It's been a rough month for small caps.

It's been a rough month for small caps.

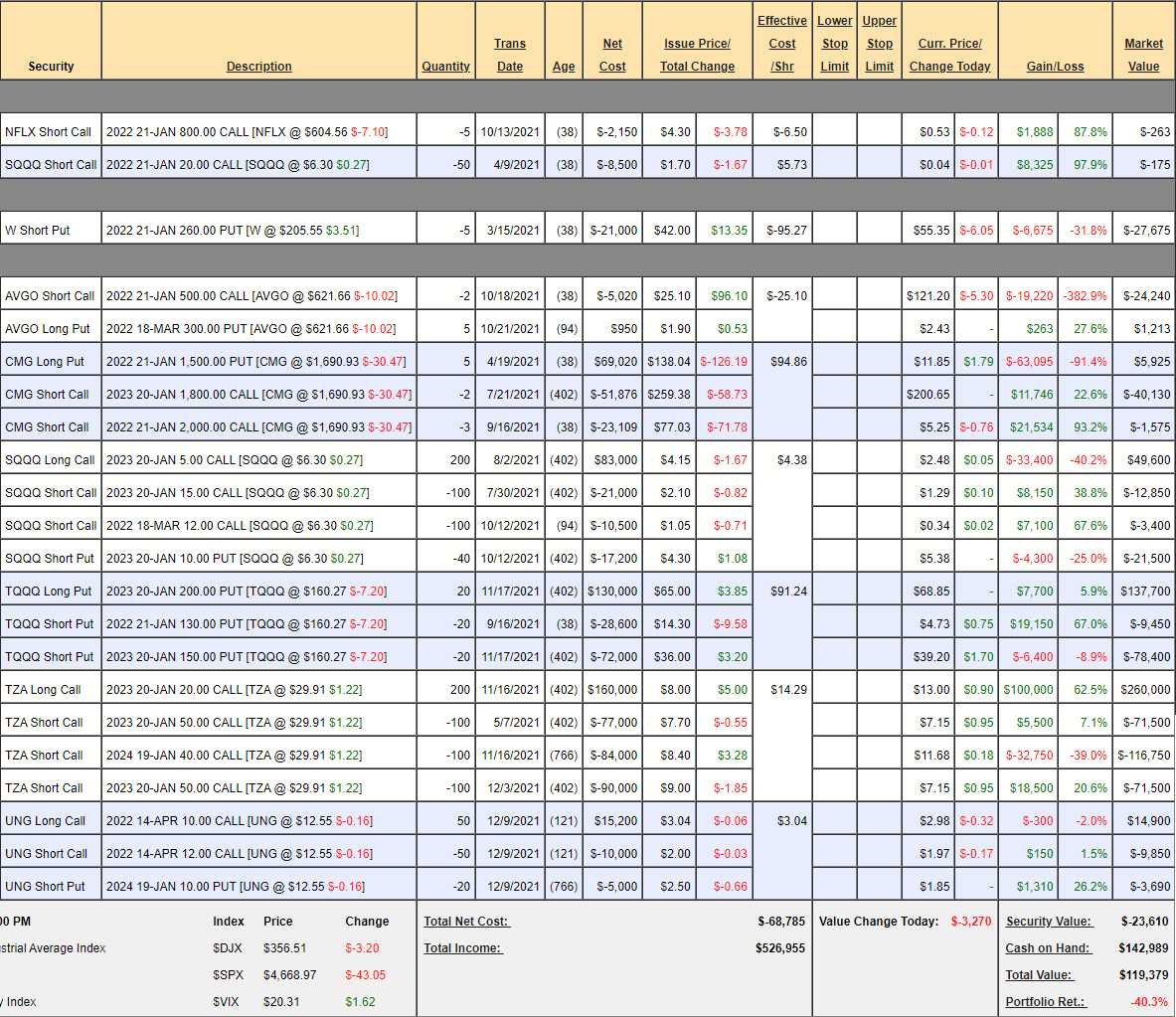

The Russell 2000 is down about 10% since our November 16th review but the other indexes are essentially flat. At the time, our Short-Term Portfolio (STP) was down 54.5%, at $91,022 at the top of the market and we made a few adjustments then and a few more adjustments on November 26th, getting more aggressively short as the new Covid strain came out and now our Short-Term Portfolio is down 40.3%, at $119,379 and up $28,357 for the month.

It's a little disappointing as our Long-Term Portfolio (LTP) is down about $100,000 and the STP is there to protect the much larger (over $2M) LTP but the hedges don't really kick in on a small drop and the LTP holdings were way overbought at +336.6% last month – we knew that wasn't going to last.. Still, we have to make sure to check our math to make sure we are adequately protected for a larger drop.

The goal of hedging is to MITIGATE (not erase) the damage of a drop so generally, we're happy to cover 50% of our losses on the way down and we're covering about 30% so we need to check to see if we are not adequately covered or if the missing $20,000 (out of $2.1M) is just a glitch that will work itself out. Looking at the positions, it's our side bets that hurt us this month:

- NFLX – These short calls will go worthless in January.

- SQQQ – Leftover short calls from an old spread, will also go worthless in January.

- W – This really hurt us as W dropped like a rock and we went from +$12,975 on 11/26 to -$6,675 – so there's a missing $19,650. It's not an excuse but we have to realize our primary hedges are working just fine and money is being drained elsewhere. Now we're in a funny position as we don't like W but we already cashed out the bearish side of the bets and we left this to expire – and it's not working. The best thing to do here is take advantage of the drop to sell more puts (while they are overpriced), so let's sell 10 2023 $150 puts for $23.40 ($23,400) and we will stop out of the current puts at $60 ($30,000) so it's a roll if we stop out but, if W does bounce back – we might get lucky and collect on both.

- AVGO – Another one we got massively burned on. This was down $7,835 and now it's down $18,957 so there's another $12,000 lost on a side bet. As with W, AVGO is way over the mark and we only sold 2 short calls so we can now sell 5 April $620 calls for $41 ($20,500) and put a stop on the 2 short Jan $500s at $30,000. Hopefully it calms down a bit and, keep in mind, these are hedges against a market crash, so we don't mind being bearish as much as we mind being bullish on W.

- CMG – Another side bet but this one has been off-kilter for a while, so it didn't cost us anything this month. You might think "stop making side bets" but these are just the ones that are left at the end of the year – the others worked out. It's not likely we'll hit the Jan $1,500 puts but we could do better than this so we'll see if they hold that trend-line at $1,600 again. If they do – we'll stop out. If not, we should recover a bit. Keep in mind that the overall play was a net $5,965 credit and, if the short calls expire worthless – that's what we'll end up with and whatever we recover from the puts is a bonus. Hard to remember making $5,965 was our actual plan!

So our side bets have cost us $32,000 and the portfolio gained $28,000 so that's $60,000 gained from our main hedges and THAT is exactly what they are supposed to be doing. Now we'll see what we can still expect from them:

- SQQQ – The short calls look very likely to go worthless. SQQQ is a 3x ETF so the Nasdaq would have to drop 30% for us to get to $12 by March. If so, the longs would be $140,000 in the money and the current net of the spread is $11,850 so it's well over $128,150 of downside protection against a 30% drop and, of course, we will sell more short calls to knock down our costs over time. Realistically, we like to calculate a 20% drop, which would be $6.30 x 1.6 = $10.08 and that would be net $100,000+ on the $5 calls so let's call this $90,000 of downside protection as it stands.

- TQQQ – This one is almost in the money already, just a twitch lower from the Nasdaq and this 3x Ultra-Long ETF comes crashing down. So here we look at the $140,000 spread that is currently net $49,850 and count this as $90,000 worth of downside protection.

- TZA – This is our big one, we thought small caps had the best chance of falling apart and this is a $400,000+ spread at $40 and we're at $30 now so only a 33% move higher puts us at goal. A 66% move higher would put us in trouble, however, so we'll have to buy more longs if that happens (or spend money to widen the 2024 part of the spread). Still, it's only net $250 at the moment so we have $399,750 of upside protection against an 11% drop in the Russell – you have to feel good about that!

So our primary hedges are giving us $580,000 of downside protection against a 20% drop and we're focused on the Russell which are the companies most likely to be crushed if the virus resurges and also the ones least able to quickly pivot against inflationary pressures. They also suffer more from labor and supply shortages as small caps can't just go out and buy their own trucks, planes or whatever to ease their issues.

- UNG – Just a little upside play we made last week and all we need is for Natural Gas (/NG) to stay above $3.50 and we'll colect the full $10,000. Currently net $1,360 so it's a great little trade for the quarter to come.

So we've determined that we have $580,000 worth of protection in this $119,000 portfolio and we've also determined that the main hedges are working as planned – so no need to adjust anything, we just need to do a better job on our side bets. If anything, the adjustment I want to make is decreasing the volatility of the LTP – perhaps selling more short calls – we'll determine that when we get to that review.

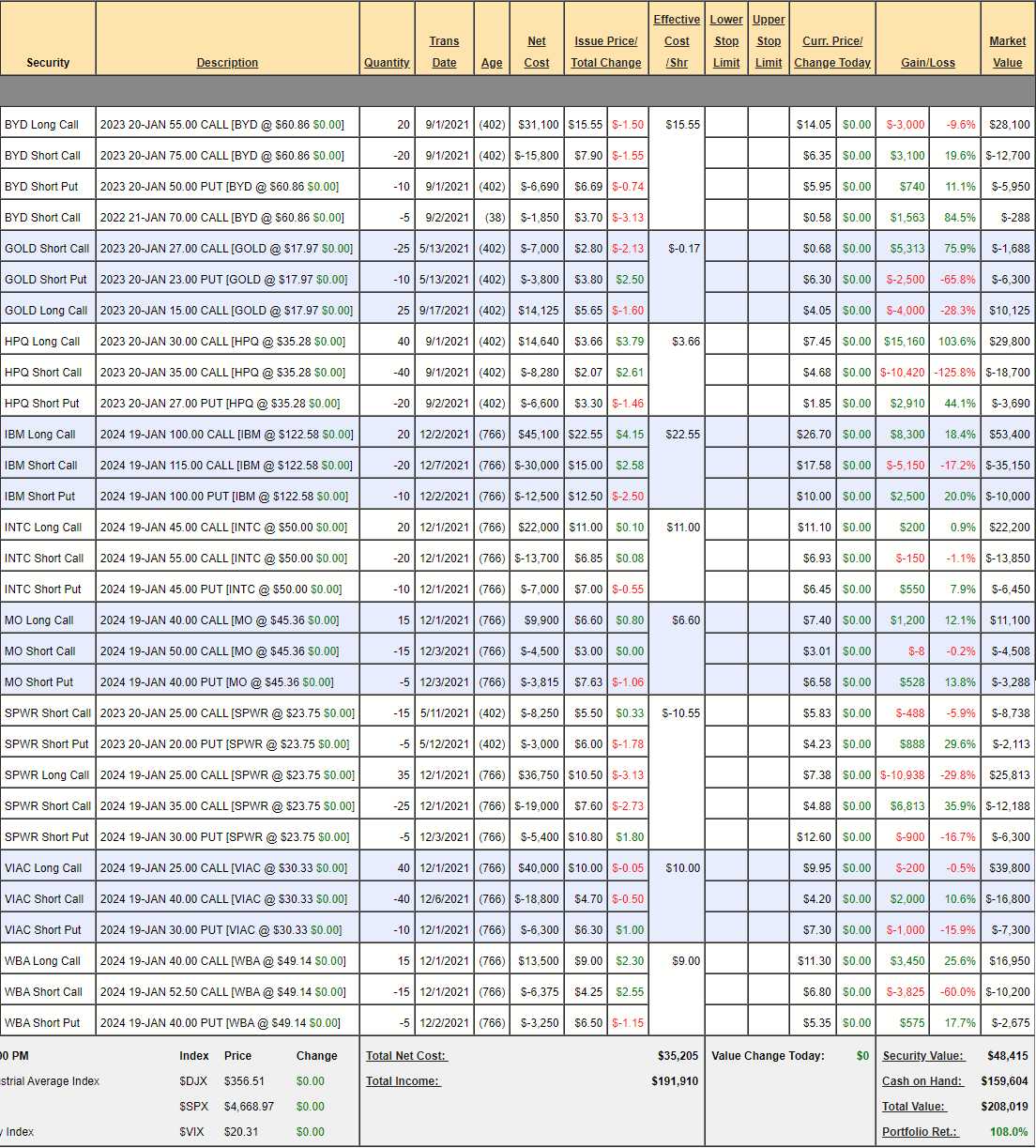

Money Talk Portfolio Review: $208,019 is up 108% in two years for our very low-touch portfolio as we only adjust this one quarterly, when we're on the Money Talk show. I was just on on December 1st and there's not enough time on TV for anything so we do a companion post the morning of the show and we had a lot of adjustments to make that day as we added 4 new positions and VIAC was essentially new as well since we closed the original spread and set up a new one. So, in essence, the whole portfolio is pretty much new now.

We shut down PFE as it had made too much money to bother keeping (it was from October 2020) and, overall, the $199,959 portfolio with $167,589 in CASH!!! now had $235,336 in upside potential over the next two years. I'm NOT going to go into heavy details – as we did that two weeks ago – let's just take a quick look at them and, keep in mind, making $8,000 (1.5%) in two weeks is simply on-track for this portfolio, which should be making $10,000 (5%) per month – and we still have $159,604 in CASH!!! on the sidelines! Aren't options fun?

- BYD – A bet on on-line gaming but also a solid casino play. The Jan calls will expire worthless and we'll wait for an upswing to sell something else. Omicron is, of course, bad for business.

- GOLD – Cheaper than our entry on this $30,000 spread. If I could adjust, I would spend $5,000 to roll the 25 2023 $15 calls at $4 to the 2024 $13 calls at $6 since we're spending $2 to roll down $2 (increasing the upside delta) and buying a year to make gains for free. If we didn't hit $27 by Jan, 2023, we could then get our $5,000 back selling more short calls so it wouldn't make any sense not to do this roll – BUT WE CAN'T – as the rules are we only make trades on the show.

- HPQ – They were so undervalied when we bought them but more realistic now. Over our $35 target a year ahead of schedule. Still only net $8,000 on the $20,000 spread so not bad for a new trade.

- IBM – Our Trade of the Year means it's the trade I feel is most likely to give us a 300% gain on cash over the following 12 months. Already a very nice $5,650 (217%) gain for us in two weeks but it's still only a net $8,250 entry on the $30,000 spread that's 100% in the money right now. If they are just going to give money away like this – why not take some?

- INTC – Last year's Trade of the Year, which was so good we cashed it in early and now we are back. Some people see an ugly chart – I see millions of traders who have no idea how to value a company.

- MO – We're betting pot is legalized and they make a fortune but, if not, they'll just keep killing people the old-fashioned way. Of course, if they do cure cancer – will more people start smoking again?

- SPWR – Just read an article that expectations for solar sales in 2022 are down 25% due to supply shortages. Not just SPWR – the whole sector. This is a real long-term investment for us so we'll just put in more money and keep rolling if we have to. Hopefully $20 holds.

- VIAC – The only stock more hated than VIAC is T – and we'll probably add that next quarter. I think $40 is a very conservative target and I keep expecting them to get bought for more than that – this is just silly. VIAC has 50M streaming subscribers already, NFLX has 200M but NFLX has a $267Bn valuation and VIAC is valued at $20Bn. VIAC makes $2.4Bn a year and NFLX makes $5Bn – so I guess the 13x value makes sense – to someone… It's too scary to short NFLX but I feel very good about being long VIAC – as their streaming service (Paramount +) is fairly new and growing fast and not even contributing to the bottom line yet.

- WBA – I've been banging the table on these guys for a long time and they still aren't going anywhere but our play is conservative and we have plenty of time.

A great collection of spreads I have a lot of faith in and I need to – as we can't make adjustments between shows. It's a good example of how you don't have to constantly tinker with your portfolio to make great returns – you just have to pick sensible stocks and set up spreads that reward you for sensible growth. We don't swing for the fences here – but we still manage to make 50% annual returns.