Well, it didn't work the first time – so why not do it again?

Well, it didn't work the first time – so why not do it again?

Congress is voting to punish China for its treatment of the Uyghur Muslims, which is kind of funny considering how we treat Muslims in this country. We are also talking about sanctioning China over their aspirations in Taiwan and we're staging a diplomatic boycott of the Olympics and, oh yes, Trump's tariffs are still in place.

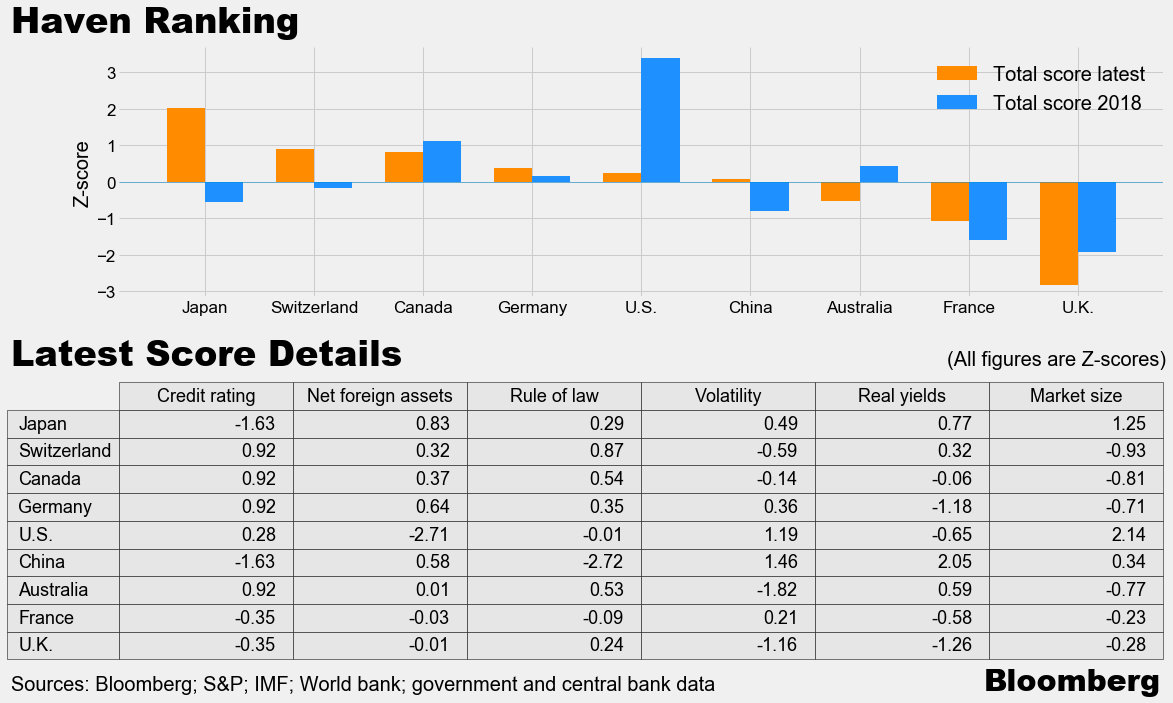

China has dropped behind the US in it's "Safe Haven Ranking", which means it's an even worse place to put your bonds than the US but, then again, they rank Japan first and that country is DEFINITELY going to end up defaulting on its debt at some point – as they are already over 300% of their GDP in debt. China is already paying effectively 2.05% interest on their debt – far more than any other nation on that list. Notice China is as bad as Japan in Credit Rating and, as I just said, Japan is DEFINITELY going to default.

What exactly does it take to be considered a haven asset, anyway? According to a European Central Bank working paper, safe assets are debt issued by a “safe” government of a country that has its own central bank, a stable currency, protection of property rights and low inflation. They are also highly liquid, an International Monetary Fund report said.

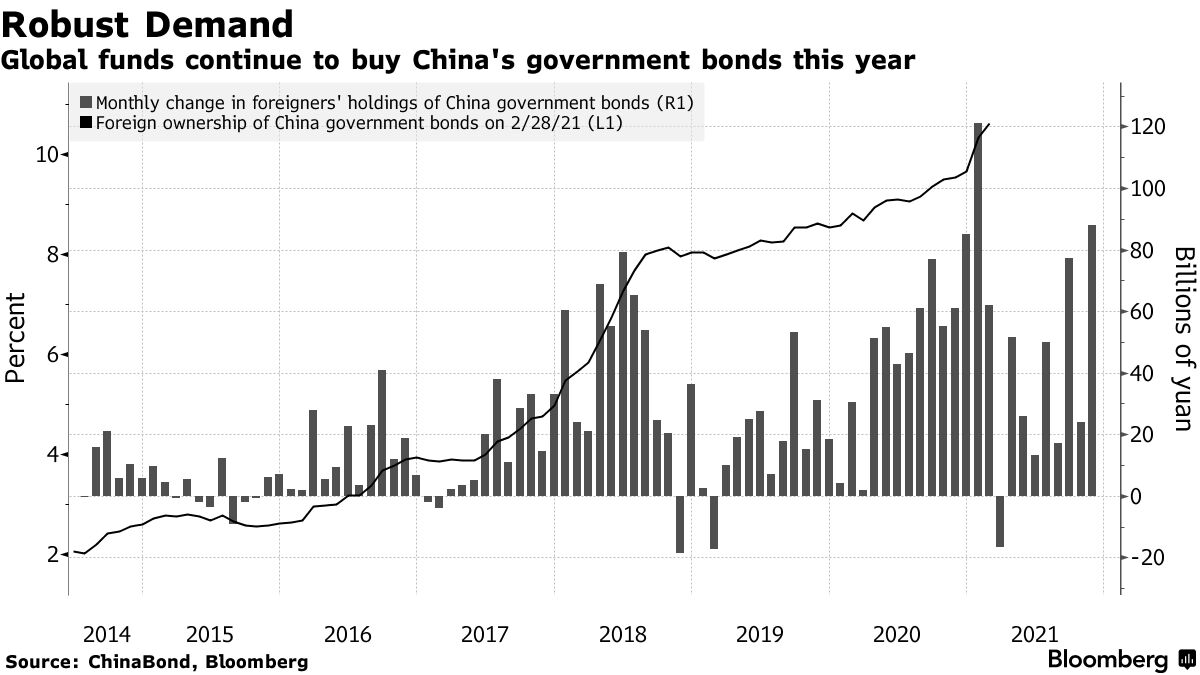

In the context of the China's Government Bonds, one key concern is that a sudden change in rules could make it harder for investors to sell their holdings or repatriate proceeds. Despite those risks, overseas investors have kept putting billions of dollars in China’s government bonds. Their holdings have grown by 513.7Bn Yuan ($81Bn) in the first 11 months of the year, the most ever for this period. Like everything else in the past two years – all this new money being printed has nowhere else to go – so it's forced into risky investments.

As China's economy softens, the Communist Party has been making it harder to obtain information about the Chinese Economy: A new data-security law has made it harder for foreign companies and investors to get information, including about supplies and financial statements. Several providers of ship locations in Chinese waters stopped sharing information outside the country, making it hard to understand port activity there. Chinese authorities have restricted information on coal use, purged documents related to political dissent cases from an official judicial database, and shut down academic exchanges with other countries.

Strict Covid-related border controls, including canceled flights and weekslong quarantines, have added a drastic drop in face-to-face interactions between Chinese citizens and the world, compounding the disconnect. Airlines carried around 1 million people in and out of China over the first eight months of 2021, down from almost 50 million over the same period in 2019, according to data from the Civil Aviation Administration of China.

President Xi has indicated he will take more control of the PBOC, risking their "independent" status and the new data-security laws indicate the Government has watching EVERYTHING that goes on and it risks making it impossible for Chinese companies to list on foreign exchanges. It's also becoming more difficult to simply do business with Chinese suppliers. Suppliers of metals like cobalt and lithium used in Electronics have grown reluctant to share information with customers outside China, said one executive at a major U.S. technology company. Data the suppliers now consider sensitive includes details like how much of a given metal they have available or what percentage of their supplies are recycled

Steve Dickinson, a lawyer at U.S. law firm Harris Bricken, recalled a recent episode in which a U.S. client had asked a Chinese company for audited financial statements to determine whether it was creditworthy. The latter declined, citing Chinese policy that states they can’t release financial statements to foreigners. Tha's going to be a problem! In early November, global ship-tracking platforms began to notice disruptions to the flow of location data of vessels in Chinese waters. Some local providers had stopped sharing detailed information of ship positions, citing the new data-security law.

The World's second-largest economy can't be a black hole – it's very destabilizing…

Also unstable is the Oil market and we shorted the Oil Futures (/CL) yesterday in our Live Trading Webinar and, this morning, it's down $1 at $71.50 for gains of $1,000 per contreact, so congratulations to all who played along at home.

Also unstable is the Oil market and we shorted the Oil Futures (/CL) yesterday in our Live Trading Webinar and, this morning, it's down $1 at $71.50 for gains of $1,000 per contreact, so congratulations to all who played along at home.

Our goal is $71 even but we have to check the bounces off $71.50 and, since we fell $1, the bounce line is 0.20 at $71.70 (weak) and we're not even going to stay in for a strong bounce as I'd rather just take $800 per contract off the table than risk another $200 at that point but I do strongly feel that the weak bounce will fail and we'll break through and head for $71- as I said in yesterday's PSW Morning Report as well.

We also still have our S&P 500 (/ES) shorts at the 4,700 line and those are also up $1,000 per contract already and also probably consolidating for a move back down. /NG is at $3.75 this morning and that's good for a long re-entry ahead of inventories at 10:30 as I can't see how they can be bad enough to justify a two-week drop from $5.25 (28.5%). Natural Gas tends to move with $2 and $4 being the major supports – $5 is just nuts and we hit $6.50 in early October.

$4.50 is our target price for /NG to settle down at but that would be the midpoint from a $3.50 to $5.50 range we expect going forward so getting an entry this close to $3.50 is very, very attractive to us as a long-term position. UNG is the Natural Gas ETF and it's over-sold at $12.50 so, for our Short-Term Portfolio (STP), let's do the following:

- Sell 20 UNG 2024 $10 puts for $3 ($6,000)

- Buy 50 April $10 calls for $3.10 ($15,500)

- Sell 50 April $12 calls for $2.05 ($10,250)

That gives us a net credit of $750 so our worst case would be owning 2,000 shares of NG at $10 ($20,000) less $750 so $19,250 or $9.625, which is 23% below the current price so about $3 for NG. Since we think that's below the low end of the range and since we can sell the UNG 2024 $12 (at the money) calls for $2 – being stuck with 2,000 shares of stock we can make 10% a year on is not a terrible scenario for our downside. To the upside, it's a $10,000 spread so, if UNG holds $12 into April, we make $10,750 (1,433%) – though we'll have to wait a while for the short puts to pay off.

Aren't options fun?