The last 2021 Fed meeting is Wednesday.

The last 2021 Fed meeting is Wednesday.

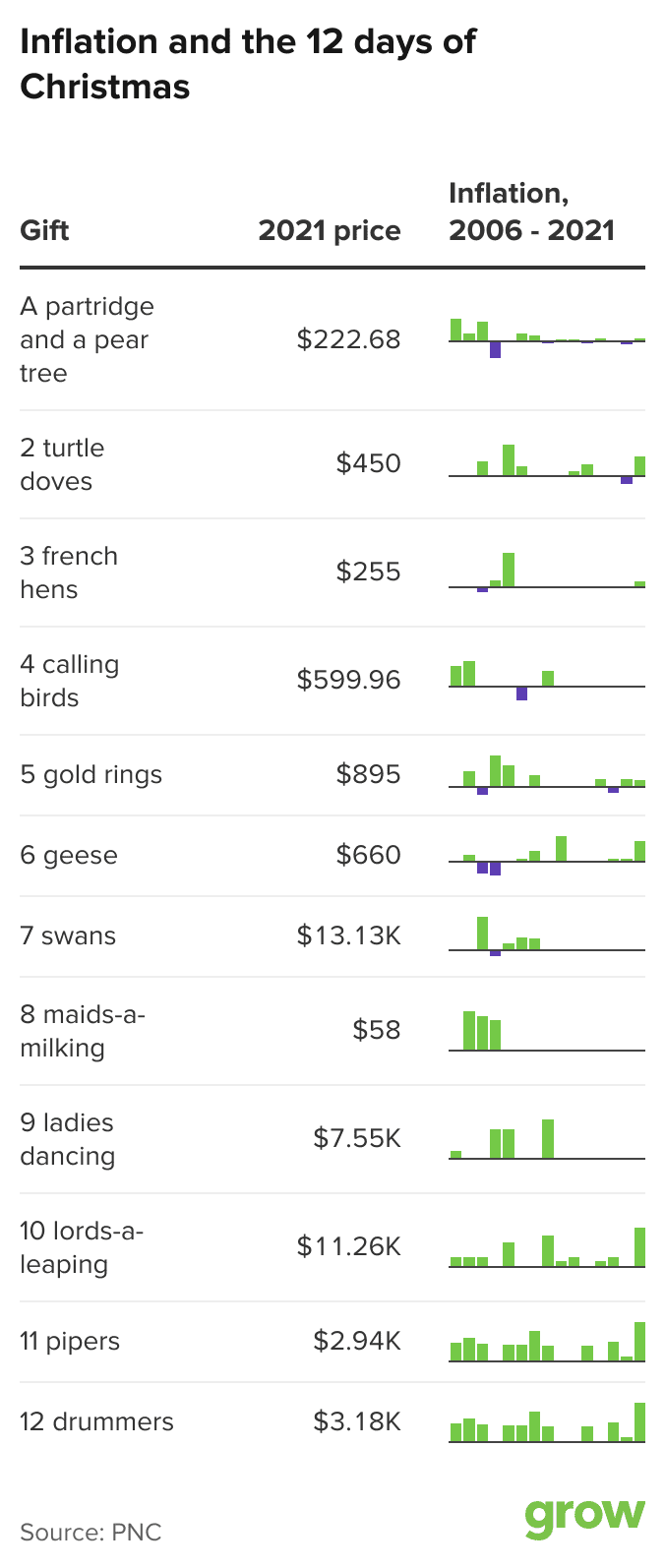

There are only 12 shopping days until Christmas. Turtle Doves are up 50%, French Hens are up 40%, Geese are up 57%, Unit Labor Costs for Pipers piping and Drummers drumming is up 7.1% – it's going to be a very expensive Christmas and I'd suggest sticking with the 5 Golden Rings, which are only $895 and up just 8.5% since last Christmas – barely keeping up with labor costs – and they make an excellent hedge against inflation too!

This is the inflation the Fed is only just now beginning to see and we'll see what Chairman Powell has to say about it it on Wednesday.

Calling inflation “transitory” was a historically bad move for the Federal Reserve, according to Allianz Chief Economic Advisor Mohamed El-Erian. “The characterization of inflation as transitory is probably the worst inflation call in the history of the Federal Reserve, and it results in a high probability of a policy mistake.”

“So, the Fed must quickly, starting this week, regain control of the inflation narrative and regain its own credibility,” he added. “Otherwise, it will become a driver of higher inflation expectations that feed onto themselves.”

Bloomberg had some interesting advice over the weekend: Just spend your money as fast as you can before it becomes worthless. This "advice" seems to come from observing what Agentinians are doing as their currency goes into free fall with 50% annual inflation down there. "And don't hesitate to borrow money" says Bloomberg – when you pay it back with deflated Dollars – you can come out ahead.

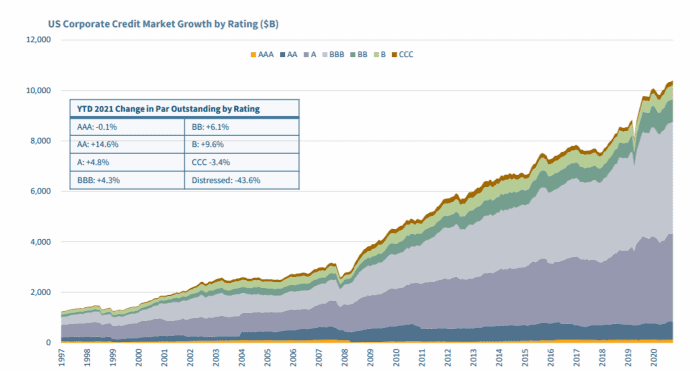

US Corporations have certainly taken that advice to heart, borrowing money at record levels ($1.3Tn so far this year) and they've been using that money to buy back record amounts of their own stock – so our Corporate Masters have MASSIVE bets that inflation will pay off for them down the road. They have no interest at all in "fighting" it.

“The Fed is in a difficult position,” said Jeremy Stein, professor of Economics at Harvard University and a Fed governor from 2012 to 2014. If inflation is more persistent “and they really have to hike rates significantly, you can imagine what happens to asset valuations: There’s just a tremendous amount of interest-rate sensitivity in markets.”

Powell said last week that officials would consider accelerating their reduction of asset purchases when they meet Dec. 14-15 to end the program a few months earlier than mid-2022, as initially planned. Wrapping the taper up sooner gives the Fed scope to raise rates earlier and faster if inflation fails to ease next year as expected. But record levels of debt may force them to temper their actions.

For their part, our Government now has a record $2.5Tn of short-term (less than 5-year) debt that is "rate-sensitive" – essentially immediately reacting to changes in policy. Raising rates just 1% cost the Government $25Bn per year in rollover debt on the short-term notes but, more importantly, there are many, many firms that have borrowed short-term money at 3% that can't possibly afford to service the debt at 5% – and those loans tend to be indexed to the Fed Funds Rate – not to fixed terms.

In addition, the average credit rating of companies has been declining, according to Moody’s — an early warning that some of them could run into problems with paying what they owe if debt service costs rise. “The economy is more vulnerable than it has ever been before to rising interest rates,” said Torsten Slok, chief economist at Apollo Global Management. “How much can the Fed raise rates? And the answer is, they can actually not raise rates that much.”

So with over 25% of the Russell on the verge of failure, with the greatest danger posed to them being a rise in interest rates – it's no wonder the Russell Index has been shakey but, so far, still holding that 2,200 line we've been watching all year long. When and if it does fail that (for more than a few days) – look out below:

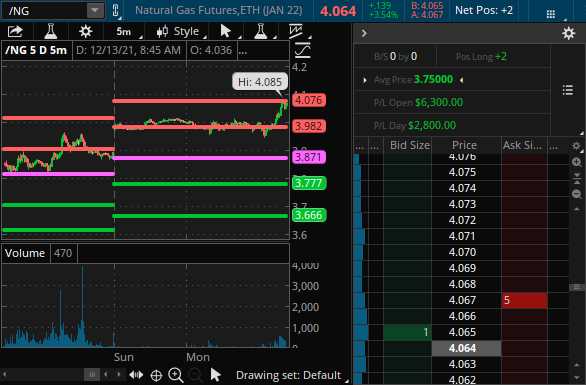

4,700 is still our shorting line on the S&P 500 (/ES) and we're above it at the moment. Speaking of above the line, we're going to take the money and run on our Natural Gas (/NG) longs with $6,000+ gains on two contracts thanks to this morning's surge so congratulations to all who played along at home on that one. We had discussed those several times last week as well as Friday morning's PSW Report (which you can subscribe to here so you don't miss the next opportunity).

4,700 is still our shorting line on the S&P 500 (/ES) and we're above it at the moment. Speaking of above the line, we're going to take the money and run on our Natural Gas (/NG) longs with $6,000+ gains on two contracts thanks to this morning's surge so congratulations to all who played along at home on that one. We had discussed those several times last week as well as Friday morning's PSW Report (which you can subscribe to here so you don't miss the next opportunity).

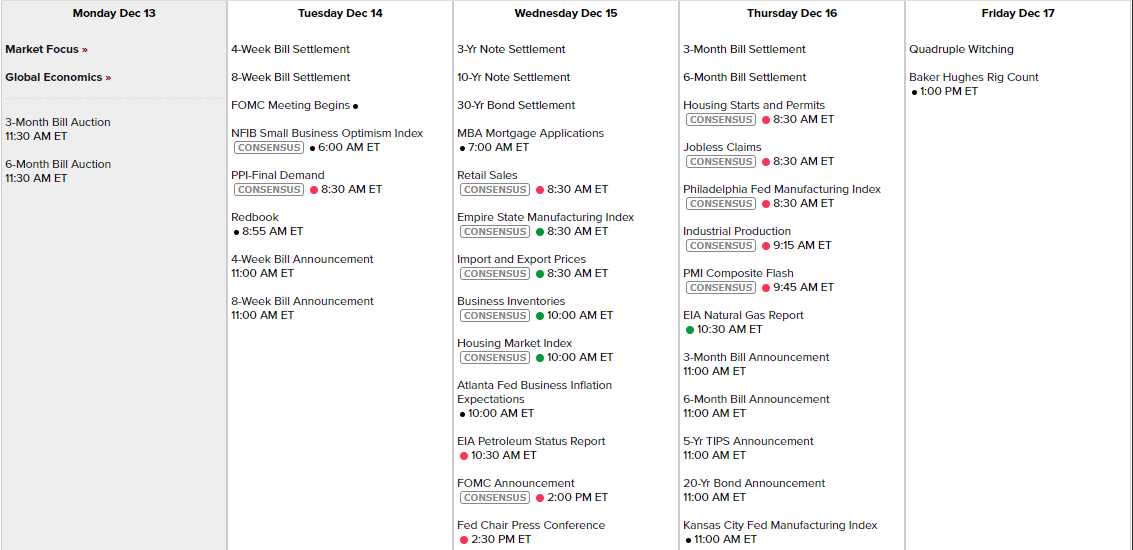

It's not a big data week and it won't be a big data week again until January as, whether officially or not, the markets tend to slow to a dead crawl by December 15th. We have PPI tomorrow, Retail Sales Wednesday along with Empire State Manufacturing, Import Prices, Housing Index and the Atlanta Fed and then Thursday, after the Fed announcement, we have Housing Starts, Philly and KC Feds, Industrial Production and PMI and, on Friday, it's the end of the year for Options and Futures – so that could be volatile.

Earnings reports are still trickling in and we'll watch Fed Ex (FDX) to see what they have to say ahead of the holidays.

And it's certainly not like nothing is going on in the World. This just doesn't seem like the kind of news that supports record-high markets to me:

Inflation Surge Pushes U.S. Real Interest Rates Deeper Into Negative Territory

Fear & Inflation: The Timeless Policy Tools Of Discredited Systems

Charting the Global Economy: U.S. Inflation at Near 40-Year High

Morgan Stanley: As Uncomfortable As It Can Be To Admit Defeat, Here We Are

BofA: "The Bubble In Speculative Froth Has Popped Resulting In Epic Divergences"

Fed Hikes Seen Starting With Yield Curve Flattest in Generation

On Inflation: Friday's 7% Increase In Consumer Prices Is 11% When House Prices Are Added

Manhattan Rents Jump Most On Record Despite Dismal Back-To-Office Return

Price Shock at Meat Counter Worsens U.S. Inflation Jitters

G-7 Warns Russia of ‘Massive Consequences’ Over Ukraine.

Private Equity Firms Plan Cuts in China to Escape Property Woes

China Seen Adding Fiscal Stimulus Soon After Setting Priorities

Stung By The Semi Shortage, Chinese Auto Sales Fall For The Seventh Straight Month

Slip in Japan Manufacturing Outlook Underplays Omicron Concern.

Panic? US Mega-Corporations Rush To Abandon Vax Mandate

U.K. Housing Loses Momentum With Second Drop in Asking Prices

Trucker Central Freight Lines to Close After Years of Losses

Four States Calling In National Guard To Alleviate Healthcare Staffing Crisis

Ponzi? Insiders Dump Stocks To Their Own Companies At Record Pace

DHL Is Keeping Pace With The Holiday Rush By Adding 1,500 New Robots

Hackers Blamed For Cream Cheese Shortage Currently Afflicting The US

A Dozen Major US Cities Hit All-Time Murder Records With 3 Weeks Still Left In 2021

Be careful out there!