7.50 ($18,750)

- Sell 5 TD April $75 calls for $3 ($1,500)

That's net $8,750 on the $37,500 spread so we have $28,750 of upside potential where we are now and we have 7 more quarters to sell calls as well to knock down the basis.