We made a nice $2,000 gain on the Natural Gas (/NG) Futures we discussed in yesterday's PSW Morning Report but then /NG came back down and we re-entered it in our Live Member Chat Room at the end of the day for another $2,000 gain already this morning. I'm more inclined to let these run but a stop at $1,000 ($500 per contract) is wise – as this is bonus money anyway – so let's call below $3.80 a stop now.

I know this seems easy but it's supposed to be easy if you are PATIENT – it's the patience that ruins it for most people. It's been ages since we played the Futures because we only play them when they hit major support or resistance levels and, even then, we're lucky to get it right 2 out of 3 times but, with the right money-management techniques – 2 out of 3 is all you need to make silly amounts of money. The trick is to know when NOT to play – which is 90% of the time….

We took the money and ran on S&P 500 (/ES) shorts and Oil (/CL) shorts – as they both had excellent runs as well and it always looks obvious in retrospect – which is why so many people are fooled into following TA. But TA only tells you about the past – it does not predict the Future. The Future is determined by Fundamentals and changes in sentiment (how people perceive those Fundamentals) and News Flow – which is not the same as "News" but the trending changes in the News that will affect the sentiment which, in turn, causes people to view the Fundamentals in a different light from day to day.

We took the money and ran on S&P 500 (/ES) shorts and Oil (/CL) shorts – as they both had excellent runs as well and it always looks obvious in retrospect – which is why so many people are fooled into following TA. But TA only tells you about the past – it does not predict the Future. The Future is determined by Fundamentals and changes in sentiment (how people perceive those Fundamentals) and News Flow – which is not the same as "News" but the trending changes in the News that will affect the sentiment which, in turn, causes people to view the Fundamentals in a different light from day to day.

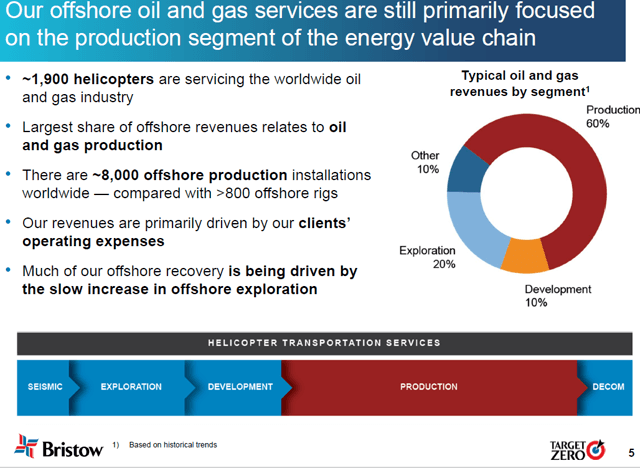

Take Bristow Group (VTOL), who have been mostly ferrying people on and off oil platforms, mostly with helicopters, for the past 75 years – very nice and very boring. The company has a $928M valuation and makes about $80M in a good year, which is good but not thrilling. Last year, however, they merged with Era Group (ERA) and changed their symbol to VTOL because the company aspires to use their expertise to enter the Air Taxi space. They just annonce a partnership with Embraer (ERJ), to develop 100 Electric Vertical Takeoff and Landing vehicles as well – causing us to add ERJ to our Future is Now Portfolio last week.

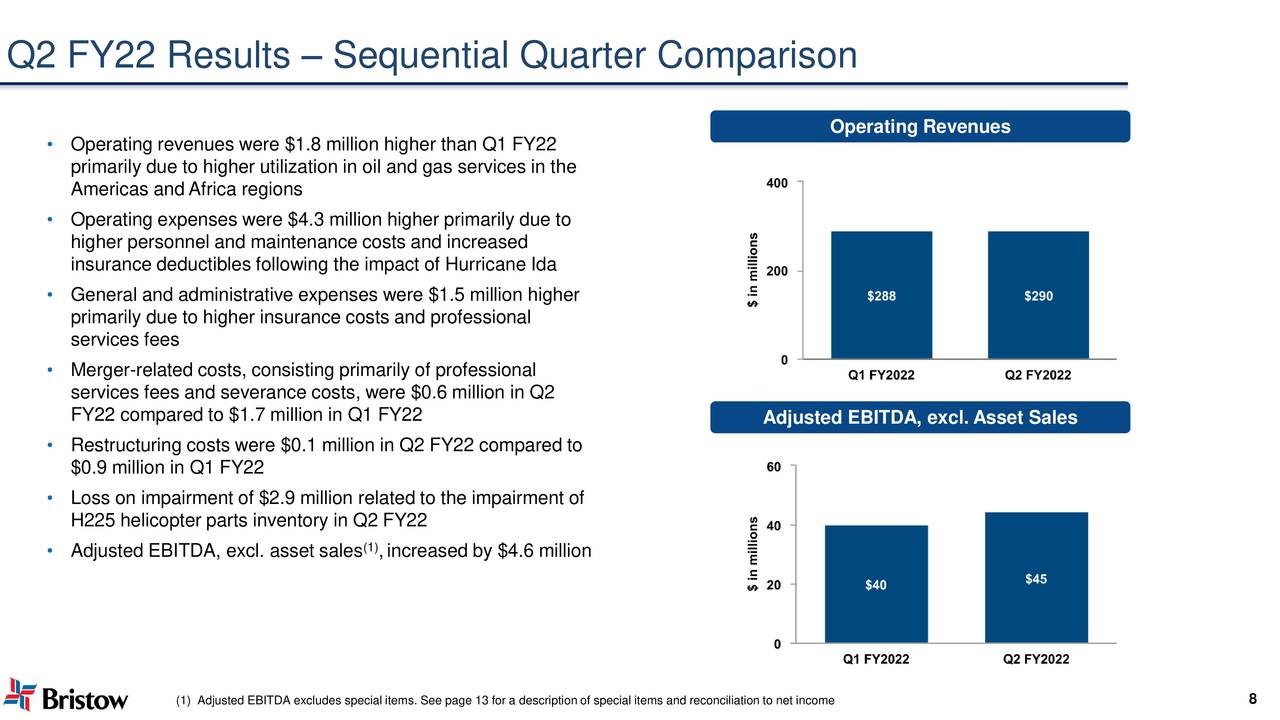

ERJ popped already but that brought my attention to VTOL and, as I said, news FLOW is what's important and investors are becoming more interested in the VTOL space and Bristow already grabbed the symbol (ETFs usually do that) and they've got the skills and partnerships to back up the play. VTOL missed Earnings on Nov 3rd and the stock fell from $37 to $29 but they beat on Revenues and it's not like they lost money – they just made less of it while they are growing….

The fun part about being a Fundamental investor is you don't care what the squiggly lines on the chart are doing – you only care about your valuation of the company and $1Bn is a very fair price for VTOL so we consider $32.50 a good floor and we set up a long-term play. Sadly, there are no long-term options but there is a lot of premium so let's do the following trade in our Long-Term Portfolio:

- Sell 10 VTOL July $30 puts for $3.50 ($3,500)

- Buy 15 VTOL July $25 calls for $9 ($13,500)

- Sell 15 VTOL July $35 calls for $3.50 ($5,250)

That's net $4,750 on the $15,000 spread so there's $10,250 (215%) upside potential by July if VTOL is over $35 again. If not, our worst-care scenariou is owning 1,000 shares at net $34.75 (more than it is now) and that would be a nice entry position in the LTP for a bigger play so we don't mind getting "stuck" with them if that happens.

The trick is to know what the squiggly lines on a chart WILL do and VTOL based at $25 and rose 60% to $40 (not quite) very quickly. A 50% gain would be $37.50 and we can see evidence of that being resistance in both directions so let's call the run $25 to $37.50 and that's $12.50 so our pullbacks would be $2.50 which means $35 is a weak retrace and $32.50 is a strong retrace and $27.50 would be a weak bounce and $30 would be a strong bounce (if it fell back to $25). So now we know what lines to watch and anything over $32.50 is simply part of consolidating for a greater move up – assuming the Fundamentals don't change.

The bottom line is people were too enthusiastic at the August earnings and then the November earnings could not live up to the hype so now we have a chance to catch them before the next positive surprise gets the company over $1Bn to stay. Another way to play is to simply buy the stock for $32.50 and sell the July $30 calls for $5.60 and that nets you in for $26.90 and, in July, you either get called away with a $3.10 (11.5%) profit for 8 months' work or you roll the calls to the Jan whatevers pay you another $3 in premium and 10 rolls like that give you the stock for free – perhaps in just 5 years!

Stock Options give you so many great ways to play the market – have fun with them!

Now, on to less pleasant matters. I'm still going to have to urge caution as the UK had 249 cases of Omicron on Wednesday and 817 on Thursday – that's quite a jump in one day. England very closely resembles the US politically, economically and socially though they do have a much denser population than we do (281 people per square Km vs just 36 per square Km in the US – and we don't even know what a square Km is!), so a virus tends to spread more rapidly.

So I will want to short the S&P 500 (/ES) Futures yet again at the 4,700 line – with tight stops above – even though we're going into the weekend. CPI just came in hotter than expected at 0.8% (annualized 9.6% inflation) vs 0.6% (7.2% annualized) expected by Leading Economorons but, then again, off by 33% is as good as it gets from our economic "wise men".

So I will want to short the S&P 500 (/ES) Futures yet again at the 4,700 line – with tight stops above – even though we're going into the weekend. CPI just came in hotter than expected at 0.8% (annualized 9.6% inflation) vs 0.6% (7.2% annualized) expected by Leading Economorons but, then again, off by 33% is as good as it gets from our economic "wise men".

This is the biggest rise in inflation since 1982, Reagan's first term in office. At the time it was considered a National Crisis – today it's considered Friday. Bank of America (BAC) CEO, Brian Moynihan, says supply chain issues will be a slow fix but, so far, consumers are not rejecting higher prices. Consumers have room to rack up more debt so we're not at the point of no return just yet – but we're making good progress towards it!

Have a great weekend,

– Phil

You're Welcome

You're Welcome